The 1882 Chinese Exclusion Act prohibited nearly all people of Chinese descent from moving to the US and made ethnically Chinese immigrants already in the US ineligible for naturalization. Chinese immigration to the US remained highly restricted until 1965, when a new federal immigration law phased out national-origin quotas. And the ambiguous status of children born to Chinese immigrants during this time is part of the story of why the US today has birthright citizenship (see the 1898 Supreme Court case, United States v. Wong Kim Ark).

The economic impact of the Chinese Exclusion Act, however, is less well understood. (Notably, despite the protests of local business owners at the time, the congressmen from western states — Arizona, California, Idaho, Montana, Nevada, Oregon, Washington, and Wyoming — unanimously voted in favor of the Chinese Exclusion Act.)

An interesting new NBER working paper attempts to quantify the economic damage to the American west, using data from states where at least 1% of the total population in 1880 was Chinese.

Let’s break down the findings of this working paper, starting with three statistics:

Chinese exclusion reduced the white male labor supply in Western states by 28% (compared to Eastern areas);

The act reduced the total manufacturing output of these states by 62%;

The act reduced the total number of manufacturing establishments in these states by 54-69%.

Wait, a loss of Chinese workers reduced the number of white male laborers in these states? How did that happen?

The first statistic indicates that Chinese workers were creating a substantial multiplier effect in the economy out west. To understand why, we first need to understand the kind of jobs these Chinese immigrants were doing.

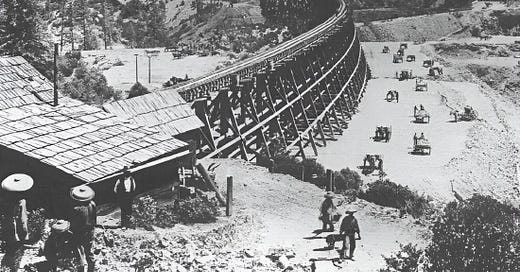

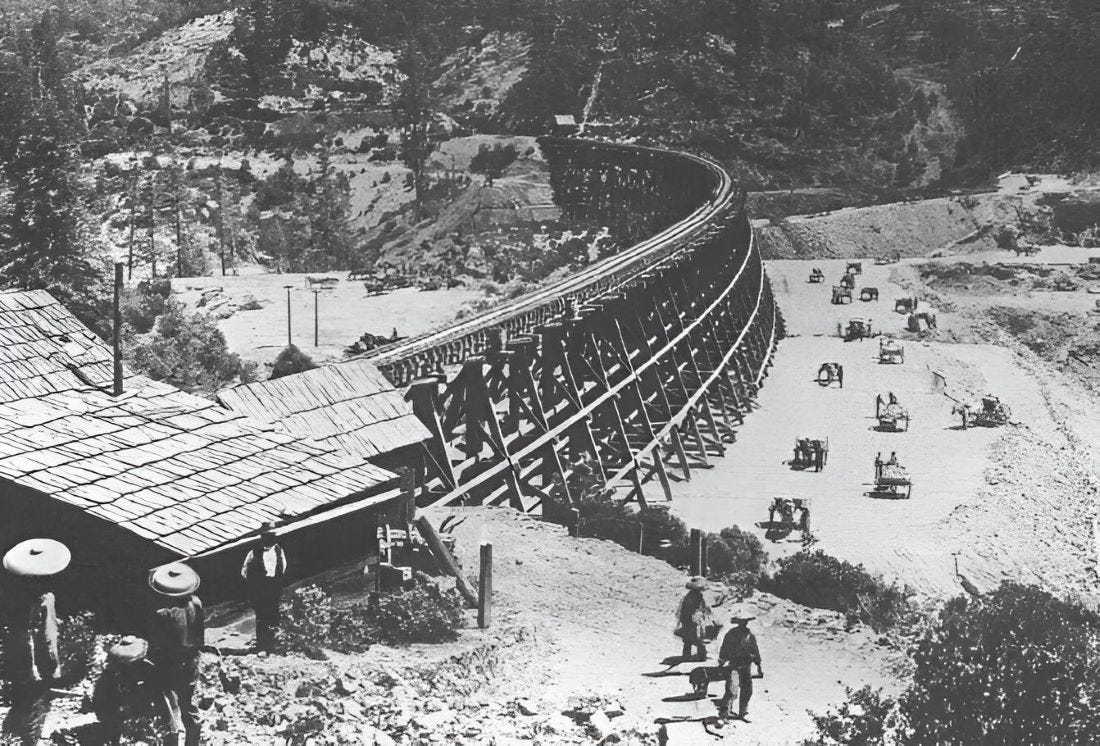

You probably already know that Chinese workers were instrumental in the construction of the transcontinental railroad — but Congress conveniently waited until the railway line was completed before deciding to gut the rights of Chinese immigrants.

What jobs, then, were those Chinese workers doing in 1880? The authors explain:

Chinese [railroad] workers usually worked on short-term contracts. After the completion of work, they were left by their employers in what were often sparsely populated areas.

Chinese workers often found new occupations in these places. In places where they had earlier logged to provide wood for railways and mines, they later logged to provide wood for the construction of new towns. Similarly, many who had worked as cooks or launders for the Chinese work gangs would later provide similar services for their new communities and local economies (Shih, 2022).

By 1880, Chinese immigrants worked in many sectors. For example, the manufacturing of shoes, hats and cigars in the Western United States was dominated by the Chinese during this period (Chang 2003, p. 60).

With this context, the economic multiplier effect of Chinese labor starts to become clear — after being abandoned somewhere along the railroad, Chinese workers built new infrastructure and provided services in remote western areas. After the Chinese Exclusion Act, the loss of Chinese labor made it hard for local businesses to find staff. That shock impacted a wide range of industries all at once:

The industries with the highest share of Chinese workers were personal services (e.g., private households, hotels and lodging places, or laundering and cleaning services) (50%), entertainment and recreational services (e.g., theaters) (22%), mining (25%), transportation (e.g., railroads) (8%) and manufacturing (6%).

So, the argument here is that the rapid loss of Chinese workers made western states worse places to live, thus discouraging prospective white migrants from moving West.

Even if there were more job openings available in theory, the authors argue, there was no way to disseminate information about these jobs at the scale and speed necessary to completely replace Chinese workers with white workers. Telegraphs and newspaper ads could only go so far.

It’s no wonder that 54-69% of manufacturing establishments opted to close up shop instead of waiting around for the New Englanders. The quote above suggests that those poor westerners couldn’t even buy cigars or a new hat to cope with their woes.

To be clear, some people did move west, and the region still grew rapidly. “28% reduction in the white labor supply” expresses 28% less growth compared to regions that didn’t previously rely on Chinese labor. Still, the authors estimate that the negative impacts of the Chinese Exclusion Act persisted for nearly 60 years, dampening economic growth in the American West until at least 1940.

What would Arizona be like today if Congress hadn’t passed the Chinese Exclusion Act? We can only imagine — but I bet TSMC managers would be less disgruntled about opening a fab in Phoenix.

Building a Silicon Shield

This week, we have a special podcast for our Mandarin-speaking audience.

Lin Hung-wen 林宏文 is perhaps Taiwan’s most seasoned tech journalist, with decades of experience covering semiconductors, biotechnology, and Taiwanese industrial policy.

His book, The Radiance of the Chip Island: TSMC, Semiconductors, the Chip War, and My 30 Years of Journalism, explores the geopolitics of semiconductors through a uniquely Taiwanese perspective. An English translation of Lin’s book will be published in early 2025, at which point we will release an English translation of this interview.

If you speak Mandarin, however, you can enjoy our interview with Lin today, hosted by Arrian Ebrahimi of the Chip Capitols substack, and cohosted by ChinaTalk Editors Nicholas Welch and Lily Ottinger.

林宏文是《晶片島上的光芒》一書的作者,這本書深入探討了台積電的歷史、管理方法和國際角色。作為台灣最資深的半導體記者之一、林宏文以其三十多年的行業經驗,為讀者呈現了一個全面而生動的台灣半導體產業發展故事。

訪談中我們討論了以下幾個關鍵話題:

台積電的創立背景及其在全球半導體產業中的獨特定位

台灣政府在推動半導體產業發展中的角色、特別是工研院和科學園區的貢獻

台積電的管理模式、包括研發與製造部門的平衡以及人才培養策略

台灣半導體產業的國際競爭力、尤其是與三星等競爭對手的比較

台積電在全球地緣政治中的角色、以及“矽盾”這一概念的由來和影響

AI時代對半導體產業的影響、特別是對記憶體和邏輯晶片整合的需求

台灣與美國在看待國際關係上的差異、以及這種差異對台灣國際戰略的影響

Lin’s song of choice:

Xi’s Fiscal Bazooka — Weibo Doomscroll

Moly at our partner Substack has translated some musings on the future of the Chinese economy.

On good vibes before the crash hit…:

Anyone else feel like the economy’s revitalized overnight?

The stock market is all red. Everything is rising. The bull market is back. [Chinese stocks are red when rising, green when falling, because red is lucky.]

The real estate market is warming back up too. Good news is endlessly rolling in and the number of sales is growing fast.

There are crowd everywhere during Independence Week, tourism industry is looking good. People don’t blink an eye when they spend money.

Lots of people going out to dinner, restaurants are full to exploding. People don’t hesitate to eat what they want and drink what they want.

I really feel like the economy’s taking an up turn, and it’s only gonna get better from here. Do you guys think so?

Comments say:

How many days has it been, and you’ve already forgotten retirement age being delayed by three years… 😂😂😂

Another post on the stock market:

If you invested 200K into Chongqing Steel on the 18th of September, you’ve made 52K by now.

If you invested 200K into Zhengzhou Bank on the 18th of September, you’ve made 61K by now.

If you invested 200K into Tianfeng Securities on the 18th of September, you’ve made 104.5K by now.

If you invested 200K into Gujing Wine on the 18th of September, you’ve made 63.2K by now.

If you invested 200K in to Yantian Harbour on the 18th of September, you’ve made 41.5K by now.

If you invested 200K into China Mobile on the 18th of September, you’ve made 20K by now.

If you invested 200K into China Energy Engineering on the 18th of September, you’ve made 43.3K by now.

If you invested 200K into Jishi Media on the 18th of September, you’ve made 69K by now.

If you invested 200K into Vanke on the 18th of September, you’ve made 62.5K by now.

Who’s saying the stock market has no investment value? From the 18th of September to now, there’s plenty of stocks that have risen 20%! Never say that stocks have no investment value again, or other people will make fun of you! Right now, the index is only at 3300 points or so. It’s not too risky yet! There’s still time to buy in!

Comments say:

We judge heroes on success and failure, but everyone is a Zhuge 諸葛亮 after the fact.

It’s been falling for years, literally. Most investors are completely trapped 被套. Some have laid flat. Some can’t keep going and have to cut flesh to survive. Now it’s only been rising back up for a couple of days. It’s a little early to say there’s a lot of investment value in the stock market right now, isn’t it?

Then a few days later…

Three main indexes for the stock market fall significantly. The market is in its first round of adjustments? #Will millions of new investors still enter? On the 9th of October, the three big indexes for the stock market both fell significantly at market open. The Shanghai index fell by 1.79%, Shenzhen index fell by 2.92%, and the ChiNext index fell by 4.84%. In Shanghei, Shenzhen, and Beijing, nearly 5000 stocks are falling.

Comments say,

Have confidence, people. It’s normal for the stock market to rise and fall. Just control your positions.

Strategic callback.

On another note…

Ding Ding’s grandma got a scam call lately. It was a man, and he opened up by asking her, “Grandma, guess who I am.”

And grandma (who’s hard of hearing) asked, “Are you Ding Ding? What happened to your voice? Why is it so thick?”

The scammer was like, “Yeah, I’m Ding Ding. I got a cold and I’m still recovering.”

And then the situation got kind of ridiculous. The scammer started crying about how he got caught sleeping with a prostitute and asked for 50K from Ding Ding’s grandma.

Grandma had a very unique set of logic for an old lady. She not only believed every word, she even asked, “How did you sleep with a prostitute when you’re a girl too??”

I’m guessing the scammer was stunned too. Who would think Ding Ding [a fairly masculine name) was a girl? He just had to keep making shit up and said that he was with a big group. “Please don’t tell my dad. Just give me 50K, in cash. I’ll send my friend to collect the money.”

Grandma continued to ask how multiple people could do it together, and even advised, “Don’t let your husband find out about this! If he found out, your marriage would be doomed!”

And the scammer just had to keep emphasising, “Don’t tell my parents, okay?”

And grandma agreed.

A couple minutes later, Ding Ding got a call from her mom, asking, “You got caught sleeping with a prostitute???”

Ding Ding: “???????”

Ding Ding’s mom: “Your grandma said you got caught sleeping with a prostitute and you need 50K!”

Ding Ding called her grandma and told her, “You got scammed. How could you believe such an obvious lie? How would I possibly get caught sleeping with a prostitute?”

And Ding Ding’s grandma went, “Oh, that’s great you weren’t caught! I figured! It’s one thing to sleep with a prostitute, it’s another thing to get caught doing it!”

Comments say,

Hahahahaha, what a progressive grandma!

Question 2, if the lie went so well, how come the scammer didn’t make any money in the end?

Question 1, just what kind of person does Ding Ding’s grandma think she is?

Great to see Nancy Qian’s work featured here. Such important evidence that more people should know about it