Angela Shen is back at it, this time with a multi-part series on industrial robotics and AI. If you missed her first ChinaTalk feature on biotech, check it out here.

At the 2024 World Robot Conference in Beijing, attendees cheered as a humanoid robot scored a goal in a fully robotic football match. Visitors could play a bot in Chinese chess and rock-paper-scissors, enjoy robotic performances of Yangqin melodies and martial arts, and marvel at robots assisting complex osteotomy and endoscopic surgeries. With the humanoid robot market surging 86% between 2022 and 2023, these mesmerizing displays make a bold statement about China’s big ambitions for robotics.

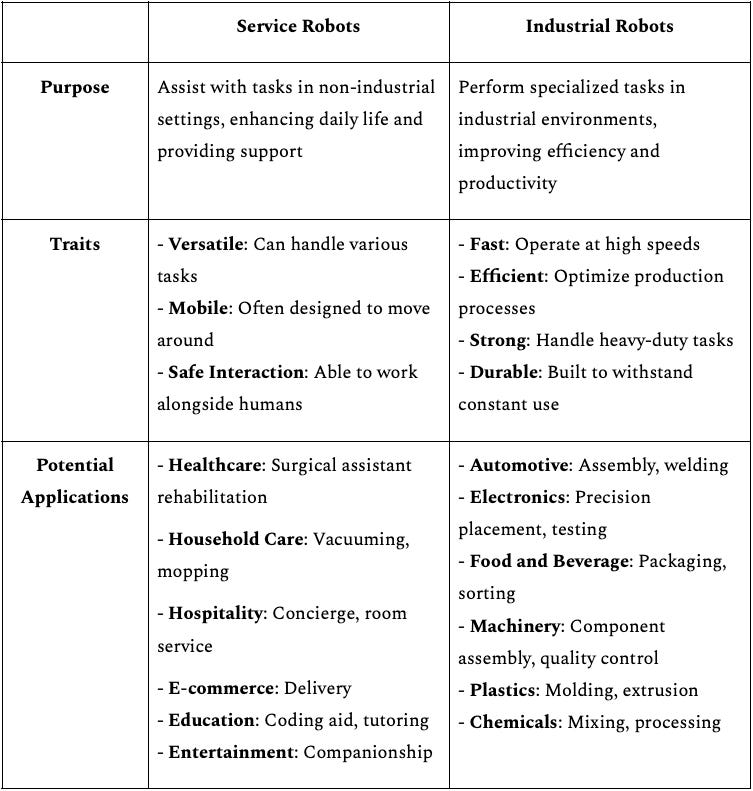

The global robotics industry is projected to reach upward of US$42 billion in 2024, of which China will make up about US$8.47 billion (~20%). Service robots account for over three-quarters of this projected market volume, and industrial robots account for the rest.1 While China shows improvement in both types of robotics, industrial robots are particularly relevant due to China’s status as a global manufacturing superpower.

To understand the future potential of these bots, we must also understand the motivations and methods behind China’s industrial policy for robotics.

China’s robotics, by the numbers

The factors driving robot adoption vary by country. Japan pursues robotics to address its aging population and high labor costs. Germany, meanwhile, invests in robotics as an alternative to human labor in the face of the country’s stringent worker safety regulations.

In general, high-income countries have a larger incentive to use robots than low-income countries: if human work is cheap, there isn’t much room for robots to cut labor costs. Industrial robots’ many applications in the electronics and automotive industries means that countries active in these sectors are also more likely to automate. As a result, the top four players in the global robotics race are South Korea, Singapore, Germany, and Japan.

National robot adoption is measured by “robot density,” ie. the number of installed robots per 10,000 workers. In 2022, China became fifth-most-automated in the world, showing rapid improvement since 2016, when the country ranked 25th. China’s 2022 robot density was 322 units per 10,000 employees. In 2024, China reported 470 units per 10,000 employees, and targets 500 units per 10,000 people by 2025.

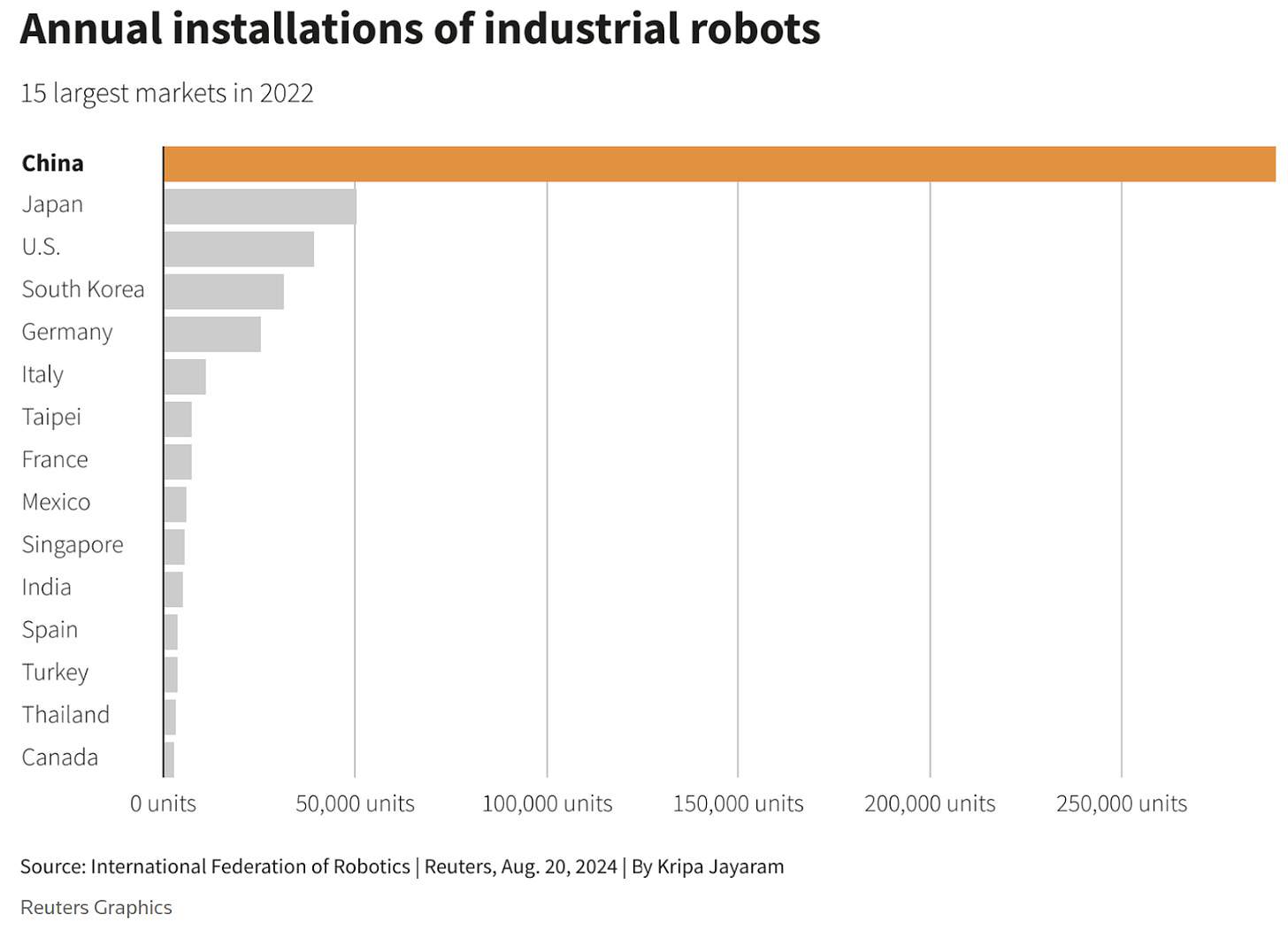

This robotics success revolves around China’s role as a consumer. For 11 consecutive years, China has been the largest market for industrial robots. In 2021 alone, 243,300 industrial robots were installed in China. That’s over half of the global total.

Chinese manufacturers’ choices to adopt robots mirror drivers of automation in other nations:

firm characteristics (with larger firms and those in the automotive and electronics sectors showing a positive correlation),

market factors (such as total wage bill, voluntary turnover rates, labor costs, and concerns over product quality),

the manual nature of tasks performed,

and government connections.

At the same time, China’s robot implementation is surging faster than can be explained by firm-level economics alone. China has 12.5 times more robots than its wage level would predict, according to an ITIF study of robot adoption across countries.

Which raises the question: why do industrial robots matter so much to China?

Job loss? Nothing to worry about 塞翁失马,焉知非福

Western media often fret that robots could render humanity as obsolete as the horse.

Chinese media, largely, does not. Government documents rarely express concerns over job replacement, instead promoting the message that robots are a positive solution to China’s labor-force challenges. With broader public acceptance of robots, China arguably resembles Japan more than the US or Europe, where public fears of job replacement may present legitimate hurdles to further robot adoption.

China is an industrial superpower, but recent demographic changes may challenge its future economic growth:

China’s working-age population is shrinking — both in absolute size and as a share of overall population. By 2050, the working-age population is projected to drop by over 20%.

Rising wages, higher labor costs, and younger generations’ disinterest in traditional manufacturing jobs threaten to exacerbate the effects of population decline.

In 2023, the Ministry of Human Resources and Social Security released a list of 100 occupations facing labor shortages, forty-one of which were manufacturing-related.

The Ministry highlighted pressures on the automotive industry — helping to explain recent significant increases in robot installations in automobile manufacturing.

The COVID-19 pandemic boosted global adoption of industrial robots, highlighting their resilience against health-related supply chain disruptions.

Research supports a positive relationship between robots and total factor productivity: robots can compensate for labor shortages, decrease error rates, improve safety, and generate higher productivity.

With the government forecasting a manufacturing sector shortage in 2025 of nearly 30 million people, some Chinese firms hope robots will fill this gap.

Industrial Robot Policy

To China, industrial robotics are therefore crucial for protecting its dominance in manufacturing. Given Beijing’s emphasis on technological advancement and self-sufficiency, it’s unsurprising that China is taking serious steps to become an innovator and producer in the field of robotics.

Starting from the 10th Five-Year Plan, China’s government has articulated a desire to develop novel technologies that boost industrial competitiveness. In 2015, China introduced the Made in China 2025 中国制造2025 initiative, aiming to establish itself as a leading manufacturing power by 2049. The plan targets ten key sectors, one of which is “high-end numerically controlled machine tools and robots.” And, advancing industrial robotics is a clear goal of China’s investments in “new quality productive forces” 新质生产力. Most recently, China pledged to increase investments in large-scale equipment upgrades by 25% by 2027.

The Robotic Industry Development Program 机器人产业发展规划 (2016-2020) was implemented to promote the use of robots in manufacturing, attract foreign investment, and boost domestic robot production. The program aimed to triple the annual production of industrial robots to 100,000 by 2020 — a goal that China exceeded, producing over 237,000 units in 2020 and 363,000 units in 2021.

In 2018, China launched the National Robot Innovation Center, a collaborative effort involving the Shenyang Institute of Automation, the Chinese Academy of Sciences, the Harbin Institute of Technology, and other companies. The 2023 “Robotics +” “机器人+” plan aims to double China’s manufacturing robot density by 2025, compared with that of 2020. Humanoid robots are meant to be a major source of that growth. In its “14th Five-Year Plan” for Robot Industry Development “十四五”机器人产业发展规划, the government targets mass production of humanoids by 2025 and world leadership by 2027.

Local and provincial governments have sought to support these strategic goals — at least twenty-one cities and five provinces offer subsidies for industrial robotics. Hunan, Shenzhen, and Beijing have released new robot industry development action plans. Beijing’s measures to promote robotics include investments in R&D, innovation platforms, industrial parks, and talent recruitment, as well as policy support with expedited approvals for land, factories, and new projects and support for public listings. In Guangdong, more than 2,000 manufacturing firms accepted government subsidies to help them switch from human to machine labor. Dongguan 东莞, a city in Guangdong province, stands out for initiating more than 4,600 "human to machine" projects, supported by a 200 million RMB annual reimbursement fund for manufacturing firms.

Dongguan also benefits from its Songshan Lake industrial development zone. In Songshan Lake, hundreds of robotics firms benefit from government-supported startup incubators and abundant robot manufacturing capabilities that offer large R&D time and cost savings.

Success, but at what cost?

Domestic robot manufacturing is increasing. In 2022, 36% of industrial robots installed in China came from domestic manufacturers, up from 25% in 2013. On the innovation front, China holds global leadership in robot-related research publications and patent filings, with 190,000 patents as of July 2024. Unlike in the US, Japan, South Korea, or Germany, where private companies dominate, the vast majority of patent filings in China come from universities. (To be sure, as with many other emerging technologies, China’s rising prominence in innovation comes with caveats: substantial government incentives and lower domestic approval thresholds may help support record-breaking patent numbers.) A number of Chinese robotics firms have blossomed under such supportive conditions. Since 2017, there have been over 3,400 robotics start-ups in China.

This feature of China’s robot market — numerous small- to medium-sized enterprises rather than a few dominant players — has drawbacks, as smaller firms may lack capital and technology reserves to withstand shocks and be competitive. Nevertheless, a couple of Chinese robotics firms have been able to stand out. Belonging to the China Academy of Sciences, Siasun 新松 has an international imprint in over forty countries and boasts annual revenue of over 3.9 billion RMB. Etsun Automation 埃斯顿自动化, an established domestic producer in China, offers sixty-four different industrial robot products and has received over 4,874 patent authorizations distributed among China, Japan, the US, and Europe. Shenzhen-based humanoid robotic specialist UBTECH 优必选 has collaborated with firms like FAW-Volkswagen and Foxconn, with plans to commercialize its humanoid robots starting from automotive manufacturing into other industries.

Unfortunately for China, its domestic robotics industry still depends on foreign players. Many of China’s robots are sourced overseas, from places such as Japan, South Korea, Europe, and the United States. In 2019, 71% of new Chinese robots were imported from abroad. In 2022, China incurred a deficit of US$1.39 billion for its industrial robot imports. This imbalance is likely to continue due to lagging capabilities in core value-adding components like servo motors and controllers.

At the same time, this year’s World Robot Conference hints at opportunities for China to break this dependence — Shenzhen-based Wisson Technology 万勋科技, for instance, uses 3D-printed plastics and pneumatic artificial muscles to power its robots, rather than traditional motors and reducers. Chinese firms are also leveraging cost competition to hopefully overcome foreign dependencies. While China remains dependent on imports for important robot components, its products are estimated to be up to 30% cheaper than European and Japanese counterparts. Between 2016 and 2023, the average price of industrial robots sold in China dropped from 300,000 to 188,000 RMB per unit. By selling robots in the low and medium end of the market, Chinese firms could edge out foreign competitors in the local market and set themselves up for international expansion, while reinvesting profits into more high-end technologies.

AI-driven synergy

Of course, the most attention-grabbing part of the 2024 World Robot Conference and China’s robot policies is Beijing’s desire to advance AI-driven robotics. In Chinese, AI-driven robotics is often referred to as “embodied intelligence” 具身智能. At the main forum of August’s conference, Beijing released its Embodied Intelligent Robot Action Plan 具身智能机器人行动计划. In this plan, China strives to be the first in several key related technologies: AI (the “brain” 大脑), motion control and balance (the “cerebellum” 小脑), and robotic body components (the “limbs” 肢体). Successful embodied intelligence would mean achieving both “one brain with multiple forms” 一脑多形 (AI that can adapt to various machine forms) and “one machine with multiple uses” 一机多用 (a machine can adapt to a diverse array of tasks and environments).

Applying AI to robots has understandable appeal. AI can streamline the design and maintenance of robots through its optimization and predictive capabilities. With human-like cognition, AI could boost robot performance directly — by enhancing sensory capabilities, enabling smarter human-robot interactions, and allowing for adaptive learning.

So far, AI applications in robotics have largely been upstream, in areas like semiconductor fabrication, rather than in downstream operational upgrades. The physical world of robots tends to be less forgiving of mistakes than the digital world. While some AI models, like OpenAI’s Sora, demonstrate a preliminary understanding of the physical world, significant work is needed for AI to effectively direct robots in every environment.

Additionally, robots have been widely used in industrial spaces for far longer than AI. Robotics faces challenges common to AI adoption in existing industries: integration with legacy systems, upfront resource costs, data management issues, and scarcity of in-house expertise. Many automatable manufacturing tasks are either already automated or have more cost-effective alternatives.

Still, Chinese companies are getting creative. Manually operated forklifts are getting updated into Autonomous Mobile Robots (AMRs) by firms like VisionNav Robotics 未来机器人 and EP Equipment. Quicktron Intelligent Technology 上海快仓智能科技 has provided over 230 Automated Guided Vehicles (AGVs) to a medical warehouse in Guangdong, and MegaRobo 镁伽 is building robots to support the development of self-driven laboratories. Domestic market share has been increasing for cobots (collaborative robots) designed to work alongside humans with high levels of safety and flexibility. Rising Chinese cobot developers include AUBO Robotics 遨博, Elephant Robotics 大象机器人, Han’s Robot 大族機器人, HIT Robot Group 哈工大机器人集团, JAKA Robotics 节卡机器人, and ROKAE 珞石机器人.

The World Economic Forum maintains the Global Lighthouse Network, a list of manufacturers leading in advanced technology, sustainability, and productivity. Over 40% of those lighthouses are Chinese. These Lighthouses have been commended for their quick adoption of advanced AI applications in production of everything from pharmaceuticals to steel to air conditioners. With these factories leading the way, AI and robotics might find a permanent future in manufacturing in China.

Forging Ahead

China has come a long way in the field of robotics. From Xianxingzhe 先行者 , the first Chinese bipedal humanoid created in 2000, which was mocked for its clunky shape, Chinese robots now capture worldwide fascination with their mimicry of facial expressions and burger-making skills. Beyond flashy displays designed to bring science fiction closer to reality, China is making moves to build a robust domestic industrial robotics industry that could change the game for how its future economy runs. While innovation is limited and dependencies on foreign imports remain, Chinese robotics may continue along the trend of dropping prices and increasing installation rates to eventually change the face of global robotics.

Do you work in robotics? Please reach out by responding to this email we would love to connect!

Great article, and a super interesting look into the cultural/social context of how China is seeing robotics and AI as well!

Also responding to the CTA here that I do work in/with and invest in robotics and AI (… though Jordan already knows me), in case there’s anything specifically you’re looking for.

Thank you for this detailed, illuminating overview of the Chinese Robotics industry Angela and Lily. I just got back from Indonesia and Malaysia and saw for myself people gathering around Chinese burger-making robots in fascination - myself included.