Does NVIDIA Have a Future in China? Can Huawei Take Jensen On?

The coming AI chip showdown. “The United States keeps patching up its clothes. Why should we continue to follow their standards for the new clothes we’ve been making these past few years?”

Back in November 2023, Chinese media reported that Baidu had ordered 1,600 Ascend 910B chips from Huawei to power its AI products. While the number is pretty small (MSFT apparently ordered 150k H100s in 2023…), it points to growing anxieties from Chinese tech firms to diversify their AI-chip suppliers. Under increasingly stringent export controls, American chipmakers can no longer supply their mainland Chinese clients with their most cutting-edge products. As such, Chinese firms heavily investing in AI are looking closer to home for more options.

Among Chinese chipmakers vying to take bites out of Nvidia’s pie, Huawei is the most promising contender. It’s managed to keep many details about the new Ascend chip under wraps, but reporting from Chinese media still gives useful glimpses into market reception so far.

So what’s the view like from Jensen Huang’s office? The CEO of Nvidia recently made a quiet trip to China. The piece below is a translation of a January 20 article by reporter He Yiran 何伊然 of 最话 FunTalk, an independent tech-focused Chinese media outlet. It’s an interesting Chinese perspective on Nvidia’s future in the Chinese market: relying heavily on anonymous sources, the piece gives a comprehensive assessment of Nvidia’s potential strategies in various verticals, as well as its associated regulatory risks. In particular, it gets into:

Just how good the Ascend chip might be;

How Chinese clients view the tradeoffs of continuing to work with Huawei;

Why customer service is Nvidia’s Achilles heel;

And how gaming and EVs factor into Jensen Huang’s blueprint for maintaining relevance in the face of export controls in China.

Bold markings and pull-out quotes are by the editor.

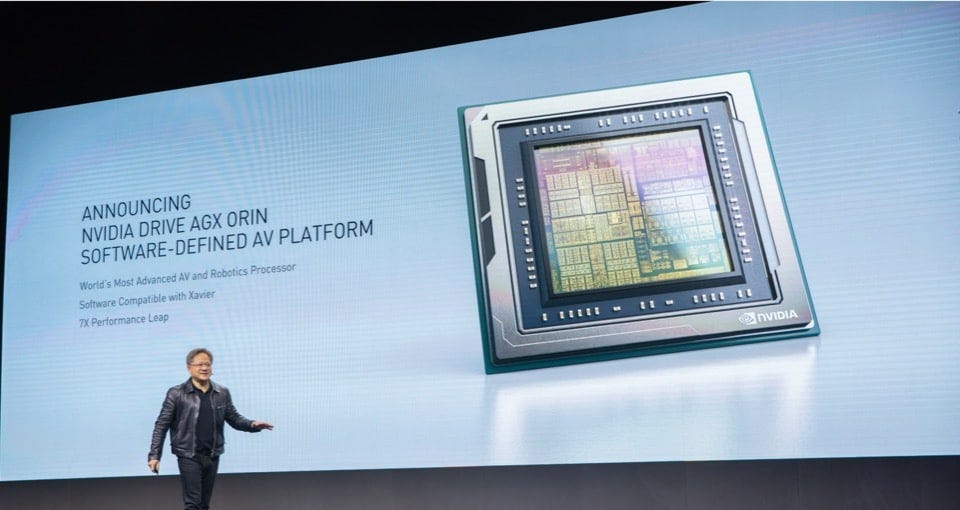

After many years, Jensen Huang 黄仁勋 is back in mainland China.

On the evening of January 20, media reports stated that Nvidia CEO Jensen Huang visited Nvidia’s offices in Beijing, Shanghai, and Shenzhen this week and attended Nvidia China region’s annual meeting. An Nvidia employee said Huang “spoke at the meeting and held a raffle for the employees.”

The same night, videos and photos of Jensen Huang dancing enthusiastically in a traditional northeastern Chinese padded vest at the annual meeting started leaking onto social media. Although his dance moves were somewhat clumsy, it was evident that “Old Huang” was in good spirits, with employees cheering him on like a celebrity.

Indeed, 2023 was Nvidia’s “dream year.”

Within one year, Nvidia’s stock price surged by 234%, its market value topped one trillion dollars, and its annual revenue was expected to reach a record-breaking $58.8 billion, surpassing both Intel and Samsung Electronics to claim the top spot among global semiconductor companies.

…

What’s more remarkable is that Nvidia’s extraordinary performance has attracted little skepticism.

Despite the company’s high P/E ratio, the industry generally believes there is no bubble in Nvidia’s growth opportunities and valuation. An investment institution commented, “Nvidia holds a dominant position in the GPU market, has strong customer relationships, and is growing rapidly — it’s hard to find many flaws in this wave.”

…

The “Special Supply” Isn’t Well-Received

Currently, the total size of the AI chip market in mainland China is about US$7 billion, with Nvidia holding over 90% market share.

In recent years, the US government has announced export control regulations targeting Nvidia’s high-end AI chips, including products such as A100, A800, H100, H800, and L40S.

As a shrewd businessman traversing the East and the West, Huang naturally understands the timeless strategy of “where there are policies, there are countermeasures.”

Nvidia immediately adjusted its flagship product H100 and launched China-market customized chips HGXH20, L20PCIe, and L2PCIe in accordance with US regulations. HGXH20 is designed for high-density servers, making it suitable for deep-learning training; L20PCIe and L2PCIe are aimed at workstations and desktop computers, meeting the AI computing needs of ordinary users.

Under strict restrictions, however, the overall computing power of these special supply chips is only about 20% of the H100.

Originally, Nvidia’s plan was to use its brand and exclusive products to stabilize its major customers in the Chinese market, and then wait to see if US policies would relax. The market performance in the past three months, however, has shown that under the backdrop of striving for autonomy and control, Chinese buyers are unwilling to take risks on Nvidia’s lower-spec chips anymore.

Insiders have revealed that Chinese companies “lack interest” in Nvidia’s special supply chips.

Recent reports indicate that Chinese companies, including Alibaba and Tencent, have been testing the performance of Nvidia’s special-supply chips since November 2023. After trialing these chips, the consensus among these companies is that the chips are “severely downgraded” and “not cost-effective.” Consequently, major corporations are unwilling to opt for these inferior products just to maintain their partnership with Nvidia.

Insiders have revealed that several companies have clearly informed Nvidia of their intention to significantly reduce their orders this year.

Statistically, inventories of second-hand A800 and H800 units in mainland China are sizable, but the majority of those inquiring now are not new users but existing users looking to replace their current units.

Generally, the lifespan of a graphics card in terms of computational power is around one to two weeks. Previously, if a card was damaged, it was possible to apply for official Nvidia after-sales service and directly receive a product exchange.

Following the implementation of the US ban, however, Nvidia can no longer replace the same chip models, leading to a significant after-sales service gap faced by many companies. Even those with previously stockpiled inventory will eventually run out.

ChinaTalk is a reader-supported publication. To receive new posts and support our work, consider becoming a free or paid subscriber.

Since US regulatory bodies have made it clear that they will periodically review chip export control policies, even if there is a potential easing period, it could be reversed in the future, posing a significant risk of uncertainty. Therefore, Chinese companies are becoming increasingly pessimistic about a possible lifting of the “chip ban” 芯片禁令 by the United States, gradually losing confidence in maintaining long-term cooperation with Nvidia.

Massive chip purchases and expenditures for adaptation and development of hardware-based applications represent significant investments for companies. This falls under technical route planning — any changes after finalization can be very troublesome. Constant back-and-forth can be unsustainable, even for industry giants.

It has been revealed that several technology companies in China are adjusting their business strategies, generally preferring to endure short-term pain for long-term stability. They are opting to cooperate with Chinese domestic enterprises that offer more reliable supply chains and higher cost-effectiveness of products.

Some American analysts even believe that, although Chinese companies will purchase Nvidia’s specially provided chips in the short term, once the transition period for domestic chip substitution is over, Nvidia’s business in China is likely to become a casualty of the US “chip ban.”

Huawei’s Vigorous Revival

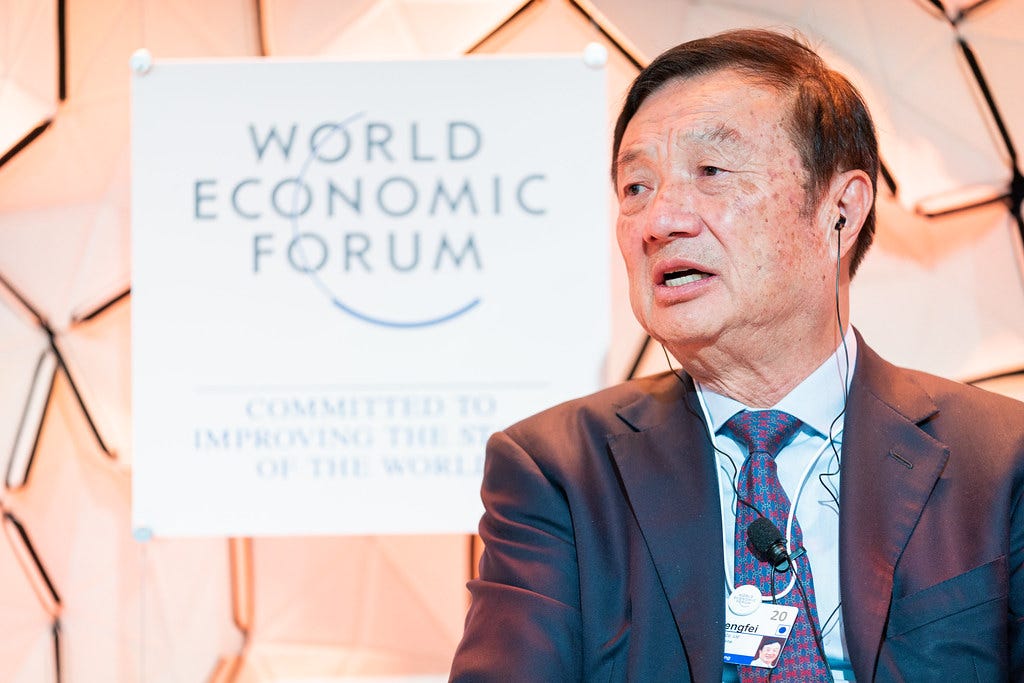

“The United States keeps patching up its clothes. Why should we continue to follow their standards for the new clothes we’ve been making these past few years? We should set standards that are better than those of the United States. Not only China but the whole world will use them.”

In July 2023, Huawei’s founder, Ren Zhengfei 任正非, expressed confidence in Chinese manufacturing during an interview. While the public worried that Ren was using his optimistic spirit to steady public confidence, Huawei’s continuous release of new products officially announced that the company had emerged from a four-year trough.

FunTalk analyzed the performance of Huawei’s Ascend 910B chip used for large model training, and this was corroborated by several media reports from data-center service providers in China that have adapted their systems to the Ascend 910B: the Huawei Ascend 910B currently achieves nearly 80% of the performance level of Nvidia’s A100. Data-center service providers consider this chip to be the preferred “alternative” for domestic companies.

After restrictions on Nvidia’s A100 were implemented, demand for Huawei’s Ascend 910B skyrocketed, with buyers even willing to pay a premium. It has been revealed that numerous Chinese intelligent computing centers and telecom operators have begun testing large-scale intelligent computing cluster infrastructures based on the Ascend 910B.

Among them, Baidu’s order received the most media attention. Insiders revealed that Baidu placed an order for 1,600 Huawei Ascend 910B chips in August 2023, with a total order value of CN¥450 million. By the end of 2023, all the chips had been delivered. Compared to the tens of thousands of chips required for large model training, 1,600 chips do not constitute a large order and cannot be compared to the hundreds of millions of dollars in orders that Baidu placed with Nvidia. Even so, this order is symbolically significant.

Baidu, with its long-term orientation toward AI development, has been a stable buyer and important partner of Nvidia in the Chinese market. In 2021, the two companies even jointly hosted the “Co-Creating AI Metaverse” 共创AI元宇宙 conference.

In August 2023, Huawei announced the initiation of the PaddlePaddle+Wenxin 飞桨+文心 large model hardware ecosystem co-creation plan with Baidu. This indicates that Baidu’s plans to purchase the 910B were in place two months before Nvidia’s high-performance chips were fully restricted in the Chinese market, at the time when the 910B’s specifications were just disclosed.

This may suggest that Baidu’s shift to Huawei was not a passive response to the US “chip ban” but a well-considered plan to adopt domestic chips, showing trust in the performance of the 910B before it was officially released.

In the chip industry, design is certainly important, but manufacturing is key. FunTalk previously learned from the supply chain that after gradually resolving issues related to process and yield rate, the production capacity of the Ascend 910B is increasing to meet the demands of Huawei and its external customers.

It’s no wonder that compared to Ren Zhengfei’s optimism, Jensen Huang appears pessimistic when discussing the “chip ban,” frequently lamenting in the media that “the Chinese market is irreplaceable” and emphasizing that the company is “helpless.”

From an economic perspective, Jensen Huang’s complaints about the “chip ban” are not for show; he genuinely does not want to see the significant market share Nvidia holds in China taken away by others. Research institute TrendForce believes that Nvidia’s AI chip market share within Chinese cloud computing companies could drop to 50% over the next five years.

This also explains why the media is so interested in this news.

While competitors were still thinking that Chinese companies are still suffering from the loss of Nvidia, a Chinese company deeply integrated with Nvidia has already made preparations and even attempted to collaborate with Huawei. Such miscalculations and discrepancies in expectations naturally lead the media to question US authorities’ “chip ban”: efforts to maintain American superiority through restrictions have inadvertently fostered internal cooperation and development among Chinese companies, directly harming the interests of American companies.

But since the ban cannot be changed in the short term, Jensen Huang made an in-person visit to mainland China to boost his team’s morale and communicate with customers, attempting to stabilize the situation.

Is the Vehicle Chips Market at Risk?

Apart from major technology firms, Jensen Huang also aims to appease the vast number of gamers and deepen “friendships” with new energy vehicle companies.

Gaming is Nvidia’s foundational market, but the ban on RTX4090 gaming graphics cards has disappointed gamers in mainland China, where the RTX4090’s price was inflated to tens of thousands of RMB at one point. Nvidia has no intention of exiting the mainland Chinese gaming market. At this year’s CES, Nvidia revealed that Chinese manufacturers like NetEase Games and Tencent Games have started developing with its latest ACE technology platform, which uses generative AI to create virtual avatars. Moreover, Nvidia will introduce a compliant version of the RTX4090 D gaming graphics card to the Chinese market, with about 10% fewer processing cores, claiming that this card’s power consumption is close to 75% of the RTX 3090 Ti. It will be gradually released starting January 2024.

Whether this “lower-spec” RTX4090 D will satisfy gamers is unknown, but it is already the highest-performance gaming graphics card that Nvidia can offer to the mainland Chinese market.

Gamers have no choice, but players in the new energy vehicle sector can still continue to collaborate with Nvidia.

2023 was a breakout year for new energy vehicles in China, with production and sales reaching 9.587 million and 9.495 million units, respectively, marking a year-over-year increase of 35.8% and 37.9%. New vehicle sales accounted for 31.6% of total new car sales. Meanwhile, China has surpassed Japan to become the world’s largest automobile exporter, with a significant increase in new energy vehicle exports. In 2023, China exported 1.203 million new energy vehicles, representing a year-over-year increase of 77.6%.

As is well known, new energy vehicles are major consumers of chips. With the rapid growth in production, sales, and export volumes of China’s new energy vehicles, the demand for automotive-grade chips has also significantly increased. The automotive sector is considered the fourth major division of Nvidia — distinct from its data center, gaming, and professional visualization businesses — and is seen by Jensen Huang as a new growth engine for the company.

Currently, over 80% of the autonomous-driving chips in the Chinese market come from Nvidia.

On January 9, Nvidia announced at the CES 2024 in the United States that Li Auto 理想 has chosen to purchase Nvidia’s DRIVE Thor centralized in-vehicle computing platform for its next-generation intelligent driving system. Additionally, Nvidia also announced that Great Wall Motors 长城, Zeekr 极氪, and Xiaomi Auto 小米 have adopted the Nvidia DRIVE Orin platform for their new generation of autonomous driving systems. DRIVE Thor is an automotive-grade System on Chip (SoC) that supports autonomous driving, automatic parking, driver and passenger monitoring, and AI-powered cockpits.

BYD 比亚迪, the industry leader in new energy vehicle sales, is likely to use the Nvidia DRIVE Orin platform. In March last year, Nvidia announced a strengthened partnership with BYD, planning to expand the use of the centralized computing platform Nvidia DRIVE Orin in 2024, including several of BYD’s next-generation models.

Nvidia’s automotive-grade system-level chips are among the most powerful ICs for intelligent driving, with the widest installation base. Numerous competitors, however, have emerged in this field, including domestic Chinese manufacturers like Huawei’s MDC platform with Ascend (Shengteng 昇腾) 610/810, Horizon’s Journey (征程) 3/5, as well as Qualcomm’s Snapdragon Ride Flex, Intel’s Eye Q4/Eye Q5H, and Texas Instruments’ TDA4VM.

The first half of the new energy vehicle revolution is electrification, and the second half is intelligence. In the competition for intelligence, chips are undoubtedly the most crucial hardware — and currently, most domestic new energy vehicle manufacturers use Nvidia products. But if the “chip ban” extends to automotive-grade system-level chips, similar to the situation with AI chips, it would be not only a significant blow to Chinese new energy vehicle enterprises, but also a severe setback for Nvidia.

The automotive industry is an economic pillar for developed countries. Especially as Chinese new energy vehicle enterprises significantly increase their competitiveness, impacting European and Japanese car manufacturers, the concern that automotive-grade chips might be blocked is not unfounded. Should that day come, Nvidia might be forced to comply and once again release a “downgraded version” specifically for the Chinese mainland market.

Just like AI chips, Huawei’s Ascend also has competitive strength. The new energy vehicles in the Wenjie series 文界系列 use Huawei chips, and their sales are gradually increasing. Although other new energy vehicle companies may not necessarily want to use Ascend chips, if they can no longer use Nvidia products, they might have to consider Ascend as an alternative, just as technology giants would.

Therefore, “connecting friendships” with Chinese automotive clients might be one of the key purposes of Jensen Huang’s visit.

Reports indicate that Nvidia will start mass production of special-edition chips for China in the second quarter of 2024. Officially, the United States has stated that the current policy does not block international business cooperation but merely represents a minor adjustment, showing a “softened stance” toward chip exports to China.

Previously, Nvidia’s CFO Colette Kress acknowledged to the media that there would be a “scale down” in sales in the Asian market, but she believed that strong performance in other markets could compensate for the shortfall. The attitude of Chinese buyers, however, has forced Nvidia to significantly reduce the production scale of the special edition chips, likely leading to a greater-than-expected contraction in Nvidia’s business in China this year.

The “chip ban” is an inescapable cloud hanging over Nvidia's otherwise sunny skies. As an American company, Nvidia has not been given any alternative by US officials but to comply with the mandate.

Within the limited space available, Jensen Huang can only make moves that maximize his own interests. In a fragmented market now teeming with challengers, the ban has significantly restricted Nvidia and impacted Chinese companies, but has also created space and time for domestic Chinese alternatives to emerge.

Of course, Chinese manufacturers still have a long way to go before they can match Nvidia’s leading edge, and the journey will not be easy. Until domestic chip manufacturers have fully formed a competitive advantage, Jensen Huang can still rest easy.

Next up: why iFlytek is Ascend’s biggest cheerleader, and how Nvidia’s current Chinese clients view the tradeoffs involved in working with Huawei…