How should America maximize its odds when competing with China? Can Trump’s approach to alliances succeed in strengthening deterrence? And what will it take for China to diplomatically capitalize?

To find out, ChinaTalk interviewed Rush Doshi, author of The Long Game: China’s Grand Strategy to Displace American Order. Rush served as deputy senior director for China and Taiwan on Biden’s NSC and is now at CFR. His new article with Kurt Campbell, entitled “Underestimating China: Why America Needs a New Strategy of Allied Scale to Offset Beijing’s Enduring Advantages,” I sincerely hope becomes a seminal document for American grand strategy in the 21st century. This is the most important show I’ve recorded all year.

Our conversation covers…

Strategies for countering China’s strengths while accurately assessing weaknesses like demographics, debt, and slow growth,

Historical lessons for US-China competition, from the newly-industrialized UK to Gorbachev’s USSR,

Capacity-centric statecraft as an underrated type of international partnership,

Persuasive versus coercive approaches to alliances,

The evolution of China’s grand strategy and how Beijing’s diplomatic overconfidence in the face of tariffs could backfire.

Listen now on iTunes, Spotify, or your favorite podcast app.

America’s Odds

Jordan Schneider: Let’s start with net assessment, that is, understanding where the US is relative to China. Why is this important for effective strategy?

Rush Doshi: You have to compare yourself relative to your adversary or competitor in order to understand exactly what your strategy should be. Without good net assessment, you can’t really form a strategy. There used to be something called the DoD Office of Net Assessment. It’s since been eliminated.

Our assessment of China has swung widely over the last few years. Back in 2020, there was a perception that the US was in decline. We’d had January 6th, we weren’t handling the pandemic particularly well, and we had alienated our allies and partners. At the same time, China’s economy was booming. It seemed to be handling Covid well. In that moment, there was a perception that America was on its way out.

Just two years later, however, the zeitgeist changed completely. Russia invaded Ukraine in 2022 but achieved only limited success. The removal of zero Covid in China didn’t bring huge prosperity or reignite the economy. Later that year, America debuted ChatGPT to the world. It seemed like we had a rabbit we could pull out of our hat again — we could always rely on American innovation to sustain our lead.

These factors created a new zeitgeist — America ascendant. “America’s got this, and China can’t possibly keep up.”

But it’s difficult to strategize around such vastly differing conclusions about where we are relative to our competitor.

In our article, Kurt and I try to present a nuanced evaluation of our position relative to China.

Jordan Schneider: This is a fascinating case study of the past four years because it almost felt like these swings occurred faster than during the Cold War. Back then, they took longer and the triggering events were bigger than COVID policy. Events like the Vietnam War — America losing a conflict — would cause you to reassess relative trajectory, or decades-long realizations that the Soviet system was not delivering the technological and economic growth that people thought it might have been in the 30s, 40s, and 50s.

The big lesson is that it’s not necessarily a flows question — it is a stocks question. The US and China each have roughly a quarter of the world’s GDP and are likely going to continue having roughly a quarter of the world’s GDP each in the decades to come.

Rush Doshi: It’s important to note that two things can be true simultaneously. China could be slowing economically and have serious economic problems, but it’s also possible that it has strategic advantages and technological advantages in the timeframe that matters most for geopolitical competition.

Poor assessment simply concludes, “They are facing tough economic times, therefore, strategically they’re going to be on their way out.” It never ends up being that neat. The fundamental point of our piece is that you have to think about how particular advantages and disadvantages in one sector translate strategically to great power competition. This isn’t intuitive. It requires some degree of guesswork, but also careful analysis to understand correctly.

Jordan Schneider: There are cones of expectation for how well the US will do and how well China will do from a national power perspective. If you base your assessment on the third standard deviation performance of one country over another, you’re probably not picking the right strategy for the vast majority of futures. The way the US and China are discussed often defaults to either “this country has it figured out” while “that country is doomed,” or vice versa.

Rush Doshi: Thinking about it probabilistically is exactly the right approach.

Jordan Schneider: What do you think about the psychology of the American public and our leaders in Washington? Do you predict a preference for one direction or another, or is there appetite for a nuanced middle stance?

Rush Doshi: There’s a fundamental sense that things are changing — that China is formidable but also has a number of fragilities. The stakes of getting this question right are very high. This leads people to promote narratives they want to believe.

Sometimes there’s a market for saying, “Everything’s fine, don’t worry. American advantages are enduring, stable, real, and decisive.” On the other side, people might suggest things are in tough shape because they have a particular domestic policy agenda to advance. We saw that with the trade war. These assessments have political valence and salience.

Currently, China isn’t even a top priority for most American strategic thinkers. The focus continues to be on Russia-Ukraine or the Middle East. China lurks in the background rather than occupying the foreground where it deserves to be. That’s partly why there’s not always much attention on getting these assessments right.

It was important to have an office that did this kind of work in the US Government, and it would be monumental if that function was restored in the Trump administration. Hopefully, they make that decision soon.

From a government perspective, you almost never have anybody doing true net assessment, because the intelligence community isn’t authorized to consider American strengths and weaknesses relative to an adversary. They can talk about “red” (the adversary), but they won’t necessarily talk about “blue” (us). This causes complications.

Jordan Schneider: I agree that net assessment is important. It’s striking that so much of the commentary about the US relative to China comes from people who aren’t necessarily China experts. It seems that there’s more appetite to use China as a rhetorical talking point, on either the left or right, rather than to make accurate assessments about China.

Rush, you point to scale as the key metric for evaluating the US and China on a decadal or multi-decadal horizon. Can you explain your US versus UK analogy?

Rush Doshi: We only had 5,000 words for our piece, but a full net assessment should be much longer. Not all large countries achieve great power status. There’s a distinction between size and scale. Scale is the ability to translate size into meaningful outcomes. Scaling up is that process.

The Asian tigers had an incredible ability to scale on a small foundation. When you take those techniques and apply them to a foundation as large as China’s, the consequences are world-shaking.

The UK found this out the hard way. The UK had a first-mover advantage in the Industrial Revolution, and a small island in the northwest corner of Europe dominated the entire world for a long time — which geographically is quite remarkable. But that first-mover advantage wasn’t permanent. British industrial methods eventually transferred to Germany, the US, and Russia.

The British knew this was happening. Lord John Seeley wrote a book in 1883 about the rise of Great Britain that ended with a warning. He worried that just as Florence was surpassed by the great nation states of Europe, Great Britain would be surpassed by larger countries — the US, Germany (which had a much larger population than the UK), and Russia. He believed the British methods for industrializing and creating wealth could be transferred to others. When that occurred, they would have what he called “scale” — unimaginable scale relative to Great Britain — and Great Britain would decline.

During that period, these countries leveraged scale to push Britain out of key markets. They used their larger domestic economies to drive down marginal costs and outcompete in third-country markets. Today, that dynamic resembles the US and China.

As the US grew in scale and became more efficient and competitive, our industrial base exploded. By 1910, before World War I even happened, we were manufacturing four or five times as much steel as Great Britain. By World War II, our size and scale were even greater.

Hitler warned that the US was an unimaginable productive power. Yamamoto thought Japan could succeed in the first six months of war, but eventually American scale would defeat them. Even the Italians feared a contest of stamina would favor the United States.

That fundamental scale advantage we had shaped the thinking of our adversaries in the run-up to World War II and during the conflict itself. It wasn’t a hidden fact of politics — it was well understood by our rivals. Now that sense of daunting scale probably belongs to China.

Jordan Schneider: You make the point that even when Nazi Germany was at its peak from 1938 through 1941-42, the relative industrial weight of the Axis powers doesn’t hold a candle to what China can bring relative to the US today.

Rush Doshi: Hitler called the US a “giant state with unimaginable productive capacities.” In many ways, he was hoping to create that kind of productive scale for Germany, which obviously led to disastrous consequences. The fact of American manufacturing prowess was well established and understood around the world.

Jordan Schneider: For a couple of decades in the middle of the 20th century, America was building everything for everyone. Then globalization arrived, which was beneficial as more people gained wealth. We prevailed over Great Britain, Nazi Germany, and Japan, and later over the Soviet Union. But we’re in a very different industrial race today. Rush, let’s look at China’s statistics.

Rush Doshi: Every great power competitor the US has faced previously lacked the size and scale that China possesses. The Soviet economy was much smaller than the US economy, less productive, and its absolute manufacturing capability was inferior to America’s. The US was stronger than Germany and Japan combined in World War II. However, China represents the first competitor with true size and scale advantages against the United States.

Consider manufacturing shares. About 25 years ago, the US share might have been 30% while China’s was 6%. Within two decades, China’s share has quintupled to nearly 32%, while the US share has fallen by half to 15%. According to the UN, by 2030, China’s manufacturing share will be four times that of the United States — about 40% to our 11%. This represents a surprising turnaround in just 30 years.

The last comparable shift occurred between the US and UK. From 1870 to 1910, the British share of global manufacturing fell by 50% — the same proportion we’ve seen fall for the US, except it took us only 20 years rather than 40.

China’s current output is remarkable: twice American power generation, three times American car production, 13 times American steel production, 20 times American cement production, and approximately 200 times US shipbuilding capacity overall (though only three times our capacity for warships).

China produces about half the world’s chemicals and ships, 67-70% of the world’s electric vehicles, more than three-quarters of the world’s batteries, 80% of the world’s consumer drones, 90% of the world’s solar panels, and 90% of the world’s refined rare earths.

They’re also betting on the next industrial revolution. The US is installing many industrial robots, but China is installing seven times more. Half of all robot installations in 2023 happened in China. Regarding nuclear power for fueling the AI revolution — China leads in commercializing fourth-generation nuclear technology that we invented, and it’s planning 100 nuclear reactors in the next 20 years.

In science and technology, people claim China can’t innovate, but they exceed us in active patents and top-cited publications. You can question these numbers and argue they manipulate statistics. There’s some truth to statistical manipulation, but the trend line is incredible. They’re probably about even with us in those categories, and in 10 years, they’ll be well ahead of us, even accounting for statistical manipulation.

This manufacturing power translates into two forms of advantage. One is military advantage, as we discussed regarding World War II. The second is technological advantage — innovation from the factory floor, tacit knowledge, process knowledge, and special production capabilities that improve over time. This creates enduring advantages for China.

We should recognize this because it mirrors American innovation. When we were becoming a manufacturing power, we lagged behind Europe in science and technology. We didn’t have the Nobel Prize numbers that we have today. Manufacturing was the leading edge, and scientific recognition came later. We’re seeing the same story with China.

Jordan Schneider: Let’s not underestimate China — I’m with you this far, Rush. What’s the answer? One approach from the administration is that we need to reindustrialize. The problem is that even with perfect policies, you might gain only 0.5-2% per year in global manufacturing production. Setting reindustrialization and manufacturing growth as long-term goals aside, the trends you’ve outlined aren’t going to reverse anytime soon.

Rush Doshi: These built advantages are very sticky. Poured concrete is poured concrete — it exists. China’s supply chains won’t immediately relocate. They’re also more resilient than people think.

Some argue that China has macroeconomic and demographic problems, questioning why manufacturing statistics matter. But these problems are probably overstated. Consider their economy — it’s smaller than ours in nominal dollar terms, and many take comfort that it’s shrinking relative to the US economy. However, much of that is due to a strong dollar.

If you remove that financial advantage and look at purchasing power parity, China’s economy probably surpassed the US economy 10 years ago and is 30% larger today. Adjusting for purchasing power has limitations, but it’s a good attempt at capturing the local price of key strategic inputs — infrastructure, weapons, government personnel — which are priced in local terms. While nominal GDP might be important for quality of life, purchasing power adjusted GDP better captures factors that generate strategic advantage.

Regarding demographics, China is aging, but when will that matter? By 2100, their population will have fallen by half based on current trends. However, the strategic harm of aging won’t materialize for another 20 years or so. Between 2010 and 2020, the under-14 share of China’s population increased in absolute terms and as a percentage of the total population. The population is still aging, but the younger share grew due to a Mao-era baby boom — these are the grandchildren. Demographics are lumpy, which can buy time.

China’s dependency ratio won’t be as problematic as Japan’s current ratio until 2050, giving them time. Their investments in industrial robotics and embodied AI could help address labor problems from a declining population. Chinese factories like BYD plants already operate with few assembly line workers.

Regarding debt, China’s level is serious — it’s 300% of GDP when combining government, household, and corporate sectors. But that figure matches the United States. The composition of debt matters, as does who holds it, but this aggregate statistic provides a sense of overall indebtedness. If comparable, China might weather this challenge by properly recapitalizing local governments.

Finally, people note that American companies have high market capitalizations — the most valuable companies on earth are American with the highest profit shares in technology. But that market cap partially reflects investors wanting dollar assets and a strong dollar. Profits matter, but American companies maximize profits while Chinese companies maximize market share. They’re willing to operate at a loss to achieve market dominance. They’re optimizing for something different that might matter strategically — if they can remain solvent longer than our companies, they can put them out of business and deindustrialize us.

China has weaknesses — aging population, economic slowdown, potential deflation, high youth unemployment. All are important, but they may not matter as much in the timeframes that determine great power competition. That’s what we’re addressing with the question of scale.

Jordan Schneider: You’ve convinced me about the unlikelihood of second or third standard deviation downside outcomes for China. You’ve addressed many bearish arguments about China’s 20-year outlook, but not political instability. Can you discuss that? Xi will eventually die.

Rush Doshi: This is a critical point. My assessments focused on macro indicators, demographics, and financial factors because those are commonly cited when people claim China might never catch up to the US. Political leadership is challenging to evaluate.

If there’s a path to Chinese failure — an inability to succeed in the 21st century — it runs through a failed political transition from President Xi to his successor. Interestingly, Deng Xiaoping set up 20-plus years of succession by selecting Jiang Zemin and Hu Jintao, but he didn’t pick Xi. We lack that same long-term planning now.

China is living in the house that Deng Xiaoping built. Xi Jinping is changing the architecture, and we don’t know if these changes will cause the house to collapse or strengthen it against external pressures — to use terminology Xi often applies about strengthening the house against the elements.

China’s ability to maintain political stability is extremely difficult to assess. The Chinese Communist Party has endured the Great Leap Forward, Cultural Revolution, Tiananmen Square massacre, and globalization, remaining powerful throughout. However, elite instability at the top can threaten to bring down the entire party, as seen at various points in China’s history — such as when Deng Xiaoping was repeatedly imprisoned during the troubled transition from Mao to his successor.

We don’t know if Xi Jinping will select a successor or be too nervous to do so, given that he’s alienated vested interests, powerful families, and parochial groups that historically exercised power more freely than they do under his leadership.

This represents one potential path to Chinese problems. However, you can’t count on systemic failure or institutional collapse, especially when China has studied the Soviet collapse intently and tried to avoid those same mistakes. We must give them credit for considering paths to decay and attempting to close off as many as possible. They won’t get everything right, but that effort can’t be ignored.

Jordan Schneider: Even if you give Kyle Bass as much credit as possible — say a 50% chance of being right — that still leaves a 50% chance that you have an incredibly legitimate superpower breathing down your neck. It makes sense to buy the insurance plan to implement all the policies needed to live in a world where China actually succeeds.

Rush Doshi: That’s a great way of putting it. In our piece, we discuss “allied scale” as the alternative grand strategy for the United States. You’re right, it is an insurance plan. You can hope that China somehow gets in its own way — which wouldn’t be great for 1.4 billion Chinese people, but geopolitically, you could hope for that. However, betting on China’s collapse, governmental system change, or a botched leadership transition isn’t sensible. You need to buy insurance by investing in an American path to scale. Few great powers have achieved scale when confronted with a bigger rival, but the US can do it through its allies and partners.

Beyond Traditional Alliances

Jordan Schneider: Let’s talk about capacity-centric statecraft. What must Washington do?

Rush Doshi: Working more closely with allies sounds like a cliché. Kurt and I argue that we need to revolutionize how we work with allies by putting capacity building at the center — flowing both from the US to its allies and from allies to the US. If done right, the benefits are substantial.

When quantifying allied scale, the US with its allies represents approximately three times China’s nominal GDP, twice China’s purchasing power adjusted GDP, and more than twice China’s defense spending, even using high Chinese estimates that aren’t publicly available. We would have 1.5 to 2 times China’s share of manufacturing, and we would dominate in patents and top-cited publications.

China may be the top trading partner for 120-140 countries worldwide, but an allied consortium would be the top trading partner for virtually everyone except perhaps North Korea. This represents an incredible scale advantage that’s readily available.

The central task of American foreign policy in this era is transforming that theoretical advantage into reality — realizing that scale. Too often, we think of allies in hierarchical terms based on post-World War II and Cold War habits. We focus excessively on military issues and categorize alliances as tripwires, protectorates, vassals, or status markers. Our contention is that alliances must function as platforms for building capacity.

We could envision Japanese and Korean investment in American shipbuilding, where they have three to five times more productivity per worker. We could provide more technology to our allies; AUKUS exemplifies this approach. Kurt and I worked closely on launching AUKUS, which involves the US and UK helping Australia acquire nuclear submarine capability — our most sensitive military technology — to build meaningful Australian capacity in the Indo-Pacific.

We should consider novel joint military formations. The British and French created a joint brigade; the US and Japan or the US and South Korea could create anti-ship cruise missile battalions to train each other on the best shoot-and-scoot tactics, learning best practices from the Marine Corps under General Berger.

Allied scale also means allies helping each other, with the US facilitating collective action and connections. South Korea could help Europe rearm with its incredible defense industrial base. Scandinavian countries with excellent anti-ship cruise missiles could sell them to Southeast Asia. France, with expertise in LEU nuclear-powered submarines, could assist India, which has the same nuclear submarine program.

This vision of allied scale doesn’t always place the US at the center, but the US provides gravitational pull to facilitate collective action. And that’s just the security dimension — there’s much more to discuss on the economic and technological fronts.

Jordan Schneider: Let’s stay on the security side for a while. You were in government for the past four years trying to implement these ideas, which didn’t emerge from nowhere. The fact that the US plus its friends will be 2-3 times larger than China and its friends over the next few decades — assuming the balance of alliances remains stable — isn’t a new insight. As you and Kurt pushed for this approach with a president who was extraordinarily ally-focused, what roadblocks did you encounter from both US and partner perspectives?

Rush Doshi: Let me first address whether allied scale is intuitive. It is intuitive — we collectively know that if we don’t hang together, we’ll hang separately. What’s been missing from most analyses is the sense of urgency. People say working with allies is good — like apple pie and motherhood — but don’t explain why it’s essential.

It’s essential because we’re underestimating China’s scale. Great Britain failed as a great power because it couldn’t achieve scale. Lord Seely looked to unite with British colonies to create scale that could rival other great powers of that age, but those efforts were too little, too late, and everyone drifted apart. The question for the US is whether we’ll face the same fate.

We have an advantage: instead of an empire, we have allies who are independently capable. That’s a huge advantage compared to the UK. What Kurt and I are arguing in our piece is that this is urgent — we must get this right or cede the century to China. This isn’t the usual framing around allies. People typically see allies as beneficial, not as a four-alarm fire necessity. Part of the challenge in implementation is that people don’t perceive it as urgent, but rather as conventional common sense.

Jordan Schneider: To be clear, the US and China independently will likely run neck and neck — or too close for comfort — in the vast majority of future scenarios over the next few decades. Therefore, America’s most important strategy is to leverage the rest of the world, which is much more likely to partner with us than with a CCP-controlled PRC. That’s how you change the balance of power — the most straightforward way to dramatically shift the balance over the coming decades.

Rush Doshi: I’ll add that we may not be neck and neck in all metrics that matter for strategic value. We’re not neck and neck in manufacturing — we’ll be one-quarter their size. Comparing the US versus China on many metrics, we’re behind. We don’t have scale. We have several advantages: capital markets, immigration, innovation, talent, and general political stability. But we lack scale.

My concern is that without allies, the US won’t run neck and neck with China. The only way we can compete on metrics for great power competition is with allies. That’s why this is urgent. Without them, we’ll be like the UK was to the US and Russia, or like Florence was to the UK — one-quarter their size.

As productivity equalizes around the world — partly due to institutions and technology — China will remain productive. They already outmanufacture us and lead in many industries. The US urgently needs its own path to scale, which comes through allies.

The British couldn’t achieve scale because they failed to unite with their colonies. What differentiates the US is that we have capable, independent, sovereign allies who share our values — not colonies or subjects. If we join together with them, it’s not even a contest with China. We completely outscale them.

Jordan Schneider: This is a really important point. Modern-day Japan and Germany are not comparable to India circa 1890. We’re talking about very different allies in terms of their latent ability to contribute to the metropole’s national power.

Rush Doshi: Even in Lord Seely’s case, he excluded India, considering it a resource pit — obviously wrong about India’s potential. He focused on Canada, South Africa, Australia, and New Zealand — the white settler colonies. But compare Japan or Korea to any of them. The American alliance system contains incredible performers — powerful, technologically advanced, economically impressive nations who also make excellent military equipment and broadly share our values. That’s an extraordinary advantage in world politics. Almost no one else has this.

Don’t take my word for it — take China’s. China believes our single greatest asymmetric advantage is our allies. In 2017-2018, their delight at rising populism stemmed from one thing: the sense that populism was breaking American alliances apart. They’ve always seen alliances as our critical advantage, and they understand what we often don’t — that alliances bring economic and technological power to bear in competition.

The Biden administration had a theory for achieving scale with good and bad elements. The Trump administration also has a theory with strengths and weaknesses. Our piece isn’t partisan — we’re not advocating for one approach. What we’re saying is that the destination must be scale. There can be a path to allied scale with “Trumpian characteristics” — great, let’s pursue that. My concern is unilateralism that resolves bilateral issues without considering the larger strategic context vis-à-vis China.

The Trump administration has an opportunity to secure several bilateral deals worldwide. My hope is they’ll do so in a way that focuses on pooling our shared capacity and building scale against the PRC.

Jordan Schneider: The J.D. Vance perspective of promoting the AfD in Germany and suggesting that if the German right doesn’t win an election, they’re no longer our allies, represents a very insidious mindset. As you said, Rush, we forget how fortunate we are to have so many countries essentially aligned with our worldview.

Rush Doshi: We fought two world wars against Germany and one against Japan. These were the preeminent industrial powers of their regions in the 20th century and part of the 19th century. Today, they’re stalwart American allies. We have disagreements, but they’re on our side and share our values. That represents an incredible accomplishment and success story.

The idea that culture war issues should dictate our approach to these allies on the greatest geopolitical challenge America has ever faced is like cutting off your nose to spite your face. It doesn’t make sense.

That said, the Trump administration could still achieve scale. One critique of our piece is that it’s an idealistic dream that made sense five years ago but not now. I strongly disagree. There is a Trump path to scale, likely less focused on persuasion — which President Biden emphasized — and more on coercion. You could criticize the Biden administration for insufficient coercion.

My point is this — you probably need to mix and match different tools depending on whom you’re dealing with. But we all know where we need to go. It cannot be the US versus China one-on-one. A unilateral America retreating to its own sphere would be poorer, less powerful, with deteriorating quality of life and diminished global influence, including on factors that make us prosperous. That’s obviously not a good path.

Jordan Schneider: Rush, you’ve outlined the two failure scenarios. The Trump administration would attribute one to the Biden administration — being too soft, allowing allies to avoid defense spending and ride our coattails into oblivion. I’ll let you elaborate on the contrasting errors.

Rush Doshi: One critique the Trump administration makes of the Biden administration is that it focused too much on persuasion and not enough on pushing allies — what you might call coercion. This resulted in free-riding. There’s a good counter-argument: progress occurred with AUKUS, the Quad, European involvement in Asia, and Asian involvement in Europe, which began moving toward allied scale.

However, the Trump administration’s critique that more needed to be done has merit. Kurt and I also believe more scale is immediately necessary. AUKUS was essentially a down payment on the kind of allied approach we need to institutionalize across the board. As someone deeply involved in AUKUS in 2021, working on negotiations for the White House under Kurt Campbell, I recognize it was novel then. We need to reach a point where such arrangements become routine.

Conversely, the Trump administration’s potential error would be excessive coercion — thinking you can bully everyone into compliance. Another error would be believing allies don’t matter, that America can go it alone, and that relations with Japan or Korea should focus solely on bilateral trade deficits and Treasury purchases.

Consider the economic picture: If we want to ensure scale for our industries when China is more competitive on a marginal cost basis, protecting only the American market isn’t enough. Without access to allied markets and allies’ access to our market, our companies cannot achieve scale relative to China. We need pooled market share.

The Trump administration has discussed erecting a tariff wall. In my view, a regulatory wall might be even better against certain Chinese exports. Beyond that, reducing trade barriers among allies would facilitate greater scaling up within the protected zone. Achieving this requires a mix of coercion and persuasion — combining Biden and Trump approaches.

Currently, President Trump has taken the coercive route with Liberation Day, sparking negotiations and deal-making opportunities. Hopefully, these deals will incorporate persuasive elements. Ideal deals would involve allies investing more while we reduce trade barriers — perhaps to zero-zero tariffs as some on Trump’s team have suggested. Allies would increase defense spending or work with us to improve their military capabilities. Additionally, coordinated steps would prevent China from dominating allied markets, including shared tariffs and regulatory policies to build a protective moat for all participants.

This kind of deal is achievable. As the Trump administration pushes these negotiations, I hope that’s their model. Some say they need to negotiate 75 deals, which seems excessive. I believe they need 8-10 key agreements. If they get those right, they can build allied scale differently from President Biden’s approach. They can claim victory and say they succeeded where others failed — that’s fine. The point is to achieve scale, and if they accomplish that, I’ll applaud them.

Jordan Schneider: Let’s stay on the Germany example for a second. The Biden administration was not able to get Germany to break its debt covenants and spend $1 trillion on defense. On the other hand, it basically took administration officials saying things so intense that Germany and Poland decided they can’t really trust extended deterrence anymore.

I don’t think the wake-up moment has necessarily come for Taiwan, Japan, and South Korea, but we seem to be in a very different timeline in the European context.

Rush Doshi: The risk of the current approach is that it’s so intense it pushes Germany away from being a core US ally on issues we care about. There’s a lot of flirtation in Europe right now with different forms of strategic autonomy, which could be interesting on their own. But if driven by dissatisfaction with the US, it might mean they’re not on our team when we need them.

Consider a concrete example: in 2020, the Europeans and Chinese negotiated the Comprehensive Agreement on Investment (CAI). This was fundamentally negotiated because Europe was concerned they couldn’t rely on the US. The Biden administration was upset — we had just taken office. That agreement eventually fell apart, but there’s a world where it doesn’t.

What worries me now is seeing Europe signal they want to hedge with China. That’s not sensible policy, but great powers can “commit suicide for fear of death” — a political science phrase I’m applying to this context. When you push an ally too aggressively, you can change their domestic politics to make it more anti-American. You can activate questions of face and respect that lead them to make poor decisions. Countries don’t always act in their rational self-interest, especially in times like these.

You can reasonably critique the Biden administration for not pushing allies hard enough, and the Trump administration for pushing too hard in ways that undermine transatlantic unity on China — which is extremely important for preserving America’s position. The truth is you need to do both. You need a nuanced approach, which either administration could achieve if they recognize the urgent need for scale and exercise more humility in American statecraft.

The capacity-centric statecraft we’re advocating is humble. We acknowledge there are capacities America has that its allies need, which we can provide. But we also recognize there are capacities America has lost that only our allies possess, and we need to regain them. How easy will it be to get Germany or Japan to manufacture in America if their domestic politics turns anti-American and their governments feel that accommodating the United States contradicts their political self-interest? That’s the risk — we might lose the transatlantic relationship we need if we’re not careful.

Jordan Schneider: In dark timelines, how does Trump 2.0 turn into America’s Gorbachev moment?

Rush Doshi: That was a provocative line in our piece. Personally, I’m hoping that doesn’t happen. Kurt and I intended to provide a strategic theory of how America should conduct itself with alliances — different from past approaches and valuable for the Trump administration. It’s not meant to be partisan.

The Gorbachev reference relates to two things.

There’s a risk that we neglect our allies’ agency, respect, face, and autonomy, causing them to move away from us if pushed too hard. Mikhail Gorbachev didn’t assume every Soviet republic would abandon his experiment, but that’s what happened. The same could happen to the American system if we renegotiate foundational elements, become unpredictable, interfere in allies’ domestic politics by supporting specific parties, or dismantle tacit bargains that underpin the American alliance system. This fragmentation would be catastrophic.

Successfully competing with China requires state capacity. Gorbachev’s reforms, and especially Yeltsin’s shock therapy, destroyed Soviet and then Russian state capacity, making it harder to accomplish geopolitical and domestic aims. I worry we’re dismantling our institutions. I’m not saying they shouldn’t be reformed or renewed — there were different approaches possible for both DOGE and the trade war. What concerns me is that these critically important initiatives weren’t implemented in the most strategic way.

Consider the trade war as a thought experiment. Imagine if, before Liberation Day, the Trump administration had presented a coherent theory of the case — policy papers explaining they would raise tariffs on China, with everyone else on notice. Imagine they had outlined what would happen to other countries in 90 days if they didn’t strike a grand bargain covering economics, trade, finance, security, and relations with China. What if they had already worked out preliminary deals with a few countries before the announcement, surprising China with this collective approach? And what if markets saw a logical grand design behind this strategy?

Would yields be spiking? Part of what’s happening is that markets don’t think we have a plan. The rationalization the Trump administration created after the fact about the trade war — imagine if it had come first. We’d be looking at a very different strategic situation.

You don’t go to war without preparation, as Russia demonstrated in Ukraine. That applies to global trade war also. What worries me is that there appears to be no document that articulates exactly what we hope to achieve globally, bilaterally, and multilaterally in the trading system. Without that framework, we’re improvising — and that’s frightening.

Jordan Schneider: As much as I want the Rush Doshi version of the Trump administration, I’m not optimistic that we’ll get it.

Rush Doshi: The purpose of my thought experiment is to imagine if we had done this differently. This could have been a moment of strategic advantage where the United States finally changed the global trading system to better reflect what’s needed regarding China’s participation. Instead, we have a unilateral, diminished American position with the entire world angry at us. I don’t believe that was the optimal approach.

You’re right — there were people with different proposals. My argument is that they should have made a different case, and I’m not certain anyone made this case. This is what they’re saying now — their post-hoc rationalization. Rewind the clock two months to the transition period. Had they presented this case then and informed the press — even if they ultimately imposed tariffs on allies — at least there would have been a coherent narrative before implementation. That story never emerged.

Jordan Schneider: Assuming the bear case from an American policymaking perspective for at least the next four years, we face several potential futures. One scenario involves democratic allies realizing they can’t count on the US, but needing to band together, put their houses in order, increase defense spending, and establish beneficial agreements between countries like South Korea and Germany. Let’s explore this path first. What might the global order look like with China checked out, while America and the rest of the developed world — uncomfortable with Chinese ascendancy — attempt to establish a new equilibrium?

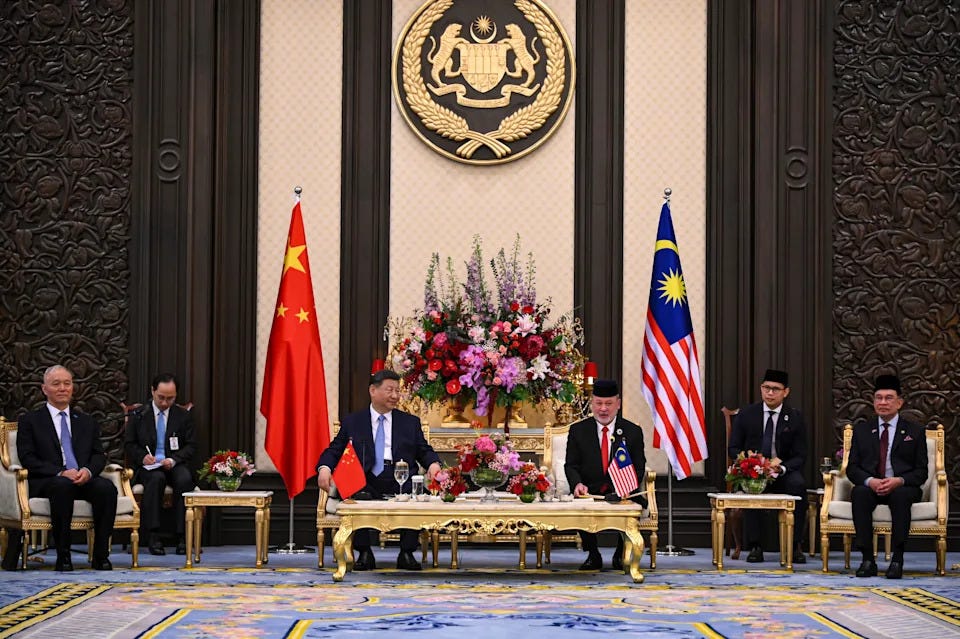

Rush Doshi: China currently appears quite excited. President Xi is traversing different countries and striking deals. They clearly see an opportunity. I recently met with Chinese academics who indicated that China’s propaganda department is ecstatic, believing they haveways to position China as a better partner than the United States. Nobody should readily accept this narrative — skepticism is warranted. Nevertheless, China is actively attempting to drive wedges between the US and its allies, using trade as their primary mechanism.

My concern revolves around the bear case scenario. If we fail to reconstitute our alliances, experience greater transatlantic ruptures, and cannot establish meaningful agreements with our East Asian partners, America might retreat to the Western Hemisphere, attempting to make its stand there. This approach is doomed to failure. We cannot cede the entire world to China’s industrial power and expect that an America retreating westward can somehow escape the Mackinder trap. Mackinder warned against allowing any power to control the Eurasian “world island” — America’s pullback to the Western Hemisphere would enable precisely that outcome. This strategy was dismissed during World War II and makes even less sense now.

It’s particularly illogical in our globalized world where, even if the trading system fragments, it will inevitably reconstitute itself with another power at its core — potentially China. In that scenario, America becomes frozen out globally, unable to access the innovation, technological progress, and efficiencies developed elsewhere. America as the Galapagos Islands represents a bleak future. We must maintain our global presence and advocate for a world order reflecting American interests.

This isn’t merely “America First” rhetoric. For those embracing an America First perspective, this approach actually aligns with those principles by safeguarding American prosperity, not just geopolitical leadership. We’re discussing the quality of life Americans enjoy, which stems from constituting just 5% of the world’s population yet achieving extraordinary wealth — a reality made possible by a system designed to sustain this quality of life. We cannot simply demolish this system hoping everything will work out. That resembles Yeltsin’s shock therapy approach, which proved disastrous for the Soviet Union and Russia. My fear centers on an America that withdraws, creating a world that becomes China’s to lose — an outcome we must avoid.

Jordan Schneider: Do you believe the Trump team has learned lessons about alliance building from missed diplomatic opportunities during the first administration? What potential playbooks might China be implementing at this moment?

Rush Doshi: We should never discount China’s capacity to undermine itself diplomatically — essentially tripping over its own feet. Your observation is accurate, Jordan. There’s considerable confidence in Beijing. In my previous work on Chinese grand strategy, I’ve noted that the most important variable shaping their approach is their perception of American power. Beginning in 2016, this perception shifted dramatically. They concluded the world was experiencing unprecedented changes, leading to more aggressive and assertive Chinese policies, even toward countries they should have been cultivating.

One of history’s greatest strategic puzzles is China’s persistent alienation of India. China consistently pushes India toward the United States, when India might naturally prefer a more balanced position. China simply makes such neutrality impossible. They could certainly repeat these mistakes.

However, Jordan, we must acknowledge that our current approach differs fundamentally from anything attempted during the first Trump term. That administration conducted a trade war with China — arguably overdue — and attempted to renegotiate certain security agreements with allies. The current approach, however, essentially applies “Control-Alt-Delete” to the entire global trading system. We have a 90-day pause, but also a 10% blanket tariff — itself a revolutionary act. If we considered this tariff in isolation, without the chart the President unveiled, we would be shocked by it. Now, because our comparative reference is that chart, we’re virtually ignoring the importance of the 10% tariff.

To answer your question directly: American policy has become much more revolutionary than during the first Trump term, creating greater opportunities for China. The question becomes: even if they execute their strategy imperfectly, but marginally better than in the past, they could still accumulate substantial advantages. That prospect deeply concerns me.

Jordan Schneider: This connects to our earlier point about political instability. They might mishandle the opportunity, or they might not. Even granting them a 50% chance of failure still leaves several undesirable futures where smaller countries worldwide must navigate coordination problems without the United States providing necessary cohesion and facilitation. That’s frightening.

Rush Doshi: Precisely. A divided world where the US abandons its role as facilitator of collective action presents serious challenges. In political science, collective action represents one of the fundamental puzzles — what enables people to cooperate despite incentives to pursue individual interests? America functions as an anchor for collective action, making cooperation possible. If we withdraw, everything potentially fragments. Allies become divided and conquered. We might currently be in the “divide” phase of China’s “divide and conquer” strategy, but we’re inadvertently assisting them with the division — the conquest follows later.

Jordan Schneider: Every once in a while people ask me, “Jordan, why don’t you become the Matt Levine for China policy?” My answer is fundamentally that Matt Levine thinks securities fraud is funny, whereas I consider this stuff deadly serious. You too are someone who cannot look at the stakes of the conversation we’ve had for the past hour, shrug your shoulders, laugh about it, and simply move on with your life. Do you have any advice, Rush? It feels very helpless when the potential geopolitical errors seem larger than they’ve ever been in either of our lifetimes. Give me the pep talk. How do I keep putting one foot in front of another with the podcast?

Rush Doshi: There are a few things to keep in mind.

First, the Trump administration can negotiate agreements with allies and partners in ways that actually achieve scale. This remains conceivable. There are signs that some individuals running the negotiations are thinking in these terms. We know many people staffing the Trump administration at the mid-level, the key principals — not specifically the Cabinet, but many people below that level — believe in allied scale. They may not have called it that, but they understand its logic. That group exists, and there remains the possibility of landing the ship in that spot. I cannot predict the odds, and I do worry, but we shouldn’t be despondent.

Part of what must happen is continued discussion of these issues. One reason Kurt and I wrote our piece was to argue why allied scale matters. I hope as that argument circulates and others reinforce it, it may help shape some of the Trump administration’s thinking. The piece wasn’t meant as a partisan attack but as a strategic framework any administration could adopt.

The last thing I’d note is that this administration won’t last forever. Congress might flip in two years. America constantly changes. For allies and partners, they will find ways to work with the United States — whether through the legislative branch, pockets in the executive branch, or a suddenly enlightened executive that negotiates better deals. It’s not over.

Great power competitions can be lost in short periods, but China faces many challenges, too. They often struggle to consolidate and press their advantages. America possesses real advantages we shouldn’t neglect: two oceans, abundant resources, 70% of the world’s capital markets, the ability to attract the best talent from around the planet, and general political stability. These represent huge advantages that won’t disappear overnight. Some might be damaged or tarnished, but others might even strengthen.

We must remember this competition won’t resolve itself in two or four years — we must make investments for the long haul. Congress can do much. Everything the Biden administration did to build allied scale received bipartisan support, funding, endorsement, and praise from Congress. We must remember Congress wields power in this domain as well.

Jordan Schneider: One last question, Rush. I remember DMing you during the administration saying, “They’re not going to let you talk about this book, right?” And you replied, “Yeah, sorry,” but here we are now. We’ll have you back to do a deeper dive and an updated discussion about it. I’m curious — assuming nearly everyone in our audience has read the book — how did your experience being on the inside, reading intelligence, and interacting with the Chinese government affect some of the conclusions you reached toward the end of your research for that project?

Rush Doshi: Thank you, Jordan. I’m really proud of “The Long Game.” It was unfortunate I couldn’t discuss it while in government, and I’m glad people found it useful. The book was based on an assessment of 5 million words of Chinese Communist Party material, as well as a rigorous social scientific approach to their behavior. The conclusion was that China has maintained, since the end of the Cold War, a grand strategy to displace American order — first regionally, then globally. My time in government reinforced my view that these conclusions were correct.

In the book, I argue that going back to the 1980s, the US and China were essentially quasi-allies against the Soviet Union. Everything changed after the Gulf War, the Soviet collapse, and the Tiananmen Square massacre. Suddenly China viewed America as the biggest threat and inaugurated a new policy — “hiding capabilities, biding time” (韬光养晦 tāoguāng-yǎnghuì) — what I call blunting American power quietly, not assertively, while benefiting from America’s system.

In military terms, they pursued anti-access/area denial approaches to keep us out. Economically, they sought Most Favored Nation (MFN) and Permanent Normal Trade Relations (PNTR) status to tie our hands. Politically, they wanted to stall American-led institutions in Asia lest they become platforms for challenging China. This approach worked quite well until the global financial crisis.

In Central Committee materials, we see China change its perception of American power, adopting a new strategy formulated by the Central Committee. China should “actively accomplish something.” This approach had military, economic, and political components focused on building order within Asia, not just blunting American order. Militarily, China invested in power projection capabilities to influence its neighbors. Economically, we saw the Belt and Road Initiative and efforts to use economic statecraft against others. Politically, China built international institutions meant to serve as the foundation for order-building within Asia.

I wrote that this worked until 2016, when China’s assessment changed again. They adopted a new phrase to guide Chinese policy: “great changes unseen in a century.” The idea was that China’s current opportunities and risks were unlike anything they’d faced in a hundred years. We witnessed the inauguration of a global Chinese grand strategy focused on global military bases and winning in Taiwan; dominating supply chains economically and making the world more dependent on China (what President Xi calls “dual circulation"); and technologically, leading the fourth industrial revolution to ensure China wins those technologies not just for prosperity but for power. Politically, it aimed to change global institutions to make them more conducive to autocracy.

All of this is motivated by a desire to “rejuvenate” China, which represents a 100-year goal. The Chinese Communist Party is fundamentally a nationalist party seeking rejuvenation. They’ve always been that way. They’re also a Leninist party wanting to centralize power in pursuit of that goal. That’s why I say China has a grand strategy — it has the concepts, capability, and conduct to pursue that vision. They don’t always execute perfectly and make mistakes, but there exists a strategic intention to create a partial hegemony over part of the world, reflected in those military, economic, and technological indices I mentioned.

The intelligence community had previously outlined these conclusions in threat assessments but hadn’t substantiated them using open sources. I’m more confident of these conclusions now than when I wrote the book. Looking at President Xi’s behavior and the Chinese Communist Party’s actions over the past five years sustains the argument that they are pursuing a global grand strategy — not always well or brilliantly executed, but nonetheless deadly serious.

Jordan Schneider: Let’s look toward the future. Rush, what’s the broader open source project you’re launching at CFR?

Rush Doshi: I’m continuing my research at Georgetown as a professor and running the China program at the Council on Foreign Relations. One of our most exciting initiatives builds on my approach in “The Long Game,” where I relied on Chinese texts and materials to make my arguments. Now we’re going to mass acquire, digitize, and translate those kinds of texts at scale, making them more available to the public so people can essentially read China in its own voice.

If you do that, China essentially tells you where it wants to go. The Chinese Communist Party must communicate with itself and its cadres, and we want to make those communications available to others. This is something the US government used to do from FDR in 1941 through 2013 under Barack Obama, when we had the Foreign Broadcast Information Service that translated foreign material. That resource largely stopped being available to scholars in 2013. Our hope is to rebuild it at scale with a far greater source base and with the help of artificial intelligence. We’ve made major investments in this effort, have access to a large cache of material, and will share more very soon.

Jordan Schneider: It has been pretty frustrating over the past few months to see China be so important rhetorically to every policy decision while genuine curiosity about understanding the country seems at a relative low point — both regarding net assessment and strategic intention. It’s on us to make this material accessible and interesting. We can’t just complain about it; we must do the work and present it effectively, even if we need to be persistent. We need to make a strong case that this is both important and engaging.

Rush Doshi: Well that’s what you do on this podcast!

Jordan: Thank you! And look, The Long Game sold well, so there’s an appetite for this content somewhere! I fully believe in the mission and have more faith in you than virtually anyone else to make Chinese strategic discussion something the world cares about and takes seriously. Godspeed, Rush!

Terrific conversation.

This is not good: "Currently, China isn’t even a top priority for most American strategic thinkers." Combine that with recent reporting of what's happening at the NSC, and things don't look so great at the moment.

While only one of many examples, you can use AI as illustrative of some of the broader challenges the U.S. is facing with matching China's ability to scale while increasing productivity growth rates. AGI and ASI are wonderful research topics, but at this point we need -- as Rush and Jeff Ding continue to underscore -- faster diffusion and putting the technology to work in ways that optimize scaled manufacturing & leading-edge software integration. Both of which are and should remain American strengths.

I'm more pessimistic about "allied scale" than Rush and Kurt seem to be, at least for the time being. Breaking trust with allies & partners and treating them as targets for coercive strategies rather than as equals, is hardly conducive to long-term success. Humility is in short supply right now. Rush's diagnosis and prescription are excellent; the ability to execute them remains highly suspect. ("Instead, we have a unilateral, diminished American position with the entire world angry at us. I don’t believe that was the optimal approach." That's the biggest understatement of the conversation!)

I've seen few books on China's strategy with such deep primary sourcing as The Long Game. Remarkable reading. Can't wait to see what comes out of the Georgetown/CFR initiative.

The conclusion I’m increasingly resolving on is “China is cooked, the US is cooked for different reasons, and the competition is to see who crashes out first.”