China’s Quantum Gamble

Investment controls are here, but does China’s quantum industry really need US dollars?

Elias X. Huber is a Yenching Scholar at Peking University and a visiting researcher at Tsinghua University. He holds an MSc from ETH Zürich, where he specialized in quantum information theory and co-led a consulting company. Today, he’s here to discuss China’s quantum ambitions, explain the new investment controls on quantum information technologies, and take us on a nuanced journey through China’s quantum research institutions — from universities to start-ups to state-owned enterprises.

On October 28, 2024, the U.S. Department of the Treasury implemented the USA’s first-ever outbound investment control regime. Investments by U.S. persons in AI, semiconductors/microelectronics, and quantum technologies in “countries of concern” (currently, just China incl. Hong Kong and Macau) now require notification or are outright forbidden.

For semiconductors and AI, the restrictions are confined to certain technical specifications and capability thresholds. The restrictions on quantum technologies, however, are far more expansive — across a broad swathe of quantum applications, transactions are now outright forbidden.

In the short term, these prohibitions aren’t going to devastate China’s prowess in quantum research. The practical implications for the future, however, are threefold:

The restrictions could systematically push the sector to further rely on state-led “patient capital.”

The rules could inadvertently reduce the transparency of China’s commercial quantum efforts.

If quantum technologies become foundational for information infrastructure in the future, the rules will ultimately restrict a much wider variety of economic activity than they do today.

Why does the U.S. government care about quantum research anyway? What funding streams are available to China’s quantum startups now that U.S. financing is banned? And what does this all mean for China’s quantum ambitions?

We’ll get there, but first — some definitions.

The New Rule and Quantum Terminology

The new rule has been over a year in the making: In August 2023, President Biden issued an Executive Order (the Outbound Order) calling for outbound investment controls in “three sectors of national security technologies and products to be covered by the program: semiconductors and microelectronics, quantum information technologies, and artificial intelligence.” What followed immediately was an advance notice of proposed rulemaking (ANPRM), a notice of proposed rulemaking (NPRM) in July 2024, and, after public comment, the final rule on October 28, 2024.

Under the new rule, U.S. persons are either forbidden from covered transactions or must notify a newly created Office of Global Transactions within the U.S. Department of the Treasury.

Roughly speaking, transactions are covered if all of the following conditions are met:

they are between a U.S. person and a Chinese entity or an international entity that is deemed sufficiently connected to a Chinese entity,

the Chinese entity engages in covered activities in semiconductors, quantum information technologies, or AI,

the U.S. person aims to acquire equity, provide financing, make investments, or enter joint ventures in the Chinese entity, and,

the transaction is not among the listed exceptions, which include publicly traded securities and some Limited Partner investments.

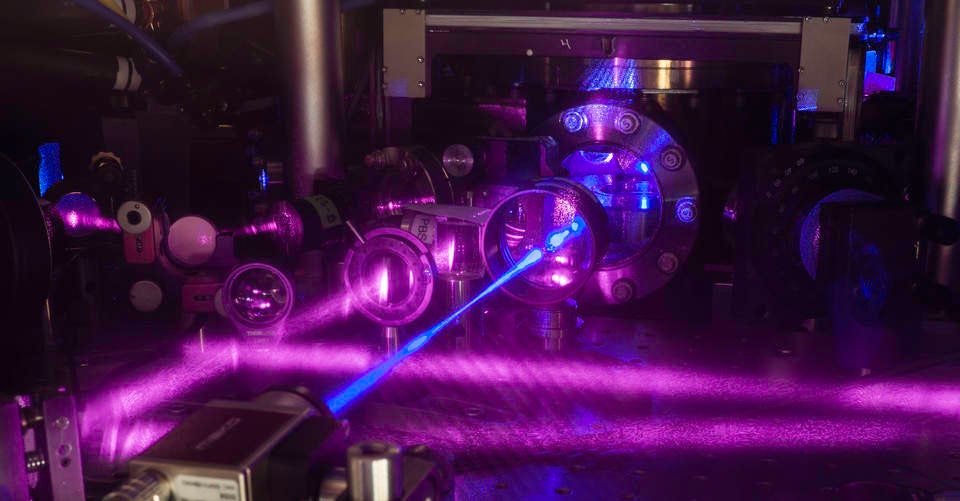

Quantum information technologies (henceforth just quantum technologies) can be divided into three main categories — quantum computing, quantum sensing, and quantum communications. These involve engineering and manipulating small physical systems according to the laws of quantum mechanics for practical applications — often leveraging counterintuitive features of quantum mechanics. These physical systems — the quantum information carriers — range from superconducting circuits cooled to near absolute zero to delicately prepared states of light.

Take quantum computing, where different states of “quantum bits” can be superposed and programmed to interfere with each other. This could theoretically solve computational problems that are near-impossible to crack today — including the encryption techniques that are used to secure your bank account.

Similarly, quantum sensors can improve sensitivity or other form factors in measuring quantities such as time or gravity.

Currently, quantum communication refers primarily to encryption and information security applications, which leverage the unpredictability of quantum measurements and the impossibility of copying quantum information. But this field could one day expand to whole networks of quantum sensors and quantum computers.

The new rule takes the same tripartite classification, with covered quantum transactions forbidden if related to the development or production of:

Quantum computers and their critical components,

Quantum sensing platforms for military, intelligence or mass-surveillance end use,

Quantum communication systems for secure communication, for scaling up quantum computing, and any other application with military, intelligence, or mass-surveillance end use.

Most notable is the restriction on quantum computers. Quantum computers receive the most investment and hype — and the new rule completely forbids investments in Chinese quantum computers regardless of end use. This is despite the fact that quantum computers are less mature than the other two, with no useful application yet available, and near-term applications that will be primarily academic and civilian. However, in the long run, quantum computing is expected to be the most broadly disruptive of the trio and is fundamentally dual-use, threatening information security for example.

For quantum sensing, the rule only restricts investments aimed at sensitive end use. Military applications of quantum sensors (such as detecting tiny variations in earth’s gravity and magnetic field caused by adversary submarines) can more often be separated from civilian uses (such as measuring magnetic fields induced by the neural activity of your brain).

Unlike a quantum computer, which could solve optimization problems and steal cryptocurrency — with little ability to discern the two uses — quantum sensors will often be closely tailored to their expected end-use (from size, power demand, and ruggedization to calibration and signal processing).

Finally, quantum communication systems for secure communication (especially a technology called “Quantum Key Distribution”) are slowly being deployed in real-world applications, with China far ahead of the rest of the world. While the quantum communications market in China is significant, it is unlikely that U.S. investment is particularly welcome here in the first place, given that it is one of few quantum technologies export-controlled by China.

Restrict to Stay Ahead

ChinaTalk has discussed the “Sullivan Tech Doctrine” and China’s military-civil fusion in previous analyses of U.S. controls on AI and semiconductors — and quantum fits right into this familiar discussion. The Outbound Order lists quantum technologies among the innovations critical to “military, intelligence, surveillance, or cyber-enabled capabilities.”

Beyond just specific military applications, the report views broad quantum capabilities (such as advanced computation) as critical to U.S. national security. Investment controls aim to prevent U.S. capital and intangible benefits that accompany it from advancing such capabilities in countries of concern, i.e. China.

Quantum is distinct from AI and semiconductors because the technology is still quite immature.

Nonetheless, the recent outbound investment rule joins a long list of quantum restrictions, including two rounds of additions to the entity list, inbound investment restrictions, restrictions on the movement of people, and multilateral export controls aimed at quantum computing.

In order to understand the impact of the newest outbound investment restrictions, we need to take a closer look at the process for commercializing quantum technology in China.

It Starts with Science — and Public Money

The term “quantum mechanics” was proposed almost exactly a century ago. However, the quantum technologies listed above only started to take off in the early 2000s during the “second quantum revolution.” Therefore, nearly all commercial efforts in quantum originate in academic research groups, with initial IP often going back to public funding.

Given the importance of said public funding, foreign observers frequently contrast the outsized role of the Chinese state — which has perhaps invested over 15 billion USD1 in quantum research — with the private-sector-driven research environment of the United States and Europe.

Consequently, leading Chinese quantum technology is often developed in publicly funded research labs — including the National Quantum Lab (量子信息科学国家实验室) or the Quantum Computing Engineering Research Center 安徽省量子计算工程研究中心 in Hefei, Anhui province. Government-controlled companies — such as China Telecom or state-owned enterprises such as China Electronics Technology Group — play an important role in the development of quantum technologies, with the former putting 3 billion yuan into establishing its own quantum technology group and the latter launching a quantum cloud computing platform.

In recent years, the closures of Baidu’s and Alibaba’s quantum computing units (donating their equipment to public institutions) have increased speculation of an “attempt by the Chinese government to assert tighter control over what it sees as a strategically important technology.”

The problem with this narrative is that the CCP doesn’t really seem to have meaningfully consolidated the broader quantum industry — abandoning quantum research made sense for Alibaba and Baidu independent of any hypothetical government agenda.2

While government-led technology development in China does have a long history, so does commercialization and partnerships with the private sector. Deng Xiaoping recognized the need to dissipate science and technology throughout the wider economy back in the 1980s. Regardless of which soundbite the CCP chooses — “rejuvenating the nation through science and education”, “innovation-driven development” or “new quality productive forces” — achieving intensive economic growth based on innovation and technology is a political priority.

So what, then, is the role of the private sector in quantum tech development?

Stepping out of the Labs

State-led efforts need not be isolated from the wider economy. Anhui’s Quantum Computing Engineering Research Center is developing quantum computers together with one of China’s leading quantum start-ups, Origin Quantum Computing.

Chinese efforts toward market-led commercialization of publicly funded innovations are reminiscent of the American Bayh-Dole Act of 1980. In China, regulations issued in 2002 and a law on S&T transformation in 2015 likewise aimed to facilitate the licensing and transfer of IP from government-funded institutes to the developers, incentivizing their commercialization.

The practical realization of this IP transfer can take many forms. For a concrete example, let us look at the University of Science and Technology of China (USTC) in Hefei, one of China’s leading centers for quantum research.

China’s first quantum start-ups — QuantumCTEK and Quasky — both originated from USTC laboratories in 2009. Under the national call for the “transformation of scientific and technological achievements 科技成果转化,” early efforts at QuantumCTEK proceeded in lockstep with the university. Back then, QuantumCTEK’s chairman Peng Chengzhi 彭承志 was managing corporate affairs while simultaneously doing research for the Micius satellite 墨子, one of the most important scientific quantum experiments of the century.3

When QuantumCTEK was established, USTC likely transferred IP rights to the company in exchange for shares — which USTC still holds. Those investments are managed by USTC’s holding company, which lists at least four other quantum start-ups in its portfolio.

Looking forward, USTC has recently piloted a new model for transferring university IP to commercialization-focused researchers. Instead of shares in the company, the school obtains access to future benefits negotiated in advance — for example, a fraction of the company’s profit. Research at USTC also benefits its business alumni: Through bi-directional recruitment and frequent exchange, academic laboratories gain access to professional equipment and organizational practices.

Beyond government slogans and incentives, the success of early start-ups such as QuantumCTEK is maybe the biggest inspiration for enterprising quantum scientists across China. QuantumCTEK was listed on the Shanghai Stock Exchange STAR market in 2020, with its share price rising ten-fold on the first day of trading. The company is now expanding beyond its original vertical in quantum cryptography to quantum computing.

In 2021, QuantumCTEK became the first Chinese quantum company placed on the U.S. entity list by BIS. Yet, Hefei has become a hub for quantum technology companies, with a dedicated “quantum avenue” for start-ups following in the footsteps of QuantumCTEK and Quasky. Thanks to enthusiastic support by the local government, Hefei hosts 60 upstream and downstream companies in the quantum industry chain.4

Now that we’ve covered the state-backed origins of China’s quantum companies, we can discuss the firms that could be most impacted by the recent outbound investment controls — that is, the young, market-driven start-ups often led by former academics. These burgeoning quantum start-ups need a healthy venture capital market in order to scale up… right?

China’s Venture Capital Woes

English language reports often paint a bleak picture of private quantum funding in China. For example, a report by the Information Technology & Innovation Foundation (ITIF) finds that, “despite large numbers of reported Chinese quantum companies, there are only around 14 private-sector firms that can be identified as making significant contributions to quantum technology, including nine start-ups and five major tech companies” — a count that includes Alibaba and Baidu, despite their exit from developing quantum computers. A 2023 McKinsey report is cited, noting 10 times more private investment in quantum start-ups in the U.S. than in China. Let us stay with this narrative for now, before explaining why, once again, there is more to the story.

China’s equity investment market is indeed in deep trouble, which brings headwinds for quantum startups. In a survey of 50 leading VC and PE institutions by ChinaVenture, less than 5 were optimistic. Besides just bad sentiment, investment activity is down — science parks visited by the Financial Times stand empty as fewer start-ups are founded and successful exits through IPOs are increasingly difficult.

FT blames political pressure by the government. The analysis by ChinaVenture points to higher U.S. interest rates, changes in exchange rates, and the poor performance of Chinese stock markets. Both agree, however, that plunging foreign investment is contributing to the decline.

The recent rule may have played a role here. Remember, that the Outbound Order first called for investment restrictions on China in August 2023. And Congress put private equity markets in the hot seat even earlier — a House Select Committee launched an investigation into five venture capital firms in July 2023, requesting information about the firms’ investments in Chinese entities. Besides Uyghur-tracking AI, the committee’s report mentions concerns about Chinese domination of critical technologies.

The downturn of U.S. investments in Chinese companies is hence both driven by markets and politics. Long-term signaling from the U.S. government ensured that the market priced in the investment restrictions in advance.

With foreign investors fleeing and a dying venture capital market, is it all doom and gloom for China’s quantum start-ups? There are at least two reasons why this might be an overeager conclusion — one is our lack of knowledge, and the other is the support of the state.

On the first one, let us revisit the current state of quantum start-ups in China. The report by the ITIF referenced above mirrors typical observations in English language reporting: China’s commercial efforts are small, dwarfed 10x in both funding and quantity by their American counterparts, and government-funded research institutions dominate instead. Without the trend line being wrong, this confident bashing risks overlooking important developments. The footnotes of the 2024 McKinsey Quantum Technology Monitor explicitly concede that the authors have limited insight into commercial quantum activity in China. The ITIF report which claims that “only around 14 private-sector firms [...] can be identified as making significant contributions to quantum technology” fails to list start-ups such as Bose Quantum or Huayi Quantum — which are both more significant than some companies that did make the list. With such limited information, it’s not prudent to announce any clear-cut conclusions.

Even admitting that there could be more to commercial Chinese quantum efforts than generally acknowledged, the question remains: Can these start-ups see success in a difficult market, without U.S. money and intangible benefits?

State assets to the rescue?

Amid the decline in private capital, the share of state-owned capital in VC and PE funds has increased. This leads to many problems. Bureaucrats at SOEs face intense pressure not to lose or mismanage state-owned assets — yet most VC investments are failures, with VC funds typically only profitable thanks to a few individual investment exits that reap high returns. Local governments, often cash-strapped themselves, primarily aim to develop the local economy — not serve start-ups. To reduce their risk, VC funds backed by state-owned assets often demand personal liability for investments — which is very scary for potential founders in a country with no nationwide personal bankruptcy law.

What is lacking is “patient capital” — risk-tolerant investments willing to support innovation with a long-term outlook. The commercialization of quantum technologies is especially challenging. Investors need much patience, as expensive development efforts may not result in revenue for a very long time due to the early stage of the technology. Beyond the business model, investors bet on the future trajectory of a complex technology, serving markets that may not yet exist.

Yet in some cases, a (local) government-dominated model can work. Alongside the quantum startup cluster, the so-called “Hefei model” has achieved success in EVs, biotech, and semiconductors through targeted investments by the local government. In Hefei, attracting investment is an all-hands-on-deck effort, where nearly all departments of the government are involved in one form or the other. State-owned enterprises provide equity financing for firms the local government wants to attract to the city, alongside legal assistance, policy adjustments, and highly personalized incentive packages for individual entrepreneurs. Beyond just attracting and incubating companies with potential, the city government creates dedicated groups to coordinate the planning and supply chains for targeted industries.

Located in Hefei, USTC is crucial for the local talent base and innovation ecosystem. It enjoys the highest support and trust from the local government, which provides funding and support to USTC’s alumni looking to establish start-ups. The Hefei government itself recruits from the university's talents. Frequent exchanges between government offices, university departments, and companies build information networks. USTC entrepreneurs are encouraged to stay in the province, with better IP transfer terms if commercialized locally.

This trust (and an unusually high risk tolerance) explains the local government's willingness to invest in quantum start-ups under less stringent terms than other government-funded VC investments. Already in 2017, the local government announced a 10 billion RMB quantum fund established by the Provincial Investment Group to support the local quantum industry. Set up for a ten-year life span, a five-year investment, and a five-year exit period, the fund established an independent decision-making committee and an expert committee made up of highly reputed academicians.

On a national level, the government has recognized, and is determined to solve the lack of “patient capital”. Replicating the “Hefei Model“ might not be easy. Local talents, institutional culture, and investment expertise take time to develop. A risk appetite like that of the Hefei local government could backfire if large amounts of state-owned assets are lost. However, in quantum, there are signs that others are willing to try.

In Hubei, the local government announced 100 million RMB into a quantum industry fund, aiming to invest in projects from local laboratories such as the Wuhan Institute of Quantum Technology. Despite being funded by the government, the investments are supposed to be market-oriented with an expert committee to provide professional guidance. In Shanghai’s 10 billion RMB Future Industry Fund, also supported by a scientific committee, quantum technology is also included. Beijing too has its own 200 million RMB Quantum Industry Development Fund to support start-ups and SMEs in the quantum industry, and recently established a Quantum Technology Incubator 中关村量子科技孵化器 and a Quantum Technology Industrial Park 量子科技未来产业园 to provide facilities, connections, and organizational support alongside capital.

Where do we go from here?

Can these government-funded efforts compensate for the loss of professional market-driven dollar investments, with all the advantages in networks, reputation, and management that U.S. investors bring?

On the one hand, local governments can holistically coordinate and incentivize whole sectors, and provide extensive logistical and legal support in tandem with funding. Which private VC could dream of the convening power to have academic expert panels evaluate their investments?

On the other hand, bureaucrats are never purely market-driven, they distort competition and often lack the track record of U.S. investors to efficiently place money, tax money that is, in risky bets.

For quantum, it is too early to tell which innovation system will prevail.

Given the abundant funds available for quantum research, it will not be the lack of U.S. money — but rather the lack of U.S. practices that come with U.S. money — that could have the most profound impact on China’s ability to commercialize quantum technologies.

Regardless, China’s quantum companies will remain fascinating to watch. Regarding further scrutiny of these companies, the recent sequence of quantum controls might backfire for U.S. policymakers. By adding leading quantum companies to the entity list, others are incentivized to keep a low profile and prepare for restrictions. Additionally, given the outbound investment controls, there are unlikely to be many foreign VCs with deep diligence in China’s quantum market, and future public reports on China’s quantum companies could become even more speculative than they are now. Increasing controls on quantum technologies could also lead to us never seeing China’s quantum start-ups compete head-to-head with those of “the West.”

For now, the new outbound investment restriction likely won’t change much for China’s development of quantum technologies: Political risks have been factored into investment decisions even before the new rules were finalized, and U.S. investments into Chinese quantum technologies never became relevant.

However, if quantum technologies become foundational for a wide range of technologies, the outbound investment controls could make an increasing number of Chinese companies taboo, or at least questionable, for U.S. investment. For example, China Telecom is an example of a large company not commonly associated with quantum, which has significant efforts in developing quantum technologies that are very likely covered under the new rule. While public trading of China Telecom shares falls under an exception to the rule, it’s clear that the effects of the rule won’t be limited to just deep-tech startups.

Another example is an interesting technology called Quantum Random Number Generators (QRNG). Random numbers are needed in cryptographic applications, but generating truly random numbers is a surprisingly difficult task without quantum physics. QRNGs are thus poised to become the first mass-market quantum technology, and Samsung is already marketing smartphones featuring QRNG security chips. But QRNGs could plausibly be categorized as a “quantum communication” device intended for “secure communications,” which would make related transactions prohibited under the new rule. This example cautions how narrow restrictions today could soon become expansive.

Perhaps the integration of mass-produced QRNGs does not fall under what the rule classifies as “develops or produces.” But imagine the confusion investors face when all networked devices, from smart cars to phones, suddenly have some “quantum” in them.

Although this estimate should be taken with a very large grain of salt: Official funding figures are not available for China and other estimates put its quantum funding between 4 and 17 billion USD. To the author's knowledge, the “15 billion USD” figure comes from media reports starting around 2017 about 100 billion RMB of planned funding for a national quantum lab, with little indication if — and on what — this reported amount has been spent.)

Exiting the quantum computing industry was a good play for these firms from a financial perspective — Alibaba’s quantum investments reportedly totaled over 10 billion USD with little near-term revenue to show for it. This decision could also simply be foresighted risk management — most leading entities developing quantum computers in China have since been added to the U.S. entity list.

The Micius satellite can send entangled photons (particles of light) to ground stations separated by more than 1,000 kilometers. Intuitively, these entangled photons allow the two ground stations to generate random but identical numbers without any mutual communication, exploiting non-local correlations possible only in quantum mechanics. These numbers can act as a secret shared password — facilitating quantum-encrypted intercontinental video calls, as scientists first demonstrated in 2017.

The importance of the Micius experiment, estimated at 100 million USD, is hard to overstate. It is not just a scientific milestone but also a political symbol (hence the stamp). If you ever visit Beijing, you can see a 1:1 scale replica proudly displayed in the Museum of the Chinese Communist Party 中国共产党历史展览馆).

Although this definition is likely quite broad, not only including companies that commercialize quantum technologies but also their suppliers.

This was a really well-written and thorough article. I learned quite a lot about the Chinese research ecosystem -- thanks!

Mindful the focus of this article was on the outbound investment rule, there's a foundational component to the ecosystem which could also be considered; namely, the academic research community. Without IP to commercialize, there's no commercialization.

Of the 4 quantum technologies (computing, sensing, communications, networking), communications is where China definitely has a lead. Not so much on the others -- computing especially. From what I can tell of the (open) literature I've seen, hardware efforts are lagging in terms of performance metrics, though a lot of work is being done on algorithms and applications.

Again, this idea doesn't directly relate to the thesis of this article, but it is one upon which the success of these models depends.

Very informative, great article. Thanks.

Systems are so different but yet so alike?