DeepSeek’s New Burdens

Does DeepSeek need Beijing, or does it need Beijing to stay out of the way?

Yesterday we published our interview with Anthropic CEO Dario Amodei. You should check it out or have a listen on Spotify, iTunes, or your favorite podcast app. Transcript here.

Anonymous contributor Code Smith reports:

DeepSeek’s R1 open-source reasoning model has garnered attention from policymakers in China and beyond. President Trump commented that DeepSeek’s open availability “could be very much a positive… Instead of spending billions and billions, you’ll spend less, and you’ll come up with, hopefully, the same solution.”

To DeepSeek’s leadership, Trump couldn’t have offered higher praise. Yet, the lofty ideals of open global collaboration may struggle to survive the harsh realities of geopolitics. In Trump’s words, “The release of DeepSeek AI from a Chinese company should be a wake-up call for our industries that we need to be laser-focused on competing to win.”

But how will its new-found fame force DeepSeek to change?

This article will explore three new challenges that DeepSeek will have to navigate going forward: corporate partnerships, employee retention and hiring, and, most importantly, the influence of the Chinese government.

Does DeepSeek need a hyperscaler?

When OpenAI hit a compute bottleneck, it turned to Microsoft. That partnership transformed OpenAI’s corporate structure, reshaping it from a non-profit committed to open source principles into a for-profit company with closed source models.

DeepSeek could face a similar transition.

China’s hyperscalers — ByteDance, Alibaba, Tencent, and Huawei — are likely all pitching partnerships to DeepSeek. Rumors of a potential collaboration with ByteDance have already surfaced in Chinese media, though their authenticity is uncertain. The partnership surely wouldn’t be a straightforward one, considering that ByteDance’s model Doubao 豆包 is among the most popular chatbots in China.

A partnership with a hyperscaler could solve DeepSeek’s compute challenges, enabling it to remain at the cutting edge of AI research. However, it would also likely transform DeepSeek’s business model and culture. For now, DeepSeek claims it has no business model, prioritizing research over profit, but a partnership deal with a hyperscaler will come with strings attached.

Employee temptations?

It’s one thing to be a young, idealistic programmer grinding for the love of AI research. But DeepSeek’s rise to international prominence will put those values to the test. Employees may soon find their inboxes flooded with offers for higher-paying jobs (a DeepSeek V3 developer has already been poached by Xiaomi and Dario on ChinaTalk said he’d love for their engineers to “come work for us.”). Some might even dream of founding their own companies, leveraging the DeepSeek name to secure blank checks from investors. Will they resist such temptations?

When asked whether DeepSeek’s “curiosity-driven madness” is a sustainable strategy for DeepSeek long term, CEO Liang Wenfeng replied, “Not everyone can stay passionate their entire life. But most people, in their younger years, can wholeheartedly dedicate themselves to something without any materialistic aims.”

DeepSeek may also soon begin hiring and expanding rapidly. The fame it has garnered could attract a very different crowd compared to the passionate, idealistic individuals it drew just a year ago. What impact will this have on a company whose success relies on a small, tightly-knit team and a shared cultural bond?

Beyond these short-term cultural shifts, DeepSeek may even have to calibrate a new relationship with the Chinese government in the long term.

Could DeepSeek get the “national champion” treatment?

On January 20, DeepSeek CEO Liang Wenfeng 梁文锋 was invited to meet Premier Li Qiang — a clear sign that the company is on the government’s radar. A meeting with Li Qiang is no small matter.

The company is poised to showcase China’s resilience under U.S. export controls. Policymakers may use the company’s example to argue that these controls aren’t stifling Chinese innovation — a powerful narrative for both domestic and international audiences (although, whether DeepSeek’s success actually refutes the effectiveness of export controls is another question).

With political backing, DeepSeek could reap state-sponsored benefits — but would the payoff justify the exposure to new domestic and international pressures?

The rest of this piece will be dedicated to speculating on the implications of a world where DeepSeek ascends to national champion status. To be clear, evidence of involvement with the Chinese state is flimsy for now, but we’ll explore some key indicators of change to watch going forward.

What’s in it for DeepSeek?

If DeepSeek were to cut a deal with the Chinese State, potential benefits for DeepSeek could include:

1. Funding

For now, DeepSeek takes great pride in the fact that it is funded entirely by High-Flyer. But clearly their research budgets are not unlimited — if they were, why would DeepSeek specifically pursue low-cost training strategies for R1?1

If and when funding does become relevant, political backing significantly reduces investment risk in China. If the government signals support for DeepSeek, it will attract more private and institutional capital at a better valuation. DeepSeek may even attract direct government funding, such as from a newly established 60 billion RMB government guidance fund for AI or 1 trillion RMB special AI financing by the Bank of China.

2. Access to other resources

The government could assist DeepSeek in other ways beyond funding. For example:

Compute Infrastructure: Local governments, which are major operators of compute resources, could prioritize DeepSeek’s access. SMEs have received “Compute vouchers” on a small scale, but such policies could be expanded to include companies like DeepSeek.

Government Data: Beijing has signaled intent to unlock more value from its vast troves of government data (think health data, traffic data, industrial data held in SOEs, etc). DeepSeek could benefit from privileged access.

Chip Supply: Depending on the level of state involvement, DeepSeek could even receive assistance in circumventing controls on chip supply.

3. Government Procurement

The Chinese government has a history of using procurement to bolster favored companies. Image recognition firms, such as Hikvision, rose to prominence largely because the state was a major customer. If DeepSeek were to be recognized as a “national champion” in the future, it might secure lucrative government contracts as a result.

But at what cost?

While state attention could bring substantial benefits, it’s not without risks. Stronger ties to the government could also lead to new challenges for DeepSeek. The company wouldn’t be the first tech giant to fall from grace. Risks include:

1. Increased State Scrutiny

With government backing comes government scrutiny. Liang Wenfeng could find himself under the spotlight, with his personal character and loyalty to the Party potentially questioned. Rumors about immoral behavior — such as sexual abuse and extramarital affairs within Liang’s hedge-fund “High Flyer” — could be investigated more closely if he becomes a poster child for Chinese innovation. The state may start paying more attention to things like the post published by his quant trading firm complaining about being blamed by the state for the market volatility in 2024. Add to that the Chinese government’s general suspicion of the finance industry.

Even though last year Xi famously asked last year “why are the number of Chinese unicorns dwindling,” the instincts that drove the techlash are still in the system. Are we sure we are well and truly past that era?

2. Cultural Interference

DeepSeek’s innovative, research-focused culture could come under threat. The government might waste the firm’s time with mandatory study sessions or political events. It may also push for specific research directions aligned with state priorities. This could dilute the company’s focus on basic research and scientific curiosity.

3. Loss of Operational Independence

As seen with other tech companies, the state could demand “golden shares” (minority stakes with strategic voting rights) to gain influence over DeepSeek’s operations. This might limit the company’s autonomy, particularly if it’s forced to align its technological roadmap with government directives. Beijing’s rhetoric has historically been in favor of open source, but that could change if DeepSeek’s innovations consistently outpace international AI research. Perhaps there is some level of technical sophistication at which the CCP would insist that DeepSeek stops open-sourcing their models.

4. Complacency Risk

A flood of government contracts and resources could stifle DeepSeek’s long-term innovation. Unlimited budgets and carte-blanche access to compute resources mean less pressure to find creative ways to boost efficiency. Guaranteed government contracts could increase complacency or draw focus away from cutting-edge innovation. Lenovo serves as a cautionary tale. In the 1990s, state support helped Lenovo secure major IT tenders, but it also undermined the company’s incentive to innovate. As Douglas B. Fuller wrote in Paper Tigers, Hidden Dragons:

“Lenovo’s initial burst of innovation soon after its founding quickly dissipated in the wake of Lenovo establishing close connections to the Chinese state. [...]

Lenovo became more embedded in the state’s patronage network, winning a bid for a large national information technology tender in 1996. The state’s direct procurement jumped from an already significant 21 percent to a substantial 31 percent of Lenovo’s sales. [...]

Entering the state’s favor undermined the incentives to innovate because [Lenovo] realized that the firm could continue to enjoy state support even while forgoing the costs of technological development.”

Stronger government ties don’t have to mean increased complacency. Huawei’s example around the same time period demonstrates an alternate path. After then-president Jiang Zemin met with Huawei founder Ren Zhengfei 任正非 in 1994, the company started to receive increasing state support. As Eva Dou details in her book House of Huawei, this meeting marked a turning point in Huawei’s history. The Chinese government gradually reversed policies that had previously favored foreign telephone switch makers, leveling the playing field for domestic companies like Huawei.

But Huawei was also concerned about what the growing government support might mean:

“The growing interest from Beijing raised the specter that Huawei could be nationalized. Becoming a sluggish state-owned enterprise was something Ren was anxious to avoid. Others also warned him against it. “You must never become state-owned,” one official told him. “If that happens, you guys will die.” After Vice-Premier Zhu’s visit [in 1996], when his aides followed up to offer more loans, Ren politely declined.”

But unlike Lenovo, Huawei maintained a strong focus on R&D (a commitment to invest at least 10% of revenue in R&D), even when government priorities didn’t align with its goals. As Fuller describes:

“Huawei did not allow the state to undermine or distort its technological learning mission. For example, Huawei made a specific commitment to developing 3G WCDMA (Wideband Code Division Multiple Access) technology in 2002 even though the Chinese state kept delaying 3G rollout. With a distinct lack of enthusiasm from the Chinese state, Huawei had to undertake such R&D all on its own and spent 6 billion RMB on this research. Huawei actually suffered losses for the first time in 2002 because of this bold move, but it paid off in terms of Huawei being forced to sell this 3G equipment internationally.”

Huawei’s commitment to innovation ultimately allowed it to emerge as a global competitor. However, its close ties to the Chinese government also brought international challenges, which brings us to the final potential downside of receiving “national champion” treatment in China.

5. Geopolitical Backlash

If DeepSeek’s ties to the Chinese government deepen, it could face international scrutiny and sanctions. PolyMarket gives DeepSeek a 13% chance of . Foreign governments may also become concerned about DeepSeek’s data security, which may lead to the app being banned. DeepSeek appears to have left sensitive user data unprotected, and the Italian government is already probing DeepSeek’s data privacy practices. If DeepSeek were to receive Chinese government support, such worries would only worsen.

DeepSeek’s Government Relations Advice for Itself

We asked DeepSeek itself (R1, not the company) how it should navigate growing political interest. Here is what it has to say:

DeepSeek should strategically leverage state support — such as funding, compute resources, and government contracts — while preserving its autonomy and ensuring compliance with evolving regulations. It must align its growth with government priorities to avoid overreach that may lead to sudden crackdowns, as seen with companies like Alibaba. Negotiating terms of state support carefully will be critical to maintaining operational independence and protecting its culture of innovation and research excellence.

At the same time, DeepSeek must prepare for geopolitical challenges by diversifying its market strategy and avoiding over-politicization. Being framed as a symbol of China’s resistance to U.S. suppression could backfire, particularly if export controls or sanctions intensify. Instead, DeepSeek should focus on its technological achievements and remain agile to adapt to shifting regulatory, geopolitical, and market conditions. By balancing state support with strategic independence, DeepSeek can maximize opportunities while mitigating risks.

A Reminder: This Is All Speculative

As of now, there’s no concrete evidence that DeepSeek is receiving “national champion” treatment. A single meeting with Premier Li Qiang, while notable, does not confirm close government ties.

China watchers should keep an eye out for signs of deeper state involvement, such as:

Government “golden shares” or board representation;

Direct funding (e.g., from AI guidance funds);

Preferential access to compute or data resources;

Major government procurement contracts.

For now, this remains a hypothetical scenario — but one worth monitoring closely. It will also be interesting to observe how much of a say DeepSeek will have in this. If the state wants them to become a national champion, could Liang deftly say no?

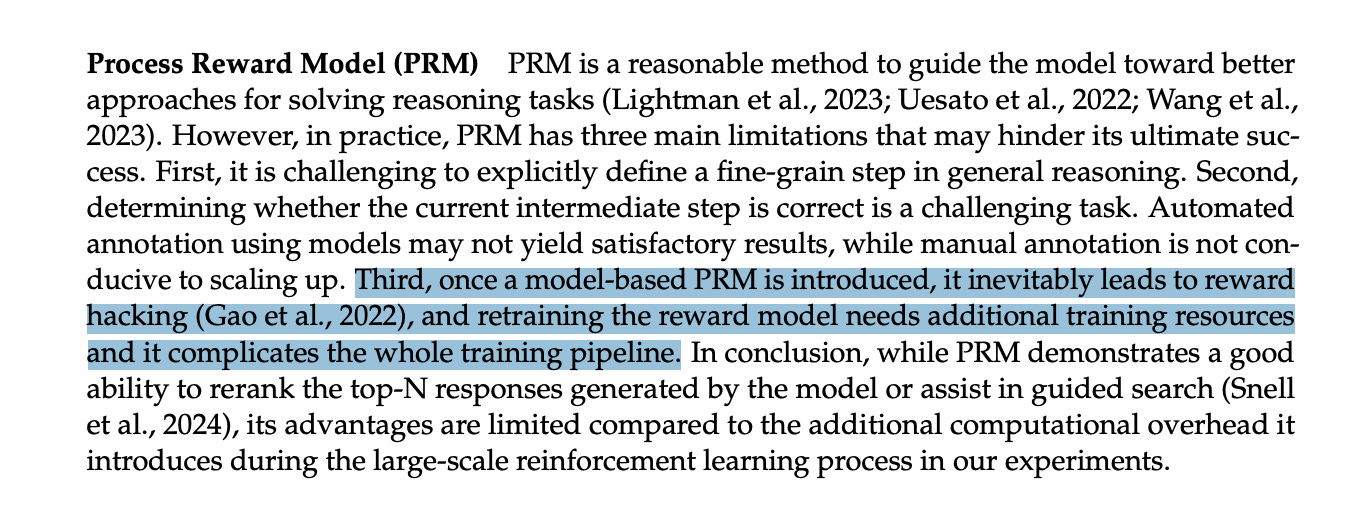

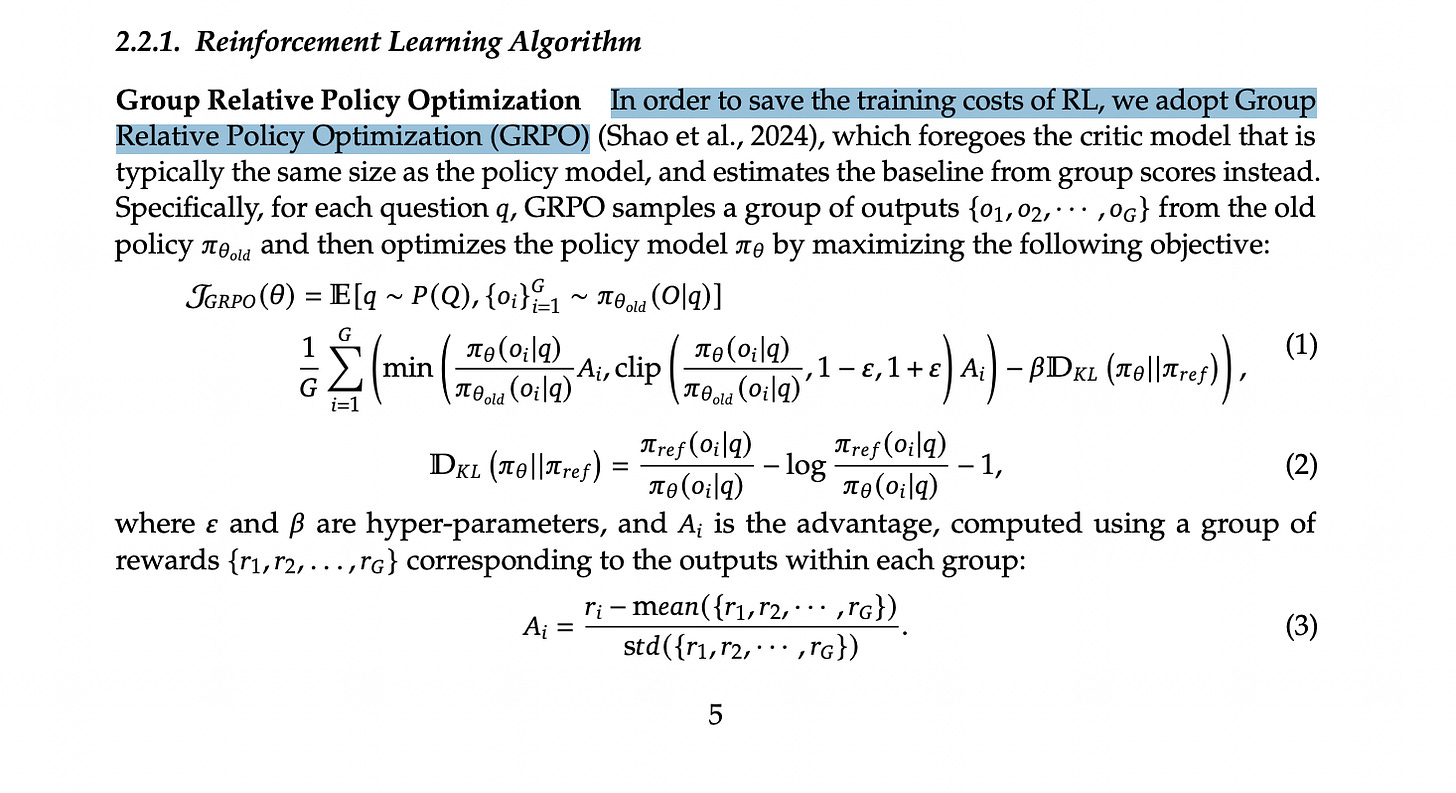

The R1 technical report shows evidence of cost sensitivity. As noted by Wei Wang, “DeepSeek unusually disclosed technical trial details, admitting failed attempts to use Process Reward Models (PRM) and Monte Carlo Tree Search (MCTS) due to reward hacking and token space complexity, ultimately opting for simplified technical pathways.”

For further reference, here’s the R1 technical report:

Great stuff as always - thanks for sharing!