Can economic warfare really work? What can we learn from the 21st century historical record of American sanctions policy?

To find out, we interviewed Eddie Fishman, a former civil servant at the Department of State and an Adjunct Professor at Columbia. His new book, Chokepoints: American Power in the Age of Economic Warfare, is a gripping history of the past 20 years of American sanctions policy.

In this show, we’ll talk about…

The evolution of U.S. sanctions policy, from Iraq and Cuba to Iran and Russia,

How Reagan’s deal with the Saudis turned the dollar into an economic chokepoint,

The incredible success of sanctions against Iran, and how that playbook could have been used to punish Russia,

Historical lessons in enforcement that are relevant for export controls on China today,

The role of great civil servants like Stuart Levey, Daleep Singh, Victoria Nuland, and Matt Pottinger in building state power,

Institutional challenges for economic warfare and the consequences of failure to reform,

Strategies for writing groundbreaking books about modern history.

Watch below or listen now on iTunes, Spotify, YouTube, or your favorite podcast app.

Financial Chokepoints

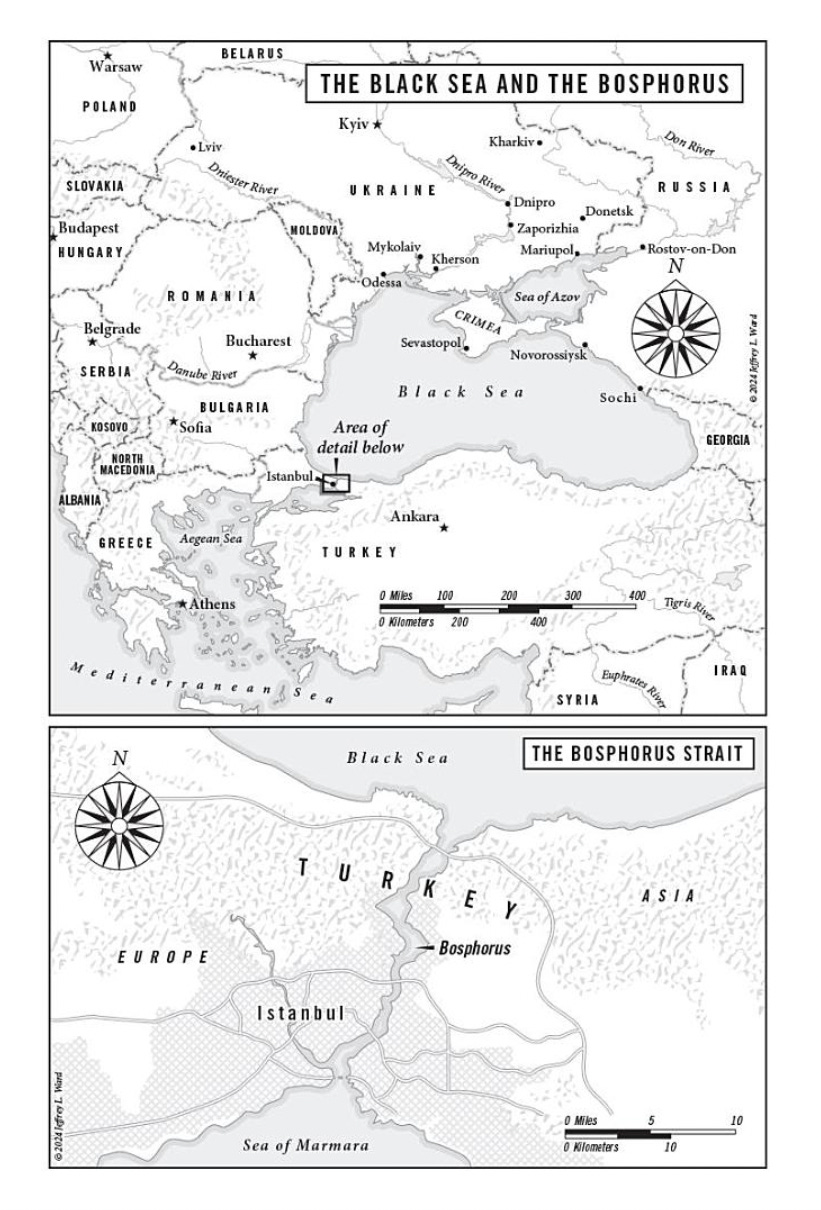

Jordan Schneider: Let’s start with the Bosphorus. How does this little corner of our beautiful planet explain the evolution of sanctions?

Edward Fishman: The Bosphorus is the epitome of a maritime chokepoint. It is a narrow strait between the Black Sea and the Mediterranean Sea. Throughout history, maritime chokepoints like the Bosphorus have been critical for strategic power. Sparta was able to win the Peloponnesian War because they won a battle around the Bosphorus and blockaded it, ultimately starving the Athenians into submission. Athens had relied on the flow of grain through the Bosphorus to feed its population — that was really the whole purpose of ancient Athens’ maritime empire.

Historically, these chokepoints have been geographic features. But now, as a result of globalization, there are chokepoints in the global economy that are not geographic — the most critical of which is the U.S. dollar. This is why the book is called Chokepoints.

For thousands of years throughout history, the only way to block a maritime chokepoint like the Bosphorus was a physical naval blockade. What’s changed is that in the wake of hyperglobalization in the 1990s, the U.S. acquired the ability to block chokepoints like the Bosphorus just by weaponizing its control of the U.S. dollar.

Today, the director of OFAC, the unit at the Treasury Department that oversees sanctions policy, can sign a few documents in her office and blockade a chokepoint like the Bosphorus. This actually happened on December 5, 2022, when the G7 oil price cap went into effect. The Bosphorus was backed up with dozens of oil tankers, because Turkish maritime officials were so nervous about violating the terms of the price cap that they didn’t want the ships to cross. It took OFAC days of very intensive diplomacy with Turkish authorities to persuade them to allow the ships to cross.

Jordan Schneider: You open this book with some wild contrast. Historically, you needed triremes. Now, all you need is a piece of paper from the Treasury Department to clog up the strait in Turkey halfway around the world.

Like you, Eddie, I was a sanctions nerd in college. I wrote my thesis about the origins of the UN and did papers on sanctions policy. I remember very vividly reading this literature arguing that sanctions are useless and don’t have any big impact. There was this great quote from George W. Bush in your book where at some point in the 2000s, he said, “We’ve sanctioned ourselves out of any influence” when it came to Iran’s nuclear program. You put the spotlight on one civil servant who takes that as a challenge and through ingenuity, creativity, and a whole lot of elbow grease, is able to discover and leverage a whole new lens of American power. Let’s briefly tell the story of American sanctions pre-Stuart Levey before we discuss Iran’s nuclear program.

Edward Fishman: When Stuart Levey came in as the Treasury Department’s first undersecretary of terrorism and financial intelligence in 2004, the most recent big case of sanctions that the U.S. had was a 13-year sanctions campaign against Iraq from 1990, when Saddam originally invaded Kuwait, until 2003, when George W. Bush launches the invasion of Iraq. That embargo required full UN backing and was implemented by a 13-year naval blockade. You had literally a multinational naval force parked outside of Iraqi ports inspecting every single oil shipment going in and out of Iraq.

The lesson from this situation was that sanctions didn’t work — Saddam didn’t come to heel. He seemed to be just as aggressive, if not more so. Over time, this embargo wound up leading not only to humanitarian problems in Iraq, which are very well documented, but also significant corruption. Saddam was siphoning away oil money under the nose of the UN.

By the time Levey comes in, sanctions had been seen as something that had been tried and failed against Iraq, and in fact had paved the way for the U.S. invasion of Iraq. In many ways, the 2003 invasion of Iraq was a direct result of the perception that sanctions had failed.

When Levey started working on the Iran problem around 2004, the prospect of even doing an Iraq-style sanctions campaign against Iran was off the table because there was no way to get the UN Security Council to agree to that at the time. Bush’s comment about having sanctioned ourselves out of influence with Iran was a result of the fact that without the UN, the U.S. thought that the only type of sanctions we could impose were primary sanctions, like an embargo where U.S. companies can’t buy things from Iran or trade with Iran. The only issue is we had had an embargo in place since the mid-90s, so there wasn’t any trade to speak of between the U.S. and Iran. The two avenues of sanctions were closed off — sanctions through the UN had been discredited by the 90s, and the other, primary sanctions on Iran, had already been maxed out and had been for a decade by then.

Jordan Schneider: The other seminal piece of sanctions in American 20th-century history is the embargo on Cuba. That is the same story — we cut off trade with this country, yet Castro’s still there in 2004, some 50-odd years later. It’s interesting — if you go back even further, there was this real hope after World War II where the UN at one point was even going to have its own air force. The idea was that sanctions were going to be this incredible tool to deter bad actions by different actors around the world because the U.S. and the Soviet Union were friends and we would all police the planet in a happy-go-lucky way. That was not how the Cold War ended up working out.

In 2004, Stuart Levey started to understand that he can leverage the dollar’s role in global financial flows. Eddie, can you tell the story of how the U.S. dollar became globalized in this way?

Edward Fishman: Bretton Woods, the conference that set the rules of the road for the post-World War II economy, happened in 1944. It put the U.S. dollar at the center of the global economy and established the dollar as the global reserve currency. It made the dollar as good as gold — the dollar is convertible for a fixed rate of $35 per ounce of gold.

At the same time, it explicitly prioritized the real economy and trade over finance. John Maynard Keynes, who was one of the architects of the Bretton Woods system, said that capital controls were a very important part of the system. For the first 30 years of this new global economy that emerged after World War II, you had the dollar at the center of the world economy, but it wasn’t a particularly financialized world economy. Most states had pretty significant capital controls, and banking was a very nationalized and, in some ways, even just a regionalized type of business.

By 1971, the U.S. dollar had been losing its value for quite some time and we were running significant deficits because of the war in Vietnam. Ironically, this is when Richard Nixon unilaterally took the dollar off of the gold peg. The dollar was still at the center of the world economy, but it was no longer tethered to gold. Exchange rates were now set by the market instead of by government fiat.

In the years after that, the capital controls of the Bretton Woods system fully erode and the dollar winds up becoming even more integral to the world economy as we see financialization take off from the ’70s through the Clinton era. You get to the point where we have a foreign exchange market that is turning over seven or eight trillion dollars every single day, which is by far the largest of all financial markets.

Jordan Schneider: How did oil come to be traded in U.S. dollars?

Edward Fishman: The dollar’s role in trading oil is arguably the most important chokepoint for a number of the key sanctions campaigns of the 21st century.

After World War II, the U.S. was a large oil producer and a big exporter. The 1973 Arab oil embargo shifted our perspective, and the U.S. realized just how vulnerable it was to being cut off from Middle Eastern oil.

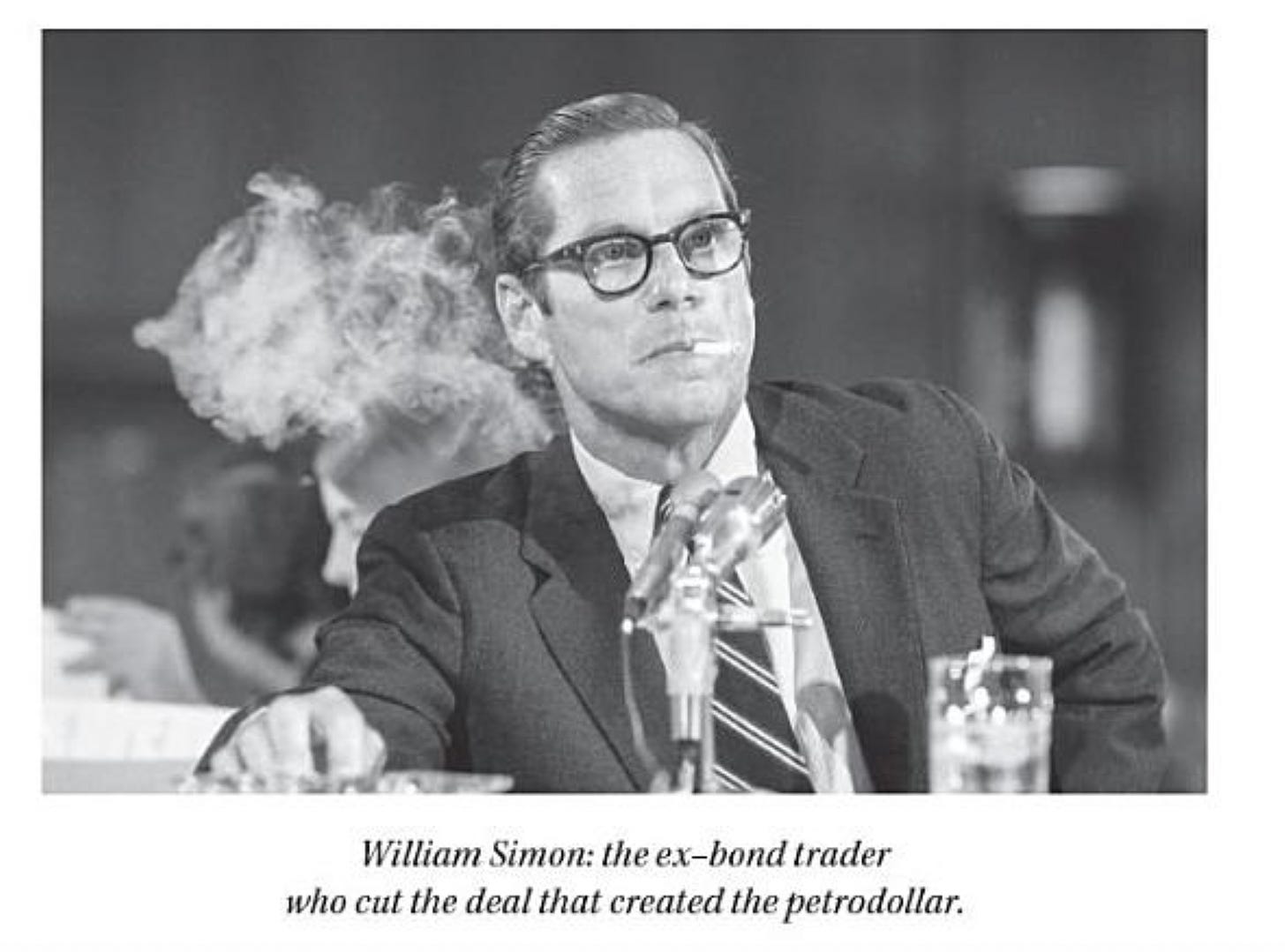

In 1974, Richard Nixon — who was wallowing under the political pressure of the Watergate scandal and massive deficits that we had no reasonable way of plugging — sent his treasury secretary, Bill Simon, to make a deal. Simon was a former bond trader, a New Jerseyite, a chain smoker...

Jordan Schneider: A chain-smoking New Jersey native, described by a peer as, “far to the right of Genghis Khan.”

Edward Fishman: He’s a really colorful figure. The book includes a photo of him testifying before Congress with a giant plume of smoke around him.

Bill Simon tried to think about how to plug these deficits using his financial background as a bond trader. He proposed cutting a deal with the Saudis such that, not only do they agree to keep pricing oil in dollars into perpetuity, but they actually take the dollars they earn from selling oil and reinvest them in U.S. government debt — they basically plug our deficit with the money that the U.S. is paying them for oil. He wound up taking a flight to Jeddah in the summer of 1974 — getting copiously drunk en route.

The deal worked. He cut a deal with the Saudis in which they agree to recycle their petrodollars into U.S. Treasuries. This agreement largely still exists to this day. Oil, by and large, is priced in dollars no matter who’s buying it or selling it.

Chokepoints in the global economy are typically formed by the private sector. They kind of develop naturally as businesses evolve. However, there are important moments when government intervention becomes critical.

Simon’s original deal in 1974 solidified the petrodollar, but then a few years later, as the dollar continued to slide in value, oil exporters and OPEC started getting upset because the weakening dollar was in turn reducing the real value of their oil earnings. Jimmy Carter’s Treasury Secretary, Michael Blumenthal, actually went back to Saudi Arabia and cut a new deal in which he agreed to give Saudi Arabia more voting shares at the IMF in exchange for Saudi continuing to price oil in dollars.

Jordan Schneider: Why did the Saudis even cut the deal in the first place?

Edward Fishman: The Saudis got two things. First, they got access to US military equipment, which was pretty beneficial to them. Second, which I think is more of a direct part of this deal and one that’s more easily provable through historical documents, the Saudis were able to buy U.S. government debt in secret outside of the normal auctions. Instead of participating in the public auctions for U.S. Treasuries, they had their own side deal where they could buy Treasuries. That was a big benefit to them because they were able to lock in prices and also do so without facing potential political opprobrium.

Jordan Schneider: That’s crazy.

Edward Fishman: It’s a remarkable turning point in the financial and economic history of the 20th century. There was a real shot that oil could have been priced against a basket of currencies, which in some ways makes more sense. For these countries in the Middle East and OPEC members, their entire economy basically depends on generating oil revenue. If you want stability and predictability, you don’t want to take exchange rate risk. But people like Bill Simon and Michael Blumenthal intervened and were able to get the dollar enshrined as the key part of the oil market.

The Iran Sanctions Formula and JCPOA Diplomacy

Jordan Schneider: Let’s talk about 2006, when Stuart Levey was trying to figure out how to make sanctions work against Iran. Can you explain his light bulb moment during the January 2006 trip to Bahrain?

Edward Fishman: Levey realized other countries hadn’t stopped doing business with Iran — only the U.S. had, and that’s why the sanctions weren’t working. But he realized that he could use access to the dollar as a lever to pressure foreign banks.

Typically, when you’re trying to get other countries on board for sanctions, you would go negotiate with their foreign ministry and say, “We think what Iran’s doing is bad. You should impose your own sanctions on Iran.” That was the paradigm before 2006. What Levey realizes is that he can go directly to the CEOs of foreign banks, bringing declassified intelligence demonstrating how Iran uses their banks to finance their nuclear program, and funnel money to terrorist proxies like Hamas and Hezbollah. To start, he could just present the facts and potential reputational concerns would often persuade these banks to exit Iran. In more extreme circumstances, when banks wouldn’t go along with him, he could threaten their access to the dollar to try to get them out of Iran.

What Levey really pioneered was the direct diplomacy between him as a Treasury official and his team at the Treasury Department with bank CEOs. You might ask, how did Stuart Levey get meetings with CEOs of banks all around the world? He was lucky — right when he had this epiphany, Hank Paulson, who had been the CEO of Goldman Sachs, came in as Treasury Secretary. Paulson is arguably the most well-connected banker in the world at the time. Hank winds up opening a lot of doors for Stuart and getting him meetings with ultimately more than 100 of the key banking CEOs around the world.

Jordan Schneider: Interestingly, you have to convince all the banks to get on board, because even the slightest institutional leakage would allow Iran to sell as much oil as they want.

How did Levey and his team go about convincing the Russians, the random Chinese banks, the Azerbaijani banks, and all of these other banks?

Edward Fishman: What Levey succeeds at doing between 2006 and 2010 is getting the big name-brand global banks to exit Iran. By and large, there are a few stragglers like BNP Paribas. Most of the big main global banks are out of Iran by 2010, though there are still some banks in places like the UAE, Turkey, and other countries doing business with Iran.

What winds up happening at that time is Congress, which has very little faith in Barack Obama’s willingness to come down hard on Iran — namely because Obama had very explicitly run for president in 2008 saying he wanted diplomacy. He even exchanged letters with Ayatollah Khamenei.

Even Iran hawks that are on the Democratic side of the aisle, like Bob Menendez, don’t really have much confidence that Obama is going to be tough on Iran. Democrats and Republicans basically form almost a coalition against the Obama administration on Iran sanctions and wind up passing progressively harsher sanctions legislation.

The key part of these sanctions laws, the first one called CISADA (the Comprehensive Iran Sanctions Accountability and Divestment Act of 2010), is that they require the Obama administration to impose what’s called secondary sanctions. That’s not sanctions directly on Iran, but sanctions on Iran’s business partners — for instance, the UAE or Turkish bank that I mentioned before.

Levey was a Bush appointee retained by the Obama administration (he’s one of only two very senior officials, along with Bob Gates, who’s kept on). He uses this law with the mandatory secondary sanctions as a significant cudgel. He goes to places like Dubai and talks to banks saying, “Look, if you don’t get out of Iran, I will be forced by American law to impose sanctions on you. You will lose access to the dollar and all of your assets will be frozen.” That threat is very significant. When the choice is between Iran and the United States dollar, it’s a pretty easy choice for most banks around the world.

Secondary sanctions had been tried before in the mid-90s, but the U.S. effectively wound up blinking and not imposing secondary sanctions on Total, the French oil company that had been investing in Iran’s oil sector. Even the George W. Bush administration decided not to impose secondary sanctions. This tool was very controversial. You can imagine it didn’t go down well with other countries. If you’re an American diplomat and you go meet with one of your counterparts abroad and say, “Sorry, we have to sanction your biggest bank if they don’t stop doing business with Iran” — that just feels like mafia diplomacy, not something that goes down very easily.

One of the virtues of Obama being so beloved around the world was the success of sanctions on Iran. Obama built international consensus that Iran’s nuclear program was a problem.

Jordan Schneider: We also had multilateral sanctions from the UN alongside U.S. action. What did that end up doing for the Obama psyche and the global push to limit Iran’s oil revenue?

Edward Fishman: Obama successfully got a major UN Security Council resolution done in the summer of 2010, right alongside when CISADA, the secondary sanctions law, passed Congress.

Jordan Schneider: In the Medvedev era, mind you.

Edward Fishman: Yes, exactly. Historical contingency matters — the fact that Medvedev was president of Russia at the time meant that Russia didn’t veto UN Security Council Resolution 1929. In retrospect, the benefit of that resolution wasn’t so much the specific sanctions it imposed on Iran. Rather, it explicitly drew connections between Iran’s banking system and energy sector with its nuclear program. This meant when Obama officials traveled the world to tell foreign banks and their governments that they’d be forced to impose sanctions if they didn’t stop doing business with Iran, they could credibly say they were just complying with UN Security Council Resolution 1929 and that international law was on the side of the United States. The legitimacy that Obama’s sanctions campaign derived from the UN was ultimately very significant.

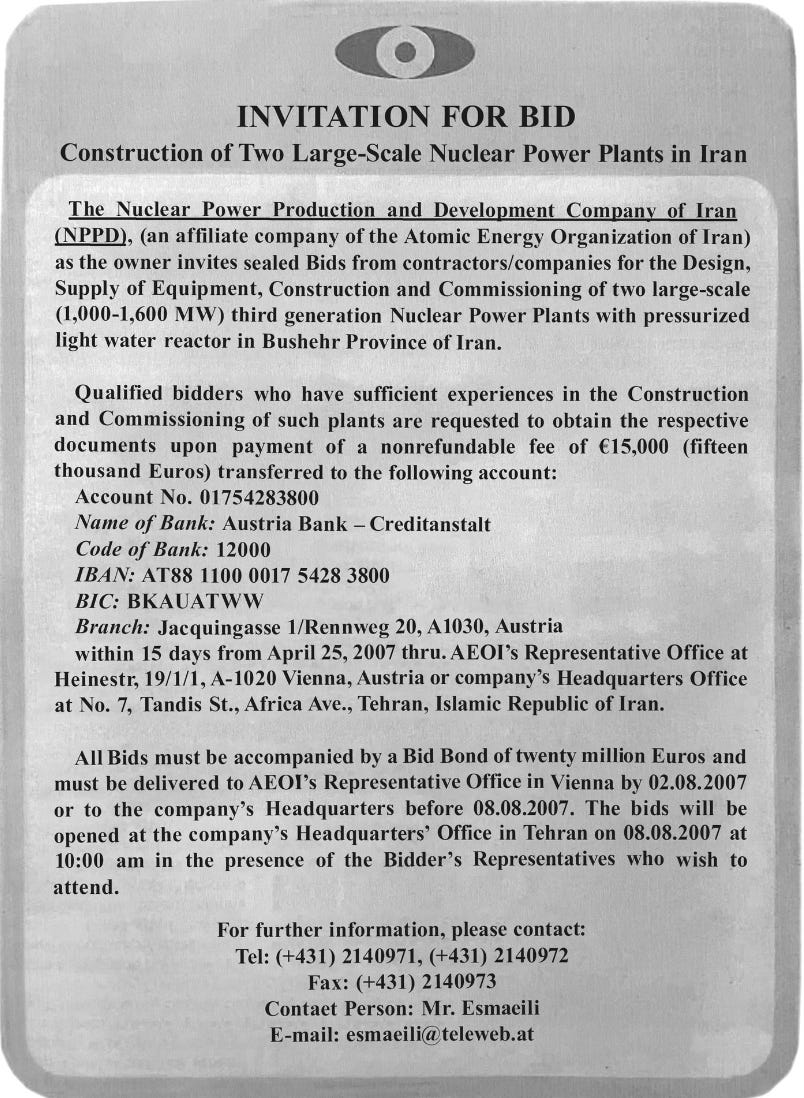

Jordan Schneider: Iran was completely unprepared for this. They literally took out ads in newspapers in Austria to beg for help financing their nuclear program.

Edward Fishman: Exactly. This speaks to assumptions about how the global economy worked at the time. People just trusted that banking networks wouldn’t be weaponized. Iran really thought that they could publicly advertise these fundraising activities with no issue. Foreign banks weren’t aware of what Iran was doing and weren’t particularly worried about being penalized for it. They probably viewed sanctions as something that were unlikely to happen to them — and if they did happen, they could just be chalked up as a cost of doing business.

Jordan Schneider: Let’s talk about the penalties. One of the remarkable accomplishments of the Treasury Department, which the export controls regime on China over the past few years hasn’t been able to do, was the billion-dollar fines thrown on violators — $2 billion on HSBC, and almost $10 billion on BNP Paribas. How did this work?

Edward Fishman: This is a very important part of the story and one that often goes unnoticed. It’s not that sanctions didn’t exist before this period in the early part of the 21st century — it’s that the cost of violating them wasn’t particularly high.

One of the most important strategic legacies of the campaign against Iran pioneered by Stuart Levey is conscripting banks to be frontline infantry of American economic wars. This wasn’t because banks decided that this was morally righteous, it was because they realized that violating sanctions was existentially dangerous for their businesses.

Between 2010 and 2014, Standard Chartered wound up getting fined about a billion dollars, HSBC was fined $2 billion, and BNP Paribas was fined $9 billion. In each case, the New York Department of Financial Services actually threatened to withdraw banking licenses from each of those banks, which would eliminate their ability to do business in the United States. That was a sword of Damocles hanging over these banks — U.S. law enforcement probably could have extracted even bigger fines.

We’re still living with that legacy today. The reason that financial sanctions in particular are so powerful is a confluence of two factors.

The dollar is essential to international commerce. Trying to do business across borders without access to the dollar is like trying to travel without a passport.

The U.S. actually can weaponize the systemic significance of the dollar because banks are afraid of going against American government dictates.

Jordan Schneider: The political economy of it is also different than whacking Nvidia or Synopsys, becauce those three banks are foreign. It is one thing to threaten with extinction some hoity-toity French bank that sponsors the French Open and has been doing business with Iran forever. It’s another to threaten a major contributor to America’s national competitiveness, employment, and growth.

Compare the death sentence of being cut off from the New York Federal Reserve versus mere fines in the case of export controls. With Huawei, there were some cases where they threatened to put executives in jail. Over the past few years, the types of companies that the Biden administration has gone after have often been random Russians in Brooklyn smuggling chips into Russia and China. Whereas the Obama administration was trying to put teeth behind big economic warfare efforts by throwing down billion-dollar fines.

Edward Fishman: Is it possible to conscript tech companies in the same way that banks are conscripted? My own view is yes. If the fines were harsh enough and if the enforcement were strong enough — because the other fact we haven’t talked about is it wasn’t just fines for these banks, it was also independent monitors. The Justice Department sent in people to oversee compliance reforms for several years thereafter.

It is possible, though politically challenging, on one hand to be subsidizing American semiconductor companies to the tune of 50-plus billion dollars, and then on the other to say we’re going to take that money back because you’re violating export controls. It is possible.

One thing I would mention though is that with the BNP fine and the HSBC fine, those took many years to come to fruition. These were years and years of bad behavior that then eventually led to giant fines. It is possible that someone right now at the Justice Department is working away at a major export control violation case that we’ll learn about maybe in a couple of years.

Jordan Schneider: You mentioned “Mafia diplomacy” as a sort of derogatory term for sanctions tactics. There are a lot of moments in this story where gentlemanliness appears to be very important to Obama.

After the invasion of Crimea, around the Maidan revolution, Obama had a call with Putin where he warned that “Moscow’s actions would negatively impact Russia’s standing in the international community.” Putin’s response was basically like, “I don’t know, man, it’s hard to take you seriously.”

Why was Obama’s demeanor so helpful in the case of Iran?

Edward Fishman: Obama was very attuned to international law, or as you put it, gentlemanliness. You could argue he was very lawyerly in his approach. With respect to the Iran sanctions, I think it actually wound up being helpful because the secondary sanctions against Iran were beyond anyone’s imagination.

We haven’t talked yet about the oil sanctions, which were put in place in 2012. The U.S. successfully reduced Iran’s oil exports from 2½ million barrels a day to 1 million barrels a day over about a year. This is explicitly a unilateral U.S. sanction.

Would that have worked as well had Obama not been as attuned to diplomacy and invocations of international law? I’m not so sure. You may have seen more challenges from places like China and India and maybe more obstinance. I do think it was helpful in some regards.

Looking at all the various examples of economic warfare that I talk about in the book, this is in some ways the most remarkable because of how unlikely it is to succeed. But it works.

One big exception from the financial sanctions during the Stuart Levey era is the Central Bank of Iran. The Central Bank of Iran is not under sanctions because it’s the repository for all of Iran’s oil revenues. The Obama administration was really nervous that if they sanction the Central Bank of Iran, other countries won’t be able to pay Iran for its oil. All of a sudden you’ll have all of Iran’s oil go off the market overnight, you’ll have a giant spike in oil prices, and everyone will be in a world of hurt.

Senator Bob Menendez, who was the key Iran hawk in the Democratic Party...

Jordan Schneider: For international listeners, Menendez is now in jail for having taken gold bars from Egypt. But anyways, continue, Eddie.

Edward Fishman: It’s a wrinkle in the story. Then Mark Kirk, who’s his Republican counterpart, who also wants to do a naval quarantine of Iran — the two of them basically say, “We don’t care, Obama, we’re going to sanction Iran’s central bank.” That amendment passes 100 to 0 in the Senate.

Obama is left with figuring out how to make this work. They come to a compromise with the Hill in which they agree to sanction the Central Bank of Iran, but they create two exceptions. One is an exception for countries who every six months significantly reduce their purchases of Iranian oil. For instance, if you’re a Chinese bank, you’re exempt from this — you can pay the Central Bank of Iran so long as China as a whole every six months reduces its overall purchases of oil from Iran. This gives a glide path for Iranian oil sales to decline over time and winds up working marvelously, luckily with the ramping up of shale production in the U.S.

The other exception put in place in 2012 says you can pay the Central Bank of Iran if you’re a Chinese refinery or bank, but those payments have to go into an escrow account that stays inside China and can only be used for bilateral trade between China and Iran.

This actually gives Chinese entities an incentive to comply, because keeping this money in China is going to boost Chinese exports to Iran — there’s nowhere else that the Iranians can use the money.

The one-two punch of these gradual oil reduction sanctions and the escrow accounts leads to a situation where Iran’s oil sales collapse by 60% by volume and it effectively has zero access to its petrodollars. Within 18 months, about $100 billion of Iran’s oil money gets trapped in these overseas escrow accounts. This is the context in which Iran’s economy really goes into free fall. Hassan Rouhani, a dark horse presidential candidate in 2013, won the Iranian presidency on an explicit platform of trying to get the sanctions lifted.

The remarkable thing about this oil sanctions regime is it’s probably the most effective oil embargo we’ve seen in modern history. It’s done unilaterally by the U.S. — no other countries are fully bought into this. It doesn’t involve any sort of naval strategy at all. There’s no quarantining of oil ships or anything. It is just using these threats of being cut off from the dollar to coax banks in places like China and India to comply with American dictates.

Jordan Schneider: This is going to be the poster child for decades of history books in that it actually created political change. It both drove home economically, causing hyperinflation and really hitting growth, and then got you a new slate of politicians who some would argue really wanted to make a deal. Looking back 15 years later, what’s your take on JCPOA and how we should think about the lessons from how the Obama administration used the leverage that they created with this oil embargo?

Edward Fishman: The JCPOA is the high point of American economic warfare in the 21st century in that you actually see sanctions leading to the outcome that the United States had set out, which was to get a peaceful resolution to Iran’s nuclear program. You can quibble about whether the terms of the JCPOA were stringent enough. However, there’s pretty good consensus that sanctions were the critical unlock to that deal.

Democrats say that sanctions were the key to getting the deal. Republicans say that sanctions were working so well that if we had only kept them in place longer, we would have gotten an even better deal. Within really a 10-year period, we flip that consensus from sanctions don’t work to sanctions are this magic bullet that just ended Iran’s nuclear program without firing a shot.

The key lesson here is that you need both economic leverage to make sanctions work and a clear political strategy. Having a clear political strategy, which was to get a nuclear deal with Iran, wound up being very important because you wind up having the international community grudgingly go along with the sanctions. They don’t voluntarily go along — they kind of have to be dragged along, including even the Europeans. But it would have been much harder to bring them along if there hadn’t been a political strategy, if it had just been bludgeoning Iran with economic pain without any sort of political end game in mind.

Responding to Russia (2014 vs. 2022)

Jordan Schneider: Let’s transition from the success of Iran sanctions to the failed response to the annexation of Crimea. What was different about how Obama and the world responded to Russia’s invasion in 2014?

Edward Fishman: Too often we tell our histories in silos — U.S. policy toward Iran vs. U.S. policy toward Russia. One thing I wanted to show in my book is that all of these sanctions campaigns are intertwined because ultimately these are the same decision makers at the table in the Situation Room across multiple issues.

The timeline is interesting here — the U.S. signed the original Iran nuclear deal, which froze Iran’s nuclear program, on November 24th, 2013. On the same exact day, hundreds of thousands of protesters descended upon the Maidan in Ukraine to protest Viktor Yanukovych’s deal with Putin.

The Ukraine crisis really does wind up taking the Obama administration by surprise. It’s not like the Iran nuclear program, which played out over the years as a slow-burning crisis. The Ukraine crisis and the Crimea annexation happened very quickly, with the U.S. constantly playing catch up. This parallel is important because right when Obama officials are scrambling to figure out what to do about Putin’s annexation of Crimea, they’re fresh off this giant victory where they just froze Iran’s nuclear program basically just by using sanctions.

It became natural for Obama officials in February-March of 2014 to say maybe sanctions could work against Russia. It’s a harder problem with Russia for several reasons. Russia has a much larger economy than Iran — in 2014 it was the 8th largest economy in the world and the world’s largest exporter of fossil fuels. Europe is completely dependent on Russian energy to heat their homes. Natural gas pipelines crisscross the continent between Russia and Europe.

Putin is creating facts on the ground as the U.S. is trying to scramble to put together sanctions. The annexation of Crimea happens within weeks of the “little green men” showing up in Crimea — they appear at the end of February and the annexation is formalized in middle of March. Shortly thereafter, Putin starts sending little green men into the Donbas, Ukraine’s industrial heartland.

Jordan Schneider: Let’s focus on the multilateral dynamic of this because obviously the UN is thrown out when Russia’s doing the thing. I remember very vividly watching the transition of the European actors who were pretty close to shrugging off this whole thing — until all those Dutch people died in the commercial liner that the Russians shot down by accident with their anti-aircraft missile. Can you explain how that changed the dynamic?

Edward Fishman: When Putin annexed Crimea in March of 2014, the U.S. and Europe did go ahead with some sanctions, but by and large they’re individual sanctions on people very close to Putin — his judo partners from childhood who have been elevated to positions of power at companies like Rosneft. Igor Sechin, for instance, the CEO of Rosneft, is sanctioned, but there are no sectoral sanctions, no actual significant economic sanctions on the Russian oil industry or its banking sector.

Obama and European leaders very publicly threatened this in March of 2014, but they don’t do anything. The reason is partly because there isn’t political will, but it’s also because they don’t know what kind of sanctions are tolerable to their own economies. They wind up spending months negotiating and coming up with what they eventually term “scalpel-like sanctions,” which effectively cut off big Russian state-owned enterprises from Western capital markets. It’s using an even narrower chokepoint than the dollar — it’s really just Western financing.

Interestingly, something that doesn’t often get recognized enough, the Obama administration went ahead with these sectoral sanctions, cutting off some big Russian energy companies and banks from U.S. capital markets on July 16, 2014, the day before MH17 was shot down. Obama and his team were getting fed up with the European foot-dragging. They say we need to send a powerful signal to Putin if we’re going to have any chance of deterring a broader invasion of the Donbas.

At the time, the New York Times was publishing headlines like, “Obama goes ahead without the Europeans.” Banking CEOs in the U.S. are incredibly upset because they’re saying this is just going to lead to a flight from the dollar to the euro and all our competitors in Frankfurt and London are going to benefit at our expense.

The next day, Putin’s proxies in the Donbas shot down a commercial airliner using a Russian-made Buk missile. They killed almost 300 people, by and large Europeans, most of them Dutch. All of a sudden the political aperture just widens completely in Europe. The Europeans are suddenly not only ready to match the U.S. sectoral sanctions of July 16, but actually go beyond them — they wind up cutting off all of Russia’s state-owned banks from the European financial system. The real core sectoral Russia sanctions are put in place after MH17, really from late July 2014 through September 2014 when Russian and Ukrainian leaders agree to the first Minsk agreement, the first ceasefire in the conflict.

Jordan Schneider: There are two parts that made me get upset rereading and reliving this story. One is that the Obama administration had just learned the lesson which Democrats in general have a really hard time with — escalate to de-escalate. It’s such an Obama thing, the same with the debt ceiling, where he was just like, “I’m going to be a nice normal actor and lay out my five demands and okay, we’ll get to two or three.” The Tea Party — this is ancient history now — and the Republicans were like, “No, we want 100% of what we want.” Obama would get scared, then they’d do a debt ceiling fight and he would end up giving way more than he realized he had to.

By the time we got to 2014, he just said “screw you.” He had the playbook with Iran. All the Treasury forecasting about the catastrophic costs of sanctions is overblown. The U.S. had more agency than expected, the euro was not going to take over.

But Russia really got away without serious economic consequences. Why didn’t Obama put the money where his mouth was?

Edward Fishman: In retrospect, there are two things that led to Obama’s overly cautious approach. One was real, genuine concern about the U.S. economy and the European economy. Remember, we’re still in the wake of the financial crisis and the Eurozone crisis is very much a live situation. There are genuine fears from the Treasury Department that you could accelerate a financial crisis in Europe if Russia were to cut off their gas supplies, and that contagion would spread to the US.

The other thing — this is an interesting paradoxical lesson for the Trump people now and people who say Europe needs to pull more of its own weight — Obama was very deferential to the Europeans over the Ukraine crisis. He explicitly wants people like Angela Merkel and François Hollande to take the lead. The negotiating block that came up with the Minsk agreement, the Normandy format, is France, Germany, Russia, and Ukraine. The U.S. doesn’t even have a seat at the table in the negotiations. Obama was saying, “This is in Europe’s backyard. It’s really their problem.”

In retrospect, that caution does not look very wise. Obama should have hit Russia much harder than he did in 2014. One interesting thing though is even though the sanctions put in place that summer — these capital market restrictions, the “scalpel-like sanctions” — are much weaker than the Iran sanctions, in the second half of 2014, oil prices cratered from over $100 a barrel to around $50 a barrel.

While the sanctions were aimed at trying to constrain Russia’s economic horizons as opposed to creating an immediate financial crisis, the sanctions do push Russia to the brink of a complete meltdown. In the winter of 2014-2015, Russia’s economy looks like it’s about to collapse — honestly just as bad, if not worse than Russia’s economy winds up looking after the much more drastic sanctions from February-March 2022.

The reaction is remarkable. I have some of these quotes in the book. European leaders look at this and say, “This isn’t scalpel-like — this is what we signed up to. We didn’t want to push Russia off a cliff.” Hollande, the French president, actually says, “We explicitly don’t want to push Russia to its knees.” The Europeans, and to a certain extent the United States, got spooked by how impactful the sanctions are because they wind up being accelerated by this collapse of oil prices. Part of the reason why there’s a real frantic desire to get another more permanent agreement, which winds up being called Minsk II in February 2015, is because the Europeans really didn’t want to see Russia’s economy fall off a cliff.

Jordan Schneider: Elections matter and leadership matters. I like that you included so many McCain quotes about the events in both Iran and Ukraine, since he could have been president during these years.

Edward Fishman: One of the key ingredients of the success of Obama’s Iran sanctions is the fact that there’s this bipartisan supermajority in favor of tougher sanctions on Iran. Even if Obama had instincts to be cautious or lawyerly, Congress was passing draconian sanctions laws 100 to 0 over a veto-proof majority. With Russia, you had no sanctions laws at all.

What that speaks to, which becomes more important as our story develops, is that U.S. companies had a lot to lose in Russia. It’s not as much of a political winner for members of Congress and senators to try to layer sanctions onto Russia because they might hurt a company in their state or district. We start seeing that maybe there are domestic political limits to how far the U.S. is willing to go with economic warfare.

Jordan Schneider: Commitment to sanctions is a key factor. Secretary Lew once remarked, “One of the things the Russians would say to me is, ‘We survived Leningrad, we could survive this.’ Their definition of what they were willing to tolerate was well beyond the realm of what we would consider tolerable.”

America’s rich, and the pain that we would end up inflicting on ourselves with sanctions would only be like a half percentage point hit to our quality of life. Whereas Russia is starting from a lower baseline, and sanctions hurt them way more than they hurt us. Yet, we’re not comfortable letting ourselves be pinpricked, even if it’s to save the international order.

You wrote…

“With the loss of the Russian market, Lithuania’s dairy industry teetered on the brink of bankruptcy. When a team of State and Treasury officials met with a Lithuanian dairy farmer outside Vilnius in 2015, they expected her to express frustration. She did, but it wasn’t about her declining business. ‘You should be hitting Russia harder,’ she said.”

It doesn’t come down to economics for a lot of this stuff. There are the political economy games of the Texas senator wanting to help out Exxon or whatever, but it often is a question of moral righteousness. We live in rich countries and we can afford to go without, by and large, way more than that Lithuanian dairy farmer could go without.

Edward Fishman: That’s exactly right, Jordan. One of the macro ironies of the book is, the rise of economic warfare in U.S. foreign policy in the 21st century is partly because military force became politically toxic in the aftermath of Iraq and Afghanistan. As those wars were going south, neither Republicans nor Democrats felt like they could even fight limited military engagements, which is very different from the ’90s when there were all kinds of small wars and U.S. bombing campaigns.

Economic warfare initially is seen as more politically palatable because it’s not hurting Americans — we can sanction Iran out the wazoo and there’s no pain felt at home. But then once you get to Russia and even more powerfully once you get to China, there are real political risks for leaders who impose sanctions on these countries. Even a 10% spike in oil prices or a marginal increase in inflation can become powerful factors in the minds of American presidents and wind up constraining our ability to successfully prosecute economic warfare.

Jordan Schneider: That’s a great point. In the 90s, you had the Taiwan Straits crisis where Clinton threw a carrier there and things calmed down. You had Mogadishu, you had Yugoslavia. But there’s this moment in 2014 where the Ukrainians asked, “Can you give us Javelins, please?” The Europeans said no. Blankets don’t win wars, bullets do.

This is the heartbreaking thing — if Russia believed that the U.S. and NATO were really going to put their money where their mouth was in arming the Ukrainians for war number one, maybe they would have been more concerned — not only about the economic impact, which they clearly underpriced, but also the military impact. We have had hundreds of billions of dollars of armaments go to help Ukraine. It was totally reasonable for Putin, based on the track record of the Obama and Trump administrations, to not expect that to be the response when it came to 2022.

Edward Fishman: Looking at the real error of U.S. policy toward Russia, it’s not necessarily anything that happened in 2014 because we were dealing with a completely novel problem, an unexpected crisis. There was no playbook for sanctions on Russia. This is one area where it’s important to be empathetic to Obama and his top team because it wasn’t easy what they had to deal with. The sanctions they did put in place in 2014 wound up being really impactful — Russia’s economy effectively collapsed that winter.

The bigger indictment on American policy is what happened after February 2015 when the Minsk II agreement was signed. After that, the Obama administration took its foot off the gas on sanctions, basically saying they’re just going to maintain what they have in place. Russia very publicly interferes in the 2016 election. Obama had threatened Putin with drastic sanctions if he continued to interfere. Putin continued to interfere, and the sanctions Obama put in place in December right before he left office were really minor. That’s a bad signal.

Then you have four years of the Trump administration in which Trump does nothing on Russia sanctions. It’s a logical lesson for Putin to draw, both from the last year and a half of Obama and all four years of Trump, that he basically got away with the annexation of Crimea at a reasonable cost. That’s just speaking of the U.S. — Europe is even worse. In 2015, after the annexation of Crimea, a consortium of companies signed the Nord Stream 2 pipeline deal to double the amount of gas that Europe would get from Russia. Putin was completely within reason to assess that the West does not have the stomach for a real economic war.

Jordan Schneider: Unlike in Crimea, the U.S. sees this coming in 2022 and has months to try to get its ducks in order, to try to do everything it can to dissuade Putin from trying to take Kyiv. What happened then?

Edward Fishman: When Biden comes in, there’s a real debate amongst his advisors about what to do. Russia had accumulated all of these misdeeds that had gone unanswered. Biden himself, when he was vice president, wanted to arm the Ukrainians. He was the most hawkish member of the top Obama team on Russia, always in favor of tougher military steps to help the Ukrainians, always in favor of tougher sanctions.

There was real debate about what to do. Should they come in right away with really tough sanctions? Biden’s conclusion was that we were still reeling from the COVID pandemic, we had climate change to deal with, and China was the biggest geopolitical issue on his radar. They tried to have what they called a “stable and predictable relationship” with Russia — which is hilarious in retrospect, as “stable” and “predictable” aren’t things you necessarily ever ascribe to Putin’s Russia.

They came out of the gate in April 2021 with a modest increase of sanctions, saying, “Here’s some sanctions to repay you for all these bad things you’ve done over the last six years. But after this, we want stability and predictability.” Putin gets a summit with Biden, which he’s very happy to get. Then he pens a rambling 5,000-word essay about why Ukraine’s not a real country and should be part of Russia in the summer of 2021 while he’s in lockdown. He masses over 100,000 troops around Ukraine’s border that fall.

It becomes quite clear that Putin has designs on Ukraine. In what is probably the biggest intelligence success of the 21st century, the US intelligence community gets Putin dead to rights. They figure out exactly what his plan is, to the point where Biden starts warning American allies privately in September and October 2021 that an invasion is coming. Very soon thereafter, he starts making public warnings that invasion is coming and tries to use the threat of swift and severe consequences, particularly very dramatic economic sanctions, to deter Putin from invading Ukraine.

Jordan Schneider: Let’s talk about how they tried to build that coalition and signal those sanctions in the lead-up to the ultimate invasion.

Edward Fishman: A stroke of luck for the Biden administration was having Daleep Singh, who had played a significant role in the 2014 sanctions. He’s one of the top financial minds in Washington — a city that doesn’t have many people with deep financial markets expertise. Daleep is an exception. He was in the perfect role to orchestrate a sanctions campaign as the Deputy National Security Advisor for International Economics, overseeing the organs of the US Government that do economic warfare.

In late 2021 and early 2022, Daleep builds relationships with his fellow G7 counterparts: in Brussels, Bjoern Seibert, and in London, Jonathan Black. They start getting into the nitty-gritty of what kind of sanctions they might impose if Putin were to invade. This preparation is important not just for being ready to do something real if Putin pulls the trigger, but also for making the threat of deterrence more credible. Russia has a world-class intelligence apparatus — if all you had was Biden wagging his finger saying “You’re going to face really strong sanctions if you invade,” but there’s no actual bureaucratic movement in these capitals creating sanctions ready to go, Putin would probably assess it was a bluff. The preparation that Daleep Singh and his counterparts in Europe and Japan do is very important.

Jordan Schneider: I love how they were doing this like in secret, but also in public. They weren’t being super hard about using classified communications — they were just calling each other on their phones because they actually want the Russians to be listening and believe they are going to put real sanctions on them.

Edward Fishman: That’s exactly right. They view the preparations as important from both a practical standpoint and a signaling standpoint.

By the time we get to the moment of decision in late February, it becomes clear after Putin and Xi Jinping meet in early February that an invasion probably won’t happen until the Beijing Olympics wraps up — Putin doesn’t want to spoil Xi Jinping’s party. By that time, you have a very extensive menu of sanctions options. Most importantly, you have what’s called the Day Zero package — the raft of sanctions that would go into effect as soon as Putin invades.

The compromise is made because inflation is at a four-decade high and there are concerns about oil prices potentially spiking. Biden says they’re going to maximize sanctions on Russia but not aggressively target its oil sales, which is tough because Russia’s economy depends on hydrocarbon exports. The strategy of the Day Zero sanctions is to implement maximalist sanctions on Russian banks — Sberbank and VTB, the two biggest banks in Russia — as well as Russia’s access to foreign technologies. They took the Foreign Direct Product Rule that had been imposed on Huawei in 2020 and recast it to cover the entire Russian economy. They take something that had been previously employed on just one Chinese company and apply it against an entire state.

The tragedy of the situation is that Putin invades and very quickly — similar to that moment in July 2014 after MH17 was shot down — there’s a giant shift of the Overton window in Europe. Everyone becomes gung-ho for very aggressive sanctions after Putin invades and we start seeing just how horrible this war is and how imperialistic Putin’s goals are. Hundreds of thousands of people protest on the streets of places like Berlin, and there’s a massive political movement in favor of stronger sanctions.

Within 24 hours of the invasion beginning, the Day Zero package that Daleep Singh and his colleagues had worked months on looked much too weak and actually undershot the political moment. Within that first weekend of the war, the United States and the G7 agreed to go much further and actually sanction Russia’s central bank directly — something that was seen as too politically radical to even consider in the lead-up to the invasion. Putin clearly agreed because he had left half of his central bank reserves completely exposed to Western sanctions.

Jordan Schneider: This goes back to the mafia diplomacy concept. Ironically, Putin expected the West to be more gentlemanly and concerned about the centrality of the dollar and euro to global trading. Once the war started and the Overton window shifted — which everyone had a hard time foreseeing — things changed. Looking back, it seems silly that they didn’t anticipate massacres when Russia invaded. While sanctioning their central bank was an option, there remained questions about whether they could get the money out, and if they would even believe the threat before it happened. The actual deterrent value we had during those months remains an open question.

Edward Fishman: Clearly, we would have been better off had the U.S. and Europe created more aggressive sanctions plans in advance. This could have strengthened deterrence and weakened Russia’s economy and warfighting capability more quickly, directly helping Ukraine on the battlefield. There were significant costs to underestimating how willing political leaders would be to implement tough sanctions in the U.S. and Europe. But going back to your earlier point, Jordan — from a deterrent standpoint, would that preparation have overridden Putin’s lesson from 2014 and the seven or eight years of basically allowing Russia to get off scot-free after annexing Crimea? Putin had likely already sized this up in his head by then, and I’m not sure we could have changed his mind.

Jordan Schneider: Here’s a crank idea — why didn’t the Treasury Department go long on oil if they were worried about it spiking up to $250 a barrel? Couldn’t you just do the math that way?

Edward Fishman: This is a point I make toward the end of the book — the U.S. is much better at imposing economic penalties than deploying capital for strategic reasons. That would be a very creative use of government resources, but it’s not a bad idea. If we had the flexibility to do something like that in a strategic manner, sure. We do use things like the Strategic Petroleum Reserve to stabilize the oil market. In March 2022, the Biden administration released 180 million barrels of oil to try to stabilize the market.

Jordan Schneider: They did eventually act, but it took too long, and the Department of Energy people are complaining that the caves might crater in. Reading through your book, I can only imagine how frustrating it must be for these officials working around the clock to get the whole world to ramp up sanctions, and they can’t even get their own government to release oil for arguably the biggest crisis in at least 50 years.

Edward Fishman: Many of our institutions are built on the assumption that we live in a peaceful, predictable world, and we don’t always get our act together in time for crisis. This isn’t unique to the 21st century — it’s been true throughout American history.

Jordan Schneider: Here’s another crank idea for you. In the winter of 2023, everyone was terrified that oil prices were going to spike. Did anyone discuss geoengineering solutions, like spraying sulfur in the air over Europe to save everyone’s energy bills?

Edward Fishman: There are a number of tragedies in this story, one being that you decided to become a podcaster instead of a sanctions nerd. Had you gone down this path, maybe we would have benefited from your creativity in the U.S. government.

Institutional Dysfunction

Jordan Schneider: The people you profile, whom you clearly admire for their incredible feats of civil service, were creating new concepts and regimes unimaginable back in 2004 while operating under such constraints in such a dysfunctional system. They made enormous family sacrifices, which you mention several times. We did a show called “Is the NSC Unwell?” where we opened with Jake Sullivan being awake at 4 AM on a Tuesday during a home invasion because he was dealing with Ukraine issues.

Is the NSC Unwell?

Heart attacks, prostate cancer, Jake Sullivan awake for a home invasion attempt at 4 a.m. because he was just up working on a random Tuesday night?

Having the idea is the easiest part. Sure, I can suggest geoengineering to fight the impact of Russian oil, but transforming a clever idea that checks all the economic, institutional, and diplomatic boxes into reality is unbelievably difficult. Multiple times in your stories, there are eight-month delays for things that everyone should have immediately approved on day one.

Edward Fishman: We need a government that’s purpose-built for the age of economic warfare. That’s the premise of my book — we are living in an age of economic warfare. Sanctions, tariffs, and export controls are how great powers compete today and will compete tomorrow. This is a secular trend we’ve seen throughout the 21st century, yet we haven’t changed our government to actually fight and win these economic wars.

There’s nothing like the Pentagon for economic warfare. During my short stint at the Pentagon working for then-Chairman of the Joint Chiefs of Staff Marty Dempsey, I noticed that military force has one agency and a clear chain of command up to the Secretary of Defense. With economic power, you’ve got numerous agencies involved — the Treasury Department, the Commerce Department, the State Department, the Energy Department. Much time is spent just coordinating the interagency process.

Ideally, we would have a dedicated department with clear leadership for economic statecraft or economic warfare. Some governments have moved in this direction — Japan now has a cabinet-level minister for economic security. The U.S. hasn’t innovated like that. There’s a core budgetary problem where agencies like TFI (Office of Terrorism and Financial Intelligence) at Treasury, which Stuart Levey led, or BIS at the Commerce Department, haven’t seen significant budget increases despite their missions growing exponentially.

Jordan Schneider: This theme comes up repeatedly in these stories and with the chip export controls. When cabinet-level officials disagree without presidential direction saying “We’re doing X, not Y, get with the program,” things stall or take longer. Cabinet members are congressionally approved; their words carry weight. When Janet Yellen believes a sanction would harm global inflation and the American economy, Jake Sullivan must call Mario Draghi to persuade her because Biden won’t act without her support. Everyone has different priorities, and without a central authority or an engaged president, you end up with stasis — allowing Russia to make an extra $200 billion they shouldn’t have throughout 2023.

Edward Fishman: Exactly. The Draghi call is one of the more remarkable episodes in the book. After the political aperture expanded during the first weekend of the Ukraine invasion in 2022, making central bank sanctions possible, the G7 agreed. Then Janet Yellen raised concerns, requiring a call from Mario Draghi, Italy’s leader and former European Central Bank chair, to personally assure her it was acceptable.

Regarding China, much of why your podcast is amazing has been its in-depth coverage of chip export controls. Looking back to the first Trump administration, export controls were deployed against Huawei instead of sanctions largely because Treasury Secretary Steven Mnuchin opposed a tough China policy. In early 2019, after the arrest of Meng Wanzhou 孟晚舟, some administration officials suggested sanctioning Huawei and putting them on the SDN list. Mnuchin refused, so they defaulted to putting Huawei on the entity list, which Wilbur Ross controlled as Commerce Secretary. The whole export controls landscape might have been very different with a more hawkish Treasury Secretary during the first Trump administration.

Jordan Schneider: You have this wild anecdote from Matt Pottinger, former ChinaTalk guest who became Deputy National Security Advisor towards the end of the Trump administration.

Pottinger noted that at one point, Bolton decided not to tell Trump about arresting Meng Wanzhou. Pottinger interpreted Trump’s rhetoric as supporting a tough stance on China.

“Pottinger told his Commerce colleagues that Trump was pursuing a two-pronged strategy. On the one hand, the president was seeking to preserve his personal relationship with Xi Jinping and the appearance of pursuing warmer ties. But as for officials in the bureaucracy, Trump ‘wants us punching as hard as we can.’ In effect, Pottinger was telling the Commerce officials to take Trump seriously, not literally — to tune out the verbal concessions that Trump made in public and keep a default position of being ‘tough’ on China.”

Presidents, even those not in their 70s, only have maybe 5% of their day for these matters. This leaves an enormous amount to be sorted out by empowered appointees and cabinet members, which explains how we ended up with export controls instead of sanctions on Huawei — quite remarkable in retrospect.

Edward Fishman: The first Trump administration has been characterized as super hawkish on China, but examining the record shows Trump himself wavered between being very hawkish and totally obsequious to Xi Jinping. The policy was shaped by different factions: people like Pottinger and Bob Lighthizer were tough on China, while Mnuchin and Gary Cohn wanted to return to the early 2000s approach — the Hank Paulson school of U.S.-China relations. These factions took advantage of opportunities when Trump leaned their way to advance their policies. Trump didn’t take a more consistently hawkish line toward China until his final year in office, when he believed Xi Jinping had lied to him about COVID, destroying his re-election chances. We’ll likely see similar dynamics in a new Trump administration — Trump vacillating while different factions capitalize on moments when he’s more receptive to their proposals.

Jordan Schneider: You close the book, Eddie, with the idea of an impossible trinity.

“We don’t yet know when the Age of Economic Warfare will end, but we can envision how. The trade-offs facing policymakers in Washington, Beijing, Brussels, and Moscow can be thought of as an impossible trinity consisting of economic interdependence, economic security, and geopolitical competition. Any two of these can coexist but not all three.”

Walk me through the 20th and 21st centuries — what different trade-offs did states make, and where are we landing now in 2025?

Edward Fishman: Let me explain why I ended the book this way. While I wrote a narrative history because I believe individuals can shape history — remove certain individuals and history would have gone differently — there are also structural reasons underlying the age of economic warfare. Consider this statistic: Barack Obama used sanctions about twice as much as George W. Bush, Trump used them twice as much as Obama, and Biden uses them twice as much as Trump. This suggests both individual agency and structural factors matter.

The geoeconomic impossible trinity I developed explains why this is happening. You can only have two of these three elements simultaneously — economic security, economic interdependence, and geopolitical competition. During the Cold War, we had economic security and geopolitical competition in a bipolar order between the U.S. and Soviet Union, but at the expense of economic interdependence — there was no meaningful economic relationship between them.

When the Cold War ended, geopolitical competition disappeared. China and Russia transformed from adversaries to potential friends, and we invested significant political capital bringing both into the liberal international order, including the WTO and other key international bodies. Without geopolitical competition, we could embrace economic interdependence without sacrificing economic security.

Today, we maintain economic interdependence while geopolitical competition has returned full force, resulting in lost economic security. This affects all major powers — the United States, Japan, European Union, China, and Russia. None feel economically secure, leading them to invest heavily in protecting themselves from rivals’ sanctions, export controls, and tariffs. To regain economic security, we must either end geopolitical competition, which seems unlikely, or significantly reduce economic interdependence. My view is we’re heading toward a significantly less interdependent global economy in the years ahead.

Jordan Schneider: You end the book with some dark words,

“Without the ability to channel geopolitical conflict into the economic arena, great powers could once again find themselves fighting on an actual battlefield. The dream of economic war, for all its downsides, is that it can be an alternative to a more violent kind of war. Someday the age of economic warfare might end, but we might miss it when it’s gone.”

Care to elaborate on this idea?

Edward Fishman: We face very significant stakes in our economic decisions today as we head toward a less interdependent global economy. This could manifest in two ways. First, a world economy where the U.S. and its allies deepen their connections. We might have less trade with China and Russia, but more with Canada, Mexico, the European Union, and Japan. Janet Yellen in the Biden administration called this “friendshoring.” Bob Lighthizer proposed this in a recent New York Times op-ed, suggesting the U.S. and other democracies create a bloc with low internal tariffs and high tariffs on everyone else.

The alternative is deploying sanctions, tariffs, and export controls arbitrarily against friends and foes alike, creating a chaotic breakdown of the global economy. We’d be forced into autarky by default, without long-term economic agreements with allies or adversaries. This scenario frightens me most because history shows that when states can’t secure resources and markets through free trade and investment, the temptation for conquest and imperialism rises.

President Trump’s talk about seizing Greenland for its mineral resources echoes Hitler’s pursuit of Lebensraum. Hitler feared being cut off from European trade after Europeans sanctioned Mussolini for seizing Abyssinia. If economic interdependence unravels into every country for itself rather than friendly blocs, we could see a return to great power war.

Jordan Schneider: Dark. I’ll refer folks back to our two-part episode with Nicholas Mulder on The Economic Weapon, which told that whole 1920s and 1930s story of how Imperial Japan and Nazi Germany developed their autarkic, resource-hungry vision. While racial ideology played a role, they were clearly terrified about accessing enough oil, minerals, and resources to remain great powers.

Researching Modern History

Jordan Schneider: Let’s shift topics. Tell me about writing history of the past 20 years. You don’t have everything declassified, you’re doing interviews, and history seems to be happening in WhatsApp groups. What was it like both as a former civil servant and then interviewing all these people to piece this recent history together?

Edward Fishman: As you know, Jordan, since we shared some classes, I studied history and in a parallel universe might be a university historian. After college, I went into government work and realized that in this era, many decisions bypass formal processes. Even back in the 2010s, decisions were made through informal communications, in coffee shops, never written down, through WhatsApp groups. This has only accelerated since I left government.

Contemporary history plays a crucial role because documentary records won’t be as valuable in 30 years as they were previously. They might even mislead — often the package going into an NSC meeting doesn’t reflect what’s actually discussed or decided. Many decisions happen outside formal meetings entirely.

This experience convinced me that the best approach was to follow Thucydides’ method — write contemporary history, documenting the times you live in, striving for impartiality. What you lose in documentary records, you gain by talking to people who were actually present. Thanks to my government experience and non-partisan reputation, I accessed everyone crucial to this story — Democrats, Republicans, and current civil servants.

Future historians will surely build on and improve the story told in Chokepoints when they access all documents. However, I hope the insights derived from my access to these people and my insider government experience will prove durable.

Jordan Schneider: Did you send Nabiullina an email?

Edward Fishman: No, I didn’t speak to Elvira Nabiullina, unfortunately. One wrinkle in the story is that I was sanctioned by the Russian government in 2022, before I even started writing. I’m currently banned from any travel to Russia.

Jordan Schneider: She’s got an open invitation to ChinaTalk. I’d love to hear her side of the story.

y through declassified documents showing what really happened — I’d bet most of the narrative around U.S. policy holds up. Rather, I hope we’ll see Chinese, Russian, or European versions of Chokepoints. While I capture those stories to some extent, the book focuses on the United States. If counterparts in those systems wrote similar books, we’d have a much more complete picture.

Jordan Schneider: Eddie and I were classmates at Yale, studying ancient history together. I love how you say you’re walking in Thucydides’ footsteps — let’s say we’re doing the same with ChinaTalk. For both of us, Donald Kagan’s classes were among the most formative in thinking rigorously about politics, history, and warfare. Any memories or reflections about his impact in the classroom?

Edward Fishman: One sad aspect of publishing this book is that Don died a couple years ago and won’t have the chance to read it. Of all my teachers, he had the biggest impact, shaping my career in many ways. He even influenced how I teach my class at Columbia on Economic and Financial Statecraft — I use his exact seminar format, with students debating each other’s papers weekly.

The main lessons I learned from Kagan that influenced the book include understanding the role of contingency in history — people and their decisions matter. While many history books focus on impersonal forces, Kagan taught me that structure sets context but free will and decisions can change history’s course. That’s why I focused on the people creating these policies.

Second, chronology matters. You must understand historical decisions within the knowledge available at the time. We tend to judge past decisions with hindsight, but understanding what people knew then reveals more about how history unfolds.

Finally, history itself matters. Kagan said, “Without history, we are the prisoners of the accident of where and when we were born.” Beyond clichés about repeating history, understanding what our predecessors did right and wrong helps us live better lives today.

Jordan Schneider: Another lesson coming through your book is that while we can debate grand strategic decisions, like Biden’s approach, the most human agency appears one or two levels below. Having someone from Goldman Sachs who understands the global insurance market enables implementing policies that might not otherwise be conceived. While we criticize civil servants in today’s America, it’s important to recognize that you can expand government’s effectiveness by empowering the right people to make decisions and analyze questions thoughtfully. For anyone at a career crossroads, read Eddie’s book and understand that your future choices matter.

Edward Fishman: I appreciate that, Jordan. If there’s one takeaway, it’s that government officials’ decisions truly matter. The protagonists I highlighted — Stuart Levey, Adam Szubin, Dan Fried, Matt Pottinger, Daleep Singh, Victoria Nuland — if you remove them from their situations, you’d have very different policies. We were fortunate to have them in those positions. Having more people with diverse skill sets willing to serve in government increases the odds of having the right person in the right place at the right time.

I haven't even finished the pod yet but have bought the book.This is an amazing assembly of the real story.

Excellent episode