Humanoid Robots: China’s Grind Toward Embodied Intelligence

Why the CCP wants world-class humanoids by 2027

The global race to build humanoid robots is heating up, and Beijing aims to dominate the industry by 2027. Our deep dive today explores:

Why it’s worth it to build humanoid robots instead of the strictly industrial robots we covered in part 1 of our robot series

How leading Chinese players stack up against Tesla and Boston Dynamics and where China is still reliant on western technology

The challenges of data acquisition for LLMs vs for humanoid robots

Why the Chinese auto industry is key to humanoid robot success

Human toddlers, on average, take 17 tumbles and toddle 2,368 steps each and every hour as they learn how to walk. By the age of two, children make walking look easy. But make no mistake — after a century of research, neuroscientists still don’t fully understand how the human brain learns to execute such a wide array of complex physical activities.

Natural selection has refined the human form over billions of years. And yet, companies around the world are now betting that they can artificially imitate the human body on a much shorter timescale, to create AI-driven general-purpose bi-manual, bipedal robots.

The question is, will this marriage of AI and robotics (also known as ‘embodied intelligence’ 具身智能) produce viable offspring?

The allure of humanoid robots

Generative AI and humanoid robotics seem like a perfect match. If combined successfully, they could replicate optimal human performance on a massive scale.

By mimicking human form, humanoid robots can operate in working environments originally designed for people (e.g. mine shafts). By mimicking human behavior, humanoids can integrate more easily into human social and emotional contexts (e.g. waiting tables or modeling clothing).

In the face of pervasive labor shortages, Goldman Sachs stuck a finger in the wind and guessed that the global market for humanoid robots could be worth US$38 billion in a decade.1 With such a large potential payoff, western firms like Tesla, Boston Dynamics, Figure AI, and Apptronik are making huge investments in humanoid robot development. But at least one third of that global market value will come from imminent Chinese demand for humanoids — and the CCP wants to make sure those industrial androids are home grown.

In 2023, China’s Ministry of Industry and Information Technology proclaimed that China would aim to be the world’s top producer of cutting-edge humanoid robots by 2027. Models by Chinese firms like AGIBOT, Astribot, and Galbot threaten to outcompete Tesla’s Optimus bot, thanks in part to Chinese advantages in supply-chain integration and mass production.

Given China’s shrinking labor force, general-purpose bipedal robots have clear appeal. Of course, humanoids could revolutionize industries characterized by dirty, dangerous and demeaning work,2 such as agriculture, construction, manufacturing, mining, or transportation.

The perfect job for a humanoid. Source.

But humanoids could also be valuable in the service sector. As personal assistants, personalized tutors, and caregivers for the elderly and children, humanoids could automate rote daily monitoring tasks while offering companionship. Maybe one day they could even provide entertainment as street performers.

Finally, China’s existing prowess in industrial automation could serve as an additional motivator. With the power to directly access, operate, and repair existing automation and computer systems, humanoids could unlock a number of creative multiplier effects that we analog humans haven’t even imagined yet.

So, what’s needed for these sci-fi fantasies to become day-to-day reality?

The technology we lack

A multi-functional humanoid robot requires advancements in both hardware and software. Beijing’s Embodied Intelligent Robot Action Plan 具身智能机器人行动计划 breaks this down into three core technologies: robotic body components (the “limbs” 肢体), motion control and balance (the “cerebellum” 小脑), and AI (the “brain” 大脑). Designing every part comes with trade-offs — complexity, power systems, weight, and size each influence cost, durability, stability, and control.

Hardware for the “limbs” 肢体 needs to mimic the complex array of joint and muscle movements possible in a human body. In robotics, the concept of “degrees of freedom” (DOF) refers to the number of independently controllable joints on a robot. A basic robotic arm might have three DOFs (forward/back, left/right, up/down). In contrast, a functional humanoid robot might require a staggering 28 DOFs just for its limbs (3-DOF hip or shoulder, 3-DOF ankle or wrist, one-DOF knee or elbow). Robot hands are a major challenge — human hands have at least 27 DOFs, a difficult target for hand-sized hardware to achieve. Recently, Shanghai-based Fourier launched a model with 12-DOF hands; Tesla’s Optimus is meant to upgrade to 22-DOF hands by the end of 2024. A robot that can manipulate objects at the level of an experienced human worker on the factory floor remains elusive.

For safety, these humanoid bodies need to be stable, accurate, and reliable. The physical world tends to be less forgiving of mistakes than the digital world—one wrong move could cause a seventy-kilogram metallic mass to crush a nearby object or human, so no room for error. Achieving coordination, balance, and posture in the robotic “cerebellum” 小脑 requires complex autonomous control systems that integrate sensory inputs into motor outputs. And, with all that out of the way, these robot bodies are still not fit for commercial use unless they can run reliably without frequent maintenance.

Meanwhile, the AI-powered “brain” 大脑 needs to substitute for human thinking and behavior.

In contrast to internet AI (those that only operate online), embodied AI learns by interacting with a physical environment. Such AI-powered robots need to be able to continuously monitor, process, and quickly respond to massive quantities of sensory input in real-time. Can the robot pick any object from a messy pile, shift it to the correct orientation, identify it, and transport it to the right place, all without damaging it? These are the kinds of questions that robot “brain” developers are asking.

Moreover, one of the key targets for a general-purpose robot brain is emergent behavior — defined as a robot’s ability to perform actions not present in its training data, such as catching an unexpected falling object. Robots have yet to master the “commonsense knowledge” to handle everyday environmental variations that humans take for granted. Even something as simple as pouring tea into a mug has countless “edge cases” that would challenge a robot. What if the mug is upside down? What if the mug is already full? What if the mug accidentally falls? Composed of many actions in a sequence, such seemingly simple tasks have long time horizons with many opportunities for errors to compound.

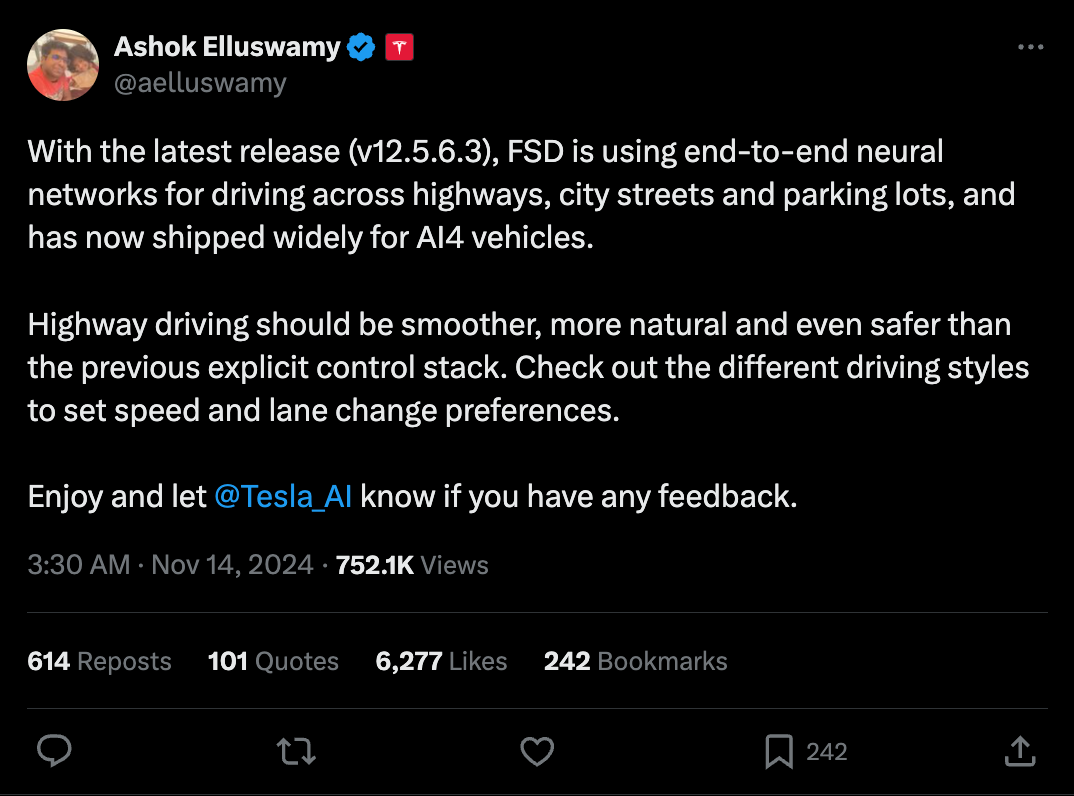

Techniques like end-to-end neural networks can help companies to research, develop, and iterate their products more quickly.3 But creating humanoid robots fundamentally requires big science — that means big datasets, investment budgets, talent pools, and teams of collaborators. The time has not yet come for them to break into reality.

But if not now, when?

Where data might come from

As with many AI applications, many researchers argue that enormous training datasets are the key to develop a general-purpose robot. But obtaining this data is not easy.

There is no internet-equivalent that can spin up a data flywheel for AI+robotics. Comprehensive robotic datasets often require sensory, motion, environmental, interaction, social, and task-specific data. That requires a lot of time, money, and coordination. The diversity of robot shapes and sizes, along with the variety of environments in which they can be deployed, complicates data collection further.

With tools like NVIDIA’s Isaac Sim, Researchers can generate synthetic data and run virtual simulations to train and test their humanoid models. These methods are increasingly advanced and safer than real-world operations, but synthetic datasets still risk producing results that are incomplete, biased, inaccurate, or ungeneralizable. Ultimately, before deployment, a humanoid robot must be trained and tested in real environments.

But where?

Automotive industry, meet Optimus

The automotive industry — in China and elsewhere — is full of problems that humanoid robots could help solve.

Manufacturers are grappling with the global EV reckoning, a fiercely competitive export market, and supply chain uncertainty. Meanwhile, consumers' tastes have grown more complicated than ever, as demonstrated by the rising popularity of built-to-order models.

The dwindling automotive workforce isn’t enough to handle these challenges. In China, government data forecasts a 1.03 million shortage of talent in the new electric vehicle industry by 2025.

But most manufacturing tasks can be automated by non-general-purpose, non-pipedal industrial robots. So why use humanoids?

The answer lies in the fact that car manufacturers can provide data and training environments that robot designers desperately need.

Factories and warehouses are “behind-the scenes” use cases in which a general-purpose robot can train and prove value without high costs of failure.

Manufacturing facilities already have structure and safeguards, and are only occupied by people with specific safety and hazard training.

Vehicle manufacturing is an especially good fit for training and testing humanoids. Standardized, process-oriented tasks like handling, sorting, welding, assembly, and quality inspection are perfect activities to help robots accumulate training data and build task libraries. Auto manufacturing factories also provide the physical ingredients for a humanoid training gym — varied terrain and dynamic elements from which robotics can learn in a relatively safe and controlled space. Through these “factory internships,” humanoids can perform relatively simple tasks to collect data, learn and generalize, and show practical value for broader commercialization.

Now, Chinese car manufacturers can preorder humanoid prototypes from Shenzhen-based robot manufacturer UBTech — presumably at steep discounts. UBTech’s plan is simple: achieve general-purpose commercialization by first rolling out humanoids in the auto industry and then expanding horizontally into consumer electronics and other industries. UBTech has reportedly already received intention orders for over 500 units from a slew of Chinese automakers. The humanoid collaboration club now includes SOEs like Dongfeng Liuzhou Motor and FAW, the privately-owned Geely Automobile, publicly-listed EV makers Zeekr and Nio, and the multinational joint venture FAW-Volkswagen (which produces VW and Audi cars for the Chinese market).

Similar strategies are taking shape outside of China as well. Figure AI’s first commercial partnership involves deploying robots in BMW’s South Carolina facility. Apptronik is sending its 160-pound bipedal Apollo bot to Mercedes-Benz’s facilities in Hungary, where the company has faced a sustained labor shortage. Toyota is investing in in-house R&D for humanoid robots and partnering with Boston Dynamics. The automotive sector is the largest source of new robot installations in all of North America, with many partnerships going beyond training to include collaboration in the eventual production and use of humanoids.

According to an anonymous industry insider, once humanoids are viable for factory applications, consumer applications could follow within two to five years.

Given that a robust manufacturing sector is critical for national defense, the auto industry’s adoption of humanoid robots could have far-reaching geopolitical implications.

Moreover, because of the unique difficulties associated with high-quality training data for humanoid robots, any entity with high-quality, proprietary, real-world data locks in an immense incumbent advantage.

China’s Strengths and Weaknesses

While data is limited, it appears Chinese humanoid models are behind the global cutting edge in a few areas.

A report from the US-China Economic and Security Commission finds that Chinese firms are on par with the US regarding robot weight, height, and speed, but lagging on key sensor technologies.

A recent Goldman Sachs analysis reveals that while both global and Chinese entities are proficient in AI “navigation,” technology is still lacking in “manipulation” and “interaction” abilities, with China slightly behind international competitors in these areas.

For a few specific hardware components — such as planetary roller screws and sensors —- China’s domestic companies seem to encounter bottlenecks not faced by their global counterparts. Chinese humanoid companies also rely on US-based NVIDIA for processing units and software. Nevertheless, some hardware suppliers like Shanghai KGG, humanoid manufacturers like Kepler Robotics, and AI companies like Huawei have made attempts to help the industry move towards localization.

However, when it comes to the inputs for humanoid robots, China is competitive thanks to its low-cost and manufacturing advantages. By taking a “fast-follower, rapid scaling” strategy, Chinese companies may become global leaders in humanoid manufacturing, even while relying on foreign innovations.

In China’s fragmented landscape of over 3,400 robotic startups, there are a few players who might become leaders in innovation as well. Two firms worth highlighting:

Unitree Robotics: producing both quadrupeds and humanoids, this company has been responsible for flashy displays at the Super Bowl and the Winter Olympics. Its H1 humanoid demonstrates dynamic motion capabilities, including a record speed of 7.38 miles per hour. The robot will be rolled out at a price around USD $90,000, comparable to models by Tesla and Boston Robotics.

Fourier Intelligence: specializing in medical and rehabilitation robots, this firm started its GRx series of general-purpose bipedal bots in 2023. GR-2, the latest edition, offers 53 degrees of freedom, longer battery life, and a streamlined design. Not yet commercialized, the G-2 is compatible with open-source software like MuJoCo and NVIDIA’s Isaac Lab for further robotic development.

Bolstered by government support, more advancements in Chinese robotics are likely forthcoming. Consider the timeline of Chinese electric vehicles: after prioritizing EVs in national economic policy throughout the 2010s, China is now recognized as a global leader in 2024. If Beijing follows through on its recent commitment to humanoid robotics, it’s not unreasonable to imagine significant strides in the next decade.

Zooming Out

Humanoid robots are a highly visible way for China to demonstrate its progress in robotics relative to the rest of the world. However, it’s important to remember that improvements in embodied intelligence — and the enhanced supply chains that follow — will come with knock-on effects that impact the rest of the economy. For example, improvements in humanoid technology could spill over to unlock new alternative robotic forms. After all, the human body does have its flaws.

Regardless of form, AI-driven robots raise thorny safety and ethical questions. A robot in the real world can collect all sorts of data — biometrics, building layouts, social behavioral data, continuous streams of audio and video, and more. Few regulations currently exist to safeguard transparency and personal privacy in the face of this increasingly robotic future. The IEEE’s study group to develop a roadmap for standards has only just started, and is set to release findings next year.

In the scenario that China dominates the humanoid robot market, some US politicians worry that the presence of Chinese-made robots on US soil could threaten national security (much like the FBI’s concerns about drones made by DJI).

There are concerns about unregulated humanoids in China as well. At present, no official safety standards exist for humanoid design. A group of Shanghai industry leaders published China’s first-ever governance guidelines for humanoid robots in July 2024, in which they floated a number of proposals including risk controls, emergency response systems, consensus-based regulation, ethical use training, and global collaboration guidelines for humanoids.

With industry leaders so eager to make their Asimovian fantasies a reality, ethical concerns are likely to arise within the next decade. The US and China have an opportunity to shape global governance frameworks together.

Admittedly, this will be difficult given geopolitical tensions. But without cross-border collaboration, firms can lobby against ethical regulations on the basis that international competitors won’t be bound by the same standards.

Behind fantasies of robot bartenders, technology is steadily advancing as hardware and software meet biology, neuroscience, and psychology. Our society is not prepared.

Still curious about humanoid robots? ChinaTalk has you covered. Write your questions in the comment section below for a chance to get insight from an anonymous industry expert coming soon to ChinaTalk.

Goldman Sachs’ original projection was US$6 billion by 2035. They recently revised it up to US$38 billion citing rapid advances in AI, reduced component costs, demand push factors (e.g. labor shortages), and broader, deeper supply chains.

The “3Ds” of bad jobs originate from the Japanese expression “3K,”「 きつい・汚い・危険 」which means “demanding, dirty, dangerous.”

Intuitively, end-to-end learning refers to the process of “training a single model to perform a task from raw input to final output, without any intermediate steps or feature engineering.” Tesla has implemented end-to-end neural networks in the development of their full self-driving features.

Prediction: China WILL be the world leader in humanoid robots. Points taken from the article.

1) Unitree robot dogs were already used at America's top sporting event (Super Bowl). The fact that China's top geopolitical rival chose its product indicates the beginning of a DJI-like dominance in quadruped robots. That will quickly extend to humanoid robots as well.

2) China has the industrial supply chain, which makes it easy to source parts and talent at a reasonable cost. Tesla and Apple wouldn't be possible without China.

The CCP does not have to wait until 2027 to have “humanoid robots”—the traumatized populace is already a herd of human robots obeying the CCP.

See my

FREE FRIENDS FORUM 25: PATERNALIST POWER CORRUPTS, PARENT POWER CORRUPTS ABSOLUTELY—INTERGENERATIONAL CHILDHOOD TRAUMA

Chinese Internet Addiction Brainwashing Camps as Symptom of Collective Trauma Re-Victimisation

https://responsiblyfree.substack.com/p/free-friends-forum-25-paternalist

Get free, stay free.