Just How Screwed is Huawei?

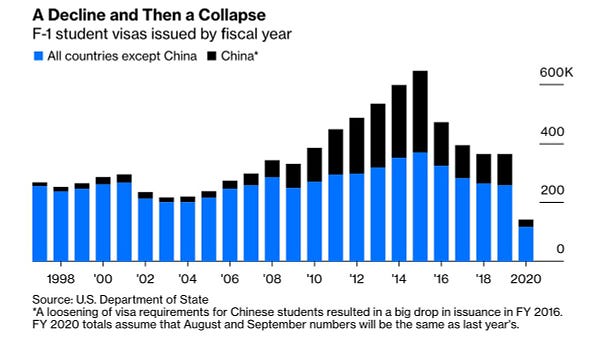

A run on Huawei phones shows how their mobile business may be even more directly hit than their 5G base stations

Turning a beloved cartoon spotlighting female empowerment into a dull endorsement of the patriarchy, autocracy and mass forced labor is no easy feat, but Disney Magic is one hell of a drug. I had a blast chatting about the utter debacle that is Mulan 2020 with think tanker Rui Zhong and novelist/meme goddess Xiran Zhao, who you know from her near weekly appearances in Tweets of the Week. Click here to open the ChinaTalk podcast in your favorite podcast app.

While the U.S. campaign against Huawei has taken aim at crippling the company’s 5G business, Huawei’s cell phone business, the world’s second largest by volume, is feeling the crunch, too. In China, where Huawei held 41 percent of the cell phone market in the first quarter of 2020, Huawei phones are going out of stock at official retailers as prices skyrocket among unlicensed sellers.

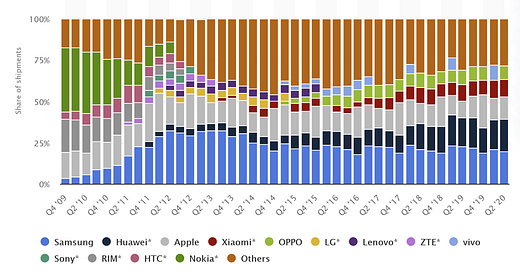

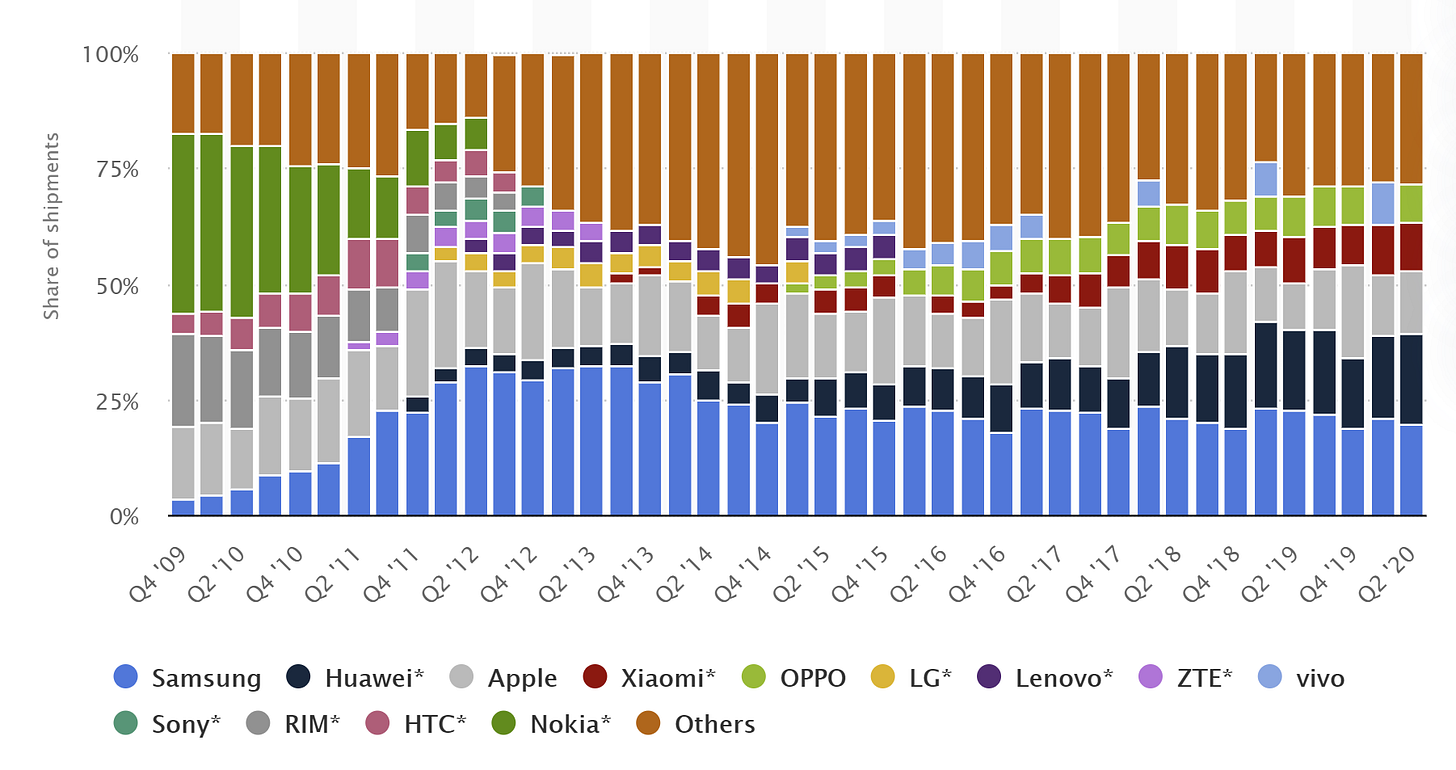

Global Smartphone Market Share by Volume. If you’re looking for more background on how Huawei developed its smartphone business into, check out a piece I wrote last year on the topic. It’s a fun piece that includes hardcore Huawei engineers clashing with an “unconventional Huawei man” who was often seen “swilling a glass of red wine, cigar in hand, dazzling in a Maserati, a high-end speaker at home, quoing Milan Kundera and Sorescu … basically like Fitzgerald’s Gatsby, the kind of guy completely out of place in Huawei.”

In response to American sanctions that have cut it off from its supply of semiconductor chips and from Google’s Android operating system, Huawei is building out a wholly “de-Americanized” chip supply chain and launching Hongmeng OS 2.0, an update to its in-house operating system that will be soft-launched for developers in December. Here’s some decent sponsored content that walks through the current OS as well as a quick youtube rundown of the talking points around the new launch.

But even as Huawei races to secure the future of its phone business, speculators are betting on the supply of Huawei phones falling short. Prices on the second-hand market are rising by the day, and people have hoarded as much as 10 million RMB worth of Huawei phones in the hope of making a quick buck off the price spike. Across China, there are reports of supply shortfalls at Huawei stores.

But even if Huawei manages to keep churning out a sufficient supply of phones, they will be running a second-tier operating system on lower quality chips. With such prospects, it may even struggle to convince app developers to make products for its Hongmeng OS 2.0 operating system. Smelling blood in the water, Huawei’s major Chinese competitors are preparing to grab a piece of its dominant domestic market share.

The following article, published originally by Phoenix Weekly Finance earlier this week, has been edited down in its translated version for brevity.

The following translation and synopsis are by Coby Goldberg, a researcher with CNAS.

As New Huawei Sanctions Kick In, Hoarders Stockpile Huawei Phones

On September 14, TSMC officially stopped producing Kirin chips for Huawei, leaving Huawei phones without a supply of high-end chips; on September 15, the U.S. government’s expanded Huawei ban came into effect; on September 16, Apple held its postponed autumn new product launch.

“The U.S. crackdown on Huawei may further intensify. In the long run, Huawei needs to establish a ‘de-Americanized’ chip supply chain, or else it’s putting its neck in other peoples’ hands,” said Zhou Xibing, author of Huawei’s Internationalization. In his view, Huawei could collaborate with European companies to build a “de-Americanized” supply chain within the next one to two years and is already investing in such a program.

In addition to building its chip supply chain, Huawei is speeding up development on its upgraded in-house operating system. At the Huawei Developers Conference on September 10, Huawei CEO Yu Chengdong said that Huawei would provide developers with a test version of Hongmeng OS 2.0 in December. Hongmeng OS 2.0 will be ready for use on Huawei smartphones by next year.

Huawei's announcement about the new operating system came at a delicate point in time. On September 14, four days after the developers' conference, Huawei was cut off from its supply of Kirin chips. After the Huawei Mate 40, which is scheduled to go on sale this autumn, Huawei will have to retire the Kirin chip.

The “big deadline” has arrived, throwing the Huawei phone market into chaos and driving up wholesale prices for Huawei phones. Even as the official prices at Huawei’s authorized retailers held steady, the WeChat channels of distributors of Huawei phones were posting about skyrocketing Huawei prices. “The price can only rise, it cannot fall, so order as soon as possible,” they told their customers...

At Huaqiangbei electronic market, the price rises twice a day

Squeezed among the stalls in Shenzhen’s Huaqiangbei Electronic Market, backpacker Li Ming watched Huawei prices rise. One customer had placed an unusually large order for twenty Huawei phones. People were starting to hoard them.

Note from Coby: The reporter for the original spoke with a number of “backpackers” at the Huaqiangbei Electronic Market in Shenzhen. A backpacker is someone who takes orders from an online buyer looking for a product, and then goes to physical marketplaces, like Huaqiangbei, to procure the product and ship it to the onliner buyer. At a market like Huaqiangbei, many of the retailers buy their phones from wholesale distributors or second hand, and thus sell them at a heavy discount. Backpackers, after making sure the product works, ship it to the online buyer at a slight markup, but a price still cheaper than those found at official retailers.

Huaqiangbei Electronics Market in Shenzhen is still a major source of online electronics today. There are dense stalls and countless backpackers like Li Ming shuttle among them. Sudden price changes touch a sensitive nerve in Huaqiangbei.

After hearing about the latest price hike on Huawei phones, another one of Li Ming’s online customers canceled an order. “Another day, another price hike,” he wrote on his WeChat moments next to a screenshot of the canceled order.

Though phone prices at official Huawei outlets are stable, they have steadily climbed at wholesale retailers. In mid-August, prices had risen by 20 or 30 RMB, and by the end of the month, they were up 200 RMB. The price of high-end phones like the Huawei Mate 30 RS Porsche are up 3,000 RMB, fetching a total price of 13,400 RMB. In the past two weeks, the phone from Li Ming’s canceled order had seen its price climb 255 RMB; with postage included, Li Ming would have been selling it at the same price as listed on the official website.

The retail stores that source their phones from wholesalers have also felt the crunch. One saleswoman told us that in her store, Huawei phones usually sell at about a 500 RMB discount compared to the price on the official website. Now, wholesalers are selling the Mate 305G, officially listed at 4499 RMB, for 4350 RMB. If she takes even a 50 RMB profit on a sale, she is only offering the phone at a price 99 RMB cheaper than the official one.

Shortages of certain models began to crop up in September, too. Huawei stores have run out of popular models like the Huawei Mate 305G and Nova 75G, and AI Caijing News reports that Huawei's overall inventory volume has dropped 30 to 40 percent.

For now, the backpackers of Huaqiangbei electronic market are still not having trouble finding Huawei phones to buy for their customers. But as Huawei’s production of new phones grinds to a standstill, they will need to look for new lines of work. Li Ming plans to focus on the second-hand phone market. Wang Qiang is thinking about focusing on Apple products.

Retailers hoard as much as 10 million yuan worth of Huawei's phones while Xiaomi and other brands scramble for market share

The Huawei price climb has been very profitable for others. One wholesale retailer, Zhang Jun, said that some “big guys” had hoarded 10 million RMB worth of Huawei phones, making as much as 3 million RMB in profits when they resold the phones. Though one of his friends hoarded 200,000 RMB worth of Huawei phones, Zhang was more hesitant and thus only invested in a few dozen. “Some people have the capital and the foresight,” he said, adding that, unfortunately, he is only a small-time retailer without enough money to fully capitalize on the moment. “I am just happy to earn a few thousand RMB from this.”

There are many who think speculators are making bad bets. Some commented online that any company’s product can be replaced; when prices for one brand rise, consumers will choose another. “They are hoarding goods and trying to drive up prices. They are just going to get their hands crushed,” one netizen wrote. “I originally planned to buy a Huawei phone, but when I saw that prices were up 200 RMB, I just gave up,” another responded…

Xiaomi, Oppo, and Vivo are all profiting, too. One owner of a phone store said that with Huawei prices continuing to climb, customers are turning to Xiaomi and other brands. The steady climb of Huawei phone prices have even nudged Xiaomi prices up by as much as 100 RMB in the case of some models…According to Pu Yin International, an investment bank, brands like Xiaomi could take 70% of Huawei’s market share.

Anticipating such a rise in demand, competitors have begun to prepare. According to a report from 36KR News, Oppo is upping production to 170 million units annually, after making only 114 million phones last year.

Huawei’s Chip Supply Will Only Last Six Months

Yu Chengdong said that in the first half of 2020 Huawei delivered 105 million phones worldwide. According to the International Data Corporation, a market research company, Huawei shipped 240 million cellphones worldwide in 2019, the second-highest volume of any company in the world…

Huawei’s phone business faces multiple risks from U.S. imposed sanctions. In May 2019, Google’s parent company Alphabet announced that, in accordance with Department of Commerce requirements, it would no longer be providing Huawei with its Android operating system. The systems used by Huawei, Xiaomi, Oppo, and Vivo are all developed based on Android; without it, Huawei’s phones may have bad service, provide a worse user experience, and even open security risks. “Hongmeng is maybe 70 or 80 percent as good as Android,” Yu told the media in recent days.

Many are pessimistic about Huawei’s future following the newest round of sanctions. Huang Haifeng, an independent communications industry analyst, said that Huawei has about 10 million high-end Kirin 9000 chips stockpiled, enough to sustain itself for half a year. After the stock is used up, Huawei's high-end mobile phone business will soon encounter great challenges. Guo Mingji predicts that, in the best-case scenario, Huawei's share of the market will decrease. In the worst case, Huawei will withdraw from the cellphone market entirely.

Huawei has taken steps to deal with the chip crisis. Shanghai Pudong Development Bank (SPDB) wrote in a report that Huawei had placed an order with chip manufacturer MediaTek and that its chip inventory will be sufficient to meet domestic market needs this year. In the short term, SPDB concluded, market risk is limited. It was previously reported that Huawei had placed an order for 120 million chips with MediaTek. On August 28, MediaTek said it was awaiting approval from the U.S. to go through with the sale.

Qualcomm has also jumped into action and is lobbying the U.S. government to remove some restrictions on the company according to Reuters. Huawei and Qualcomm signed a long-term patent license agreement on July 30. CICC noted in an August 2 research report that the patent agreement between Qualcomm and Huawei opens the door for Huawei to purchase Qualcomm chips for future phones…

But Huawei’s phone business will be unable to avoid the fallout from the chip problem. Zhou Xibing said that after September 15, Huawei might be able to purchase general-purpose chips from MediaTek and Qualcomm. But compared to the Kirin chips, general-purpose chips cannot meet Huawei’s specialized requirements and will lag on performance. With fewer supplier options, moreover, Huawei is in a weak bargaining position and could have to pay even more for chips.

The Hongmeng 2.0 operating system, meanwhile, aims to challenge Google and Apple, said Wang Yanmin, president of global ecosystem development at Huawei. “It’s time for a challenger to establish a new ecosystem outside their duopoly,” he said, adding that Huawei’s long term goal is for Hongmeng 2.0 “to be one of three equal operating systems, at the same level of quality as the other two.”

However, the establishment of a good operating system is an “ecosystem project,” requiring the cooperation of many app developers. If mainstream apps do not adapt their products for the new system, consumers will not pay for it. With Huawei’s chip supplies limited and its market share likely slipping, it is unclear if app developers will want to invest time and money in the new ecosystem.

China Twitter Tweets of the Week

Thread

thread

thread

thread.

So many good threads this week!

Xiran, who is a legend.