Chinese Chip Prospects + Tweets of the Week (Taylor Swift Marketing, Bob Iger, Japanese City Pop, Say Goodbye to Critical Thinking (?), Lunch Time, 草书)

In spite of the reported $1.4tn in state money committed to making a self-reliant chip ecosystem a reality, of late some major Chinese companies have hit serious stumbling blocks.

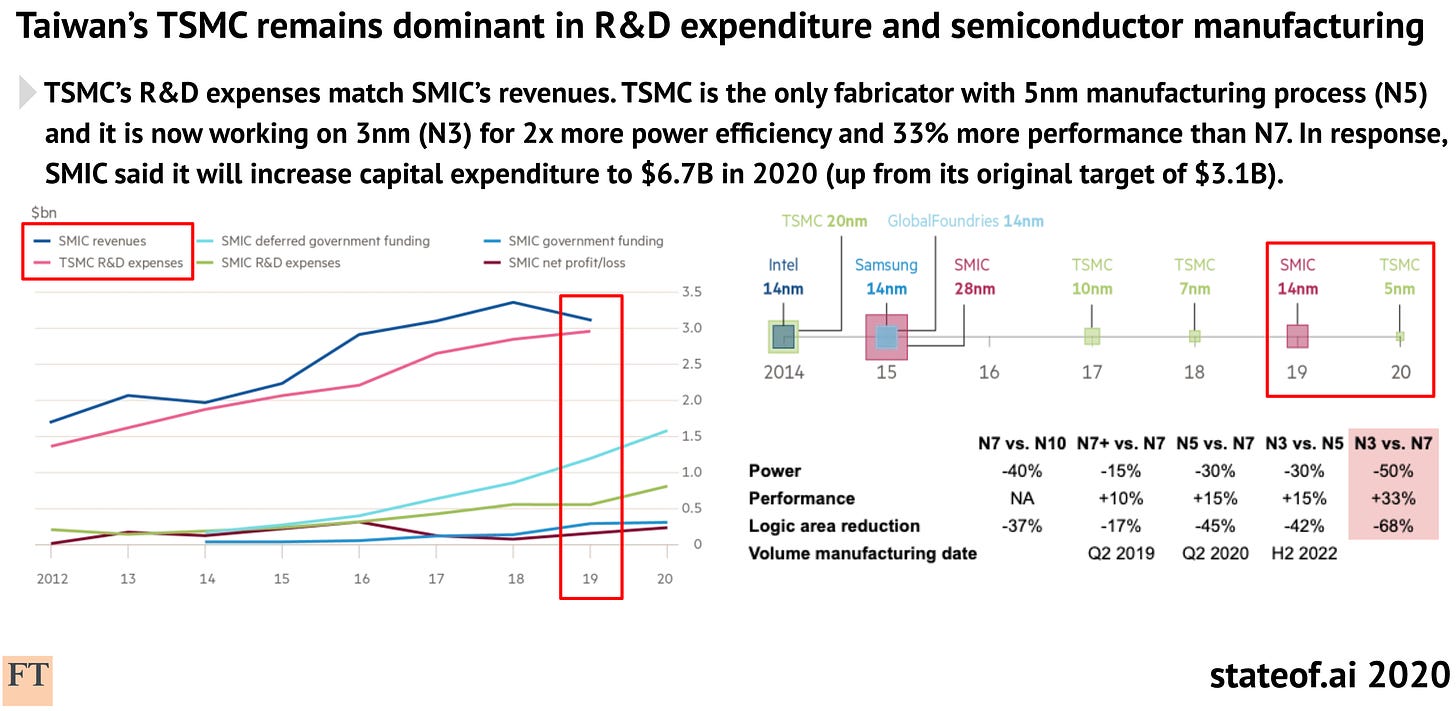

Xi has made clear that creating a self-reliant semiconductor ecosystem free from foreign dependencies is one of his top policy priorities. In spite of the reported $1.4tn in state money committed to pursuing that aim, of late some major Chinese companies have hit serious stumbling blocks. For instance, the C-suite of SMIC, China’s most advanced domestic fabrication firm, is in turmoil while the Tsinghua Unigroup tech conglomerate is likely to default on $2.5bn in foreign bonds.

Tsinghua Unigroup wasted decades of Chinese government funds and talent underdelivering in its chip divisions and running its acquisitions, which have frequently comprised some of the most promising Chinese chip firms, into the ground (see my past podcast with Doug Fuller). Aside from its portfolio company Yangtze Memory Technology, a Wuhan-based manufacturer of largely commoditized 3D NAND memory, its holdings do not have much strategic importance to China’s self-sufficiency push. The government’s decision to presumably reject their pleas for a cash infusion are both reflective of a broader push to discipline corporate debt markets and perhaps a sign that the government is finally beginning to invest more intelligently in its future.

Taking a step back, what could that $1.4tn buy China’s industry?

In the near term, that money will likely go to building more fabs which will increase China’s global stranglehold on the bottom of the semiconductor value chain like fabrication of larger nm chips and older packaging technologies. All the money in the world, however, can’t buy quick fixes for the two biggest Chinese vulnerabilities which the US is using to put the squeeze on Huawei’s HiSilicon and TSMC. China’s reliance on American Instruction Set Architectures (Intel’s x86, Arm) and foreign electronic design automation (Synopsis, Cadence, Siemens) will hamper the industry for years and years to come.

Over the longer term, even with a significant American commitment like the CHIPS Act, it’s hard to imagine mainland Chinese firms not eventually narrowing the gap between its firms and the west’s. China simply has far too much engineering talent and even if these investments do not pan out in the next five years, the investments in universities and experience young professionals garner in these ventures will pay dividends in the decades down the road.

visual from the State of AI Report + FT

Two recent ChinaTalk podcasts I want to highlight. The first is with Wendy Cutler, a longtime USTR official now at the Asia Society. I ran the trade policy ideas I wrote about last week by her, including the ‘Strategic Shiraz Reserve’ and ‘Mutual Trade Defense Pact.’ A committed multilateralist who has devoted much of her career to strengthening the WTO, she preferred Biden first use allies to pressure China to sign up to new rules. However, I was surprised at the degree to which she agreed with me that the current state of play requires a deep rethink.

It didn't start with Australia. We've seen it with Korea. We've seen it with Japan on rare earths. We've seen it with Philippines on bananas. But Australia moves are escalating with no end in sight. And frankly, I don't think it's going to end with Australia if there is not an international response. What does China conclude then? Basically that they have the market power to do this and it's cost free. So the message to other countries is, don't criticize us because we'll hit your products next.

I also interviewed Xiaowei Wang on her new book, Blockchain Chicken Farm: And Other Stories of Tech in China’s Countryside.

I think people think of China and they’re like, “high-tech cities, everyone's tracked … they've really contained this perfect system,” right? But then on the ground, it’s still so unevenly developed. Somehow that has changed to the outside world.

Her short book is in my top five for 2020, providing a rare deep dive into tech’s influence on rural life. It features the best English coverage I’ve seen of Taobao villages (rural villages whose economy is structured around e-commerce manufacturing). We touch on free-range chicken farms that rely on high-tech processes such as chicken Fitbits, surveillance, and, yes, blockchain software.

Wang reflects on the cast of characters she encountered on her travels through rural China: young determined entrepreneurs hunting for their next scheme, a young police officer struggling to get his older counterparts to adopt new technology, Snow White costume manufacturers following the U.S. holiday season, on-demand pearls, and other stories that highlight the curious interactions between rural Chinese and America. Do have a listen.

Programming note: I’ll probably be taking the next two weeks off. Read a good China book!

Tweets of the Week

Thread.

Context: the 80s Japanese city pop song in the video just blew up on TikTok.

Send Devin your pitches! We did a great podcast a few weeks back on the CCP’s pathetic influence operations in Japan. An excerpt from his report on the topic:

Madoka Fukuda of Hosei University told us in an interview:

During times of turmoil between Japan and China, these friendship associations try to promote cultural exchange. But in Japan, their activities are not very successful. The associations want Japanese affinity for Chinese culture but Japanese people don’t have interest in it. In the first place, Japanese don’t like China so they don’t want to join their association activities. Also, the way they produce these association activities does not fit Japanese culture; in part, Chinese culture is part of a problem. I have been interested in these activities, such as cooking and calligraphy, but I see little Chinese soft power. It is much different from Japan-Taiwan exchanges; there is a Taiwan center in Toranomon (a business district in Tokyo) that has really interesting events such as movies and books, and it’s popular. But the Chinese centers are less attractive to Japanese, especially young people.

Several other Japanese scholars agreed with that assessment, with one telling us on background that the friendship associations were “useless” because China’s political warfare suffers from an “unsophisticated middle kingdom mentality” and another saying the associations were dated, uninfluential, old-fashioned, and ineffective since Japanese do not want to be “suckers” to Chinese influence activities

I also learned from his report that the detention of a leading Japanese China scholar on the mainland had a major impact on the relationship.

See, we have painting and calligraphy here on Tweets of the Week! Show off just how cultured you are.

Hi Jordan, as usual, an excellent edition.

My takeaways on China's semiconductor industry are slightly different. Had written about it here: https://www.scmp.com/tech/article/3109569/chinas-semiconductor-gold-rush-reality-check

TL;DR - China's own arrogant international conduct that has resulted in significant geopolitical barriers for its fledgeling semiconductor industry. The impact across the supply chain will vary. China's prospects in IC design are blocked by US' control of EDA tools; manufacturing prospects can be constrained by lack of access to EUV, and by Japanese dominance over photoresists, wafers, and etching gas. The key point is that if US-China relations continue to be confrontational, China's semiconductor industry will be forced to play an expensive catch-up game.