Why can India today design chips with the best of them but seems completely unable to develop fabs—much less a broader electronics industry?

Pranay Kotasthane began his career as an IC designer who worked at Qualcomm and TI, then left the field to join think-tankdom. He's currently the deputy director at the Takshashila Institution, and most recently co-authored a book called When The Chips Are Down, a history of India’s chip industry andexploration into the geopolitics of semiconductors.

Co-hosting today is Chris Miller, author of Chip War.

We get into:

How the political economy of technology in India led to world-class software and services but underwhelming manufacturing

Why India was slower to the uptake than China in the pivot from socialism

What does the future look like for India’s chip manufacturing

What can we learn from the successes and failures of India’s state-owned enterprises

ChinaTalk is hiring! — looking for a multimedia content editor to help with the production cycle of our podcast and YouTube channel, as well as an China AI analysts for full and part time positions.

We’re also looking for someone interested in covering Japan’s AI and semiconductor industry. If you’re that person just respond to this email.

Jordan Schneider: India has emerged as a powerhouse of software and design—not hardware or manufacturing, which is a different tack than the arc that China has been on in the latter half of the 20th and into the 21st century. Pranay, as a student of history, what hasn't worked from the perspective of manufacturing versus software-oriented industries?

Pranay Kotasthane: We have to see the history of India's economy to understand this. Before 1991, there was no economic liberalization and largely it was the state that was supposed to do things, even in the area of technology. The government had a prime role in all industries, whether steel, space, or semiconductors. It is not very dissimilar from what you would see in the USSR and China pre-1978 as well. The state-run semiconductor efforts of all three failed, and I draw some parallels between the three.

That was the internal context. The external context was that India was placed under many technology denial regimes because it was seen to be close with the USSR during the Cold War. What resulted was that the state took it upon itself to do many things on the technology front. It achieved some success in space, very limited success in defense, and some success in nuclear. Thus, the state tried to implement the same kinds of steps in the semiconductor domain. This era's semiconductor efforts were by the government and for the government.

There were just two government-run semiconductor companies, which began in the 1950s. The first company was called Semiconductor Complex Limited, or SCL. It is a government enterprise in Chandigarh and it started producing chips using 5 μm CMOS in 1984. And because it had government backing, it had a good pool of graduates and PhDs from India's top engineering colleges. By the late 1980s, it also got some technology transfer from an American company called Microsystems Incorporation, and then it also had some collaborations with Rockwell and Hitachi. So over the years, it moved to 800 nm CMOS. It was a few years behind the global cutting edge, never leading, but it was not that bad either.

But what you see thereafter is that it couldn't graduate to producing large-scale, trendsetting commercial chips. It started hitting the limits of Rock’s Law – which says that the capital cost of fabs almost doubles every four years. Because it was a government-run company, there was no incentive to invest a large amount of money to produce chips for export. That's not what government companies are supposed to do. They are supposed to be economical, they are supposed to preserve the precious foreign exchange that existed at a time of capital controls pre-1991. There was no mindset that you need to grow big and succeed. Eventually, SCL fell behind. It was only producing very niche chips for the space and nuclear domains. It was not working on commercial chips. And thereafter it was taken over by the Department of Space, and only recently it has gone back to the Electronics Ministry. Now there is talk of actually reforming it and putting it into the private domain.

The other parallel effort that was going on was a company called Bharat Electronics Limited (BEL). This was, again, a government sector company. It started doing germanium transistors way back in 1959. In 1962 it had technology transfer from Phillips. In its heyday, it was manufacturing nearly 20 million transistors. By the 1980s, it also started moving towards ICs (Integrated Circuits).

In fact, BEL got technology transfers from RCA also, which eventually led to technology transfers in Taiwan and TSMC as well. So there were similarities in that sense. But again, we see a repeat of the same story. The company starts manufacturing and makes progress, but then there is not much capital investment and it falls progressively behind other companies. And over time, it keeps manufacturing only for the limited government space.

Jordan Schneider: Can you compare the arc of these two semiconductor national champions to the aerospace industry and the vehicle industry? Were there broadly similar stories that were happening, as in India's other efforts to build itself into a manufacturing house or powerhouse? Or were there particular challenges within the semiconductor industry that led to these underwhelming results?

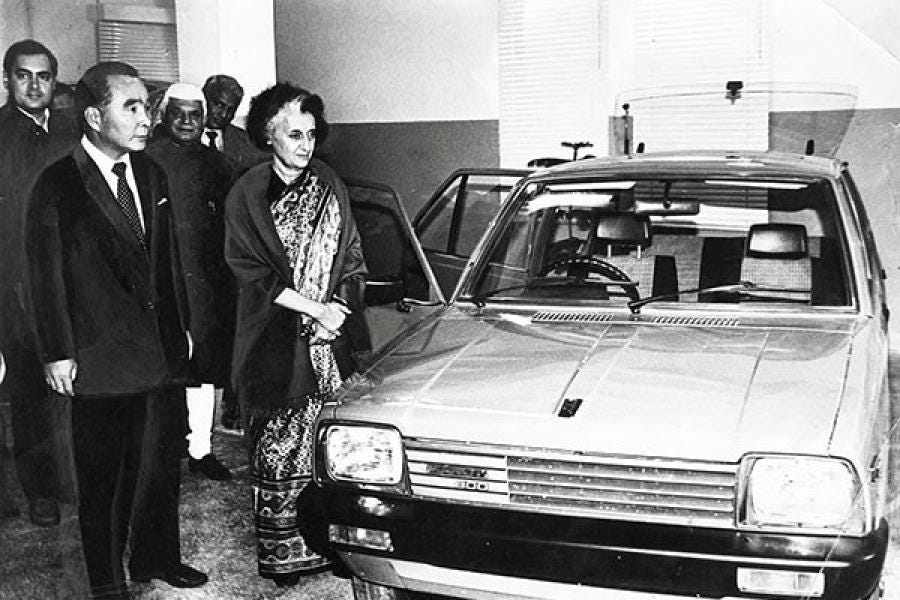

Pranay Kotasthane: That's a great question. The story depends on the sectors that we are talking about. So, for example, India does quite well in automotives. It does export a lot of cars, not electric ones as of yet, but we have a very good two-wheeler industry and a four-wheeler industry. Now, the unique thing about the automotive industry is that earlier efforts failed. Similarly, there was a government-run company, but that company was started because the prime minister’s son had a special interest in it. He literally ran the company, which was Maruti. There was a lot of political capital invested in getting it off the ground.

There were special exemptions made to this company so that it could collaborate with foreign companies, take technology transfer easily, import a lot of components, et cetera. That kind of drive wasn't there in some of the other sectors.

Now, space is one thing where India did succeed. Chandrayaan landed on the south pole of the moon recently. In space, the story that you see is because the buyer was largely the government, they never had to look at major capital expansion of the kind that you need in semiconductors. To give you an example, the entire budget of the Department of Space, even today is less than a billion dollars, whereas the latest Arizona TSMC fab is, what, $12 billion to begin with. That just shows you how different the two sectors are.

In the sectors where the demand was small–space and nuclear–you could indigenize technologies by getting a smart bunch of people. These scientists quickly learn the technology through some transfers, and then innovate over time. But that was not the case in semiconductors, because the demand is different, the capital costs required are different, and the buyers are the whole world. You need to keep investing repeatedly. So because of these sorts of sectoral differences, the strategy that worked in space didn't work in semiconductors, whereas for automotive it was a completely different, unique story.

Jordan Schneider: I wrote a Fulbright application to study Maruti Japan, which I think the State Department very smartly rejected back in 2015. But it is a really interesting story because you had the Indian government make this special exception. You had Japan-India relations riding on this one story which ended up being a moderate success even though you have the son running it. There was so much energy and excitement, and I guess a lot of pressure on this firm to deliver.

Pranay Kotasthane: Yeah, I wish he were interested in chips at that time. Maybe then we would have had a semiconductor industry as well.

Path divergence between Taiwan and India

Jordan Schneider: An interesting point you make in your book, Pranay, is this idea that TSMC and the Indian competitors were almost starting from the same position–almost at the same starting blocks. Chris and Pranay, I'd love to hear you compare and contrast Taiwan and India at that time.

Chris Miller: That's a great question. And it's not only India—Singapore also had Chartered Semiconductor which was founded in 1987, the same year as TSMC.

To me, I think the interesting thing that India faced was that it didn't have a broader electronics ecosystem. It was trying to build semiconductor manufacturing on a very narrow base, whereas Taiwan, in the 1980s, was already one of the centers of OSAT (Outsourced Semiconductor Assembly and Test). It was pretty easy to ask industry leaders from the US, Europe, or Japan to imagine building chips in Taiwan because they'd already been assembling chips in Taiwan.

One of the challenges that Indian firms faced was that they didn't have the rest of the pyramid, and building the top of the pyramid without the base was a very difficult undertaking. It's still an issue that India is working through today.

Pranay Kotasthane: I agree with that. Taiwan, Japan, and even China started from the other end of the supply chain. They started with electronics assembly, then chip assembly, then finally they got fabs and eventually design. India's model is exactly the opposite. Even when we started doing well, we started doing well in design because we already had a good software industry. The key difference for this is also that India was not that globally integrated into the supply chains because of the state-run model. So until 1991, any relationship with the external world, especially imports, was seen as a big burden because foreign exchange was really precious. There were strict controls on what a company could import. Whereas in Taiwan, right from the 1950s, you have opened up the markets. This even precedes military rule. The world of global integration into supply chains had already reached Taiwan, Japan, and even China after 1978, but that didn't happen in India until 1991. It was a very different world.

Another important reason: As I already discussed, government-run companies had no incentive to compete. This hyper-competitive space demanded capital infusion constantly and complete technological upgrades. By the time these companies could get a product, their buyers already had good foreign alternatives. So they didn't buy from them and they just faded out. There's a difference between how Taiwan and India approached this.

Between the two companies—SCL and BEL—eventually, the government told BEL to stop making chips. The government told them to only work on integration, and SCL was told to only make chips because they couldn’t afford both of them running. In the private sector, you would have seen competition as a great thing, but not in the government sector. Whereas in Taiwan, even though there were government-led efforts by the ERSO (Electronics Research and Service Organization), the actual work was being done by multiple companies and competitors, which the ERSO was engaging with. Taiwan had competition working for them, whereas that was not the approach in India.

A final reason was an inward-looking approach. Business policies were difficult, importing things was difficult, and there were exorbitant tariffs. Even BEL and SCL have files on record stating that it was very difficult for them to import the machines that were required for them to progress to the next node. Eventually, they just fell behind in the race, which, again, was not the case with Taiwan.

Chris Miller: I think there's also got to be some pretty deep political economy factors that explain why India never embraced export-led growth. You could hypothesize that Taiwan is small, so it has no other option other than export. Maybe there's some truth to that, but the counter would be China, which is big and yet it nevertheless embraced export-led growth in the 1980s and 1990s. If India was facing this challenge with foreign exchange, why wasn’t increasing exports used as a potential solution? Why didn’t India embrace that model, just as Taiwan did?

Pranay Kotasthane: You have to see from the historical lens of India's anti-colonial struggle. When independence came to India, World War II had just ended, so there were world war-related controls (trade barriers) that were already operating. These make it difficult both to export and to import. There is this historical experience of being exploited by connections with the world, and poverty is very high.

At that point in time, it was not clear whether capitalism was the right way to go, which we came to know 15-20 years later. Prior to that, it was a 51/49 thing. Some countries, like the USSR, were also growing. So the Indian political thinking at that time, felt closer to the USSR model.

Like you said, Chris, one solution to foreign exchange is to export a lot and earn foreign exchange. While that was the thinking initially in the government as well, they realized that would not be happening soon because everything was controlled. The lesson they learned is, that the way we should preserve foreign exchange is by restricting imports, not by actually producing exports.

Jordan Schneider: Chris, you wrote a whole book about how in the Soviet Union, Gorbachev was like trying to wake up even into the early and mid-80s, but Deng Xiaoping had the realization in ‘78. That extra 15 years of setting your country back relative to China over the course of the 1980s has had some pretty long ripple effects.

[We discuss Chris’ book in this OG ChinaTalk episode below]

Chris Miller: That's absolutely right. I see that the question of foreign exchange was central to Indian policymakers' thinking. The Taiwanese had the same problem, but they chose a different method of dealing with it, which was just to keep their currency low, making it too expensive to buy anything for the consumers. That solved their foreign exchange problem and it enabled exports to be cheap. India had the exact opposite, they had an overvalued currency by a lot of metrics for a very long time.

Pranay Kotasthane: Actually, there was an attempt at devaluation of Indian currency also, which happened in 1966 after seeing South Korea and other countries doing this. The idea was that it would devalue the currency and in exchange, there would be some collaboration with the US government because, at that time, there was a shortage of food so grains were coming in. But India and the US governments had a falling out on that. The Indian PM felt that the US part of the deal was not followed through. And back after 1966, India went full-on socialist in the model. Remember, devaluation will have some short-term adverse effects before you see exports increase. We didn't give that time for things to recuperate and we just went full-on socialist after that.

Software vs Hardware and Small-Scale-Industry Reservations

Jordan Schneider: So earlier, Pranay, you mentioned that the Indian model of development has been coming at it from the opposite direction compared to the paths of Japan, South Korea, and Taiwan. And you are a product of that software-focused development strategy. Let's do the sort of historical political economy of how that strength ended up developing over the course of the 20th century.

Pranay Kotasthane: Because of these controls, large-scale manufacturing is subjected to insane levels of control on labor, for example, whether you can hire or fire workers. These controls were very high in the pre-liberalization era. Certain items were restricted for manufacturing exclusively by the small sector. What this means is that the company had to remain small. Companies in certain sectors weren’t allowed to bring in more capital, machinery, et cetera. This policy started with handicraft toys, but believe it or not, by the 1990s even electronics were included in it. Can you imagine?

India's human capital story began again in the 1950s. After independence, it invested a lot in higher education, but not so much in primary education, which was the case in China. That was partly the reason why we did well in space, nuclear, and the start of semiconductors—there was this base of technically sound people.

When the software industry starts coming in, the interesting thing is the software firms are not under industrial regulations. The restrictions I’ve mentioned don't apply to software. They come under the Shops and Establishments Act, which is very different from the Industries Act. The contracting norms are easier. The restrictions on hiring and firing were much smaller. That’s one central point for why this sector takes off, whereas the others don't.

By the way, India's software story starts with a semiconductor firm, actually, in the sense that Texas Instruments India was the first multinational company (MNC) to set up shop in Bangalore. You had largely software work happening in TI India then, and things related to satellite communication started in 1985. Over time, in the 1990s, you liberalize. Then there were a lot more MNCs coming into India. In 2000, the Y2K crisis really boosted Indian software exports. There was lots of work done in India by that time. Then you also see a lot more semiconductor design firms starting to set up shop there.

I joined Texas Instruments in 2003, and by the time I had joined, it was already nearly 18 years into the game. By that time you already had architecture-level work happening there. It was not just back-end work. For example, the fastest, industry-leading digital-to-analog converter was made by TI India. India had the largest number of TI fellows outside of the US. There were interesting things happening

Then you see many more companies, from Nvidia to AMD, that set up shop there. All the companies did work at varying levels of expertise. Some did backend work with a large number of engineers. Those companies were just taking advantage of labor arbitrage and the fact that there was a large number of people.

On the other hand, some other companies were deeply entrenched in doing architecture-level work.

Interestingly, with all these companies coming in, another section developed, which was design services. These were services firms that were providing project-specific labor to the design houses of Texas Instruments, AMD, etc.

That is not often mentioned when we see value-addition charts of semiconductors. But that is a very big deal in India. You had a large number of people who were providing these services. Big-name software firms such as Infosys and Tata Consultancy Services also have hardware and VLSI hardware services. Those companies also employed people in these design houses. That was the next phase.

I think we are in hardware today where we were in software 10-15 years ago, in the sense that 10-15 years ago there were no Indian software products, though there were a lot of services and software services. That's where we are in hardware. There is a lot of technical expertise on the design side, but we don't have great products. Hardware design will be the next jump for this sort of industry. That's where we are today.

Heaven is high and the emperor is far away

Chris Miller: Is the reason the government didn't restrict software like it restricted other spheres because they just didn't understand it? Or was it that the software industry was developing a bit later in the 80s when partial liberalization was being spearheaded by Rajiv Gandhi? Is it a chronological story or is it just the bureaucrats had no idea software was going to be something important?

Pranay Kotasthane: It is both. Like in many places. Papers that stated we were following the wrong economic trajectory came out in 1969. So by the 1980s, there was already some realization within the government that this was not the right strategy. You correctly noted that we had already done some partial liberalization from 1985 onwards. That realization was there, and also software was, at that time, something so inconsequential that they thought, “Why even bother to restrict it?”

Also important factor is that software started taking off in Bangalore, which is in the south of the country and far away from the country’s power center, Delhi, in the north. Bangalore is India's most globally connected city, and it has an ecosystem of a large amount of good technical institutes, including the Indian Institute of Science (IISc), which is India's best postgraduate science institution.

All these firms that I've talked about, the technical firms, even the government-run firms, all of them started in Bangalore in this ecosystem building up away from Delhi. The state government here just said, let's just experiment. There's nothing to lose. And that sort of helped.

Subscribers get access to the rest of our conversation, where we discuss:

The architecture of a semiconductor design firm

India’s CHIPS Act and the ingredients needed to create and operate their own semiconductor fab

Why India’s software industry has flourished compared to China’s

The national security value of indigenous chip manufacturing

Chris Miller: How did Bangalore become the Indian Silicon Valley? So I guess I see story one, which is that they have good universities and technical institutes. That makes total sense. You mentioned Bangalore being globally connected. Was that true in the 50s and 60s? When I think of the big cities of India at that time, it was like Bombay, Delhi, and Calcutta. But talk to us about Bangalore and its development, and why it is the Silicon Valley.