For the past six months, I’ve been working with Chris Miller (Tufts) and Danny Crichton (TechCrunch) on a Korea Foundation-funded exploration of issues facing the US semiconductor industry. Today I’m publishing part two of our report, which examines how the US should think about rejuvenating its semiconductor workforce.

See here for the full report complete with footnotes and a fancy pdf layout if you’d prefer that format.

We’ll also be doing a zoom event with my co-authors this Thursday at 9 AM EST. Feel free to register here.

Supporting the Semiconductor Workforce

The semiconductor industry is a knowledge-intensive field demanding a wide spectrum of deeply specialized experts to design and manufacture chips. Many entry-level jobs at top firms require masters- or doctoral-level training as well as practical industry experience. Workers often hyper-specialize in a particular process or technology, potentially becoming one of just a few dozen such experts worldwide in their field as they develop expertise on the job. From start to finish, it can take a decade or more to train and prepare a worker to become productive in the industry.

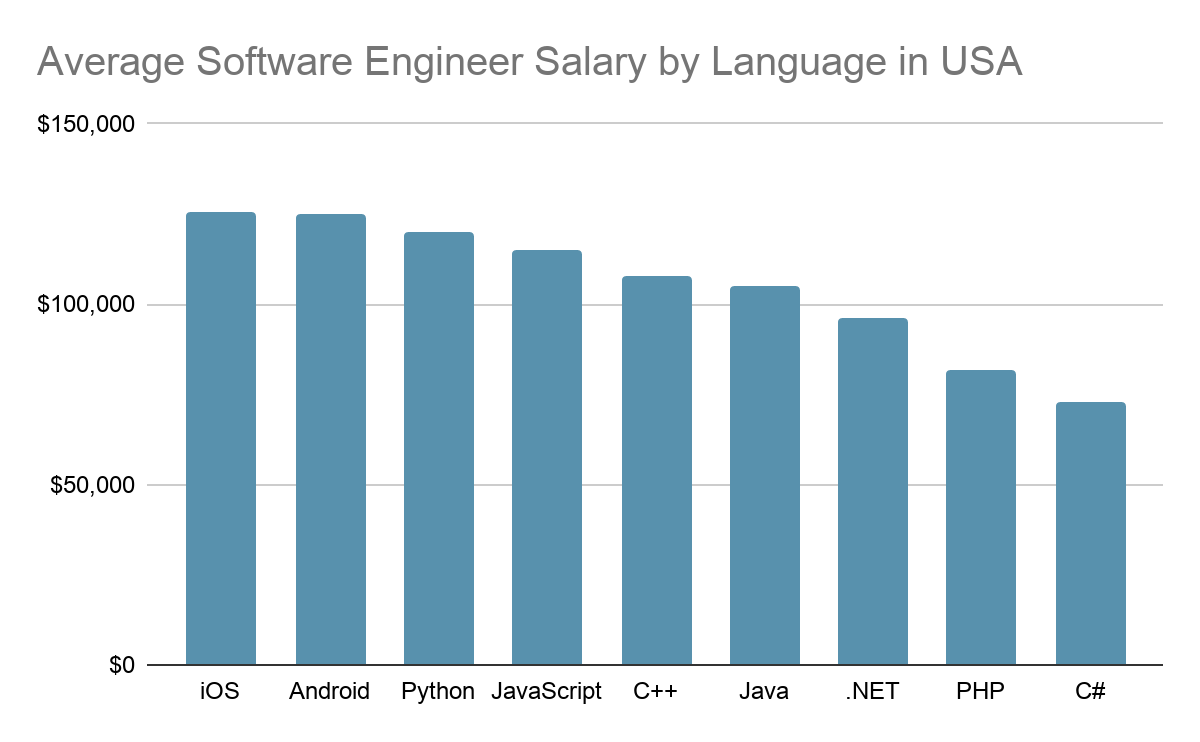

America’s pipeline for chip designers has hollowed out over the last two decades as software has increasingly enticed top technical talent away from semiconductors. Software engineering jobs in the United States typically pay better, can require significantly less training, are at more well-known companies, and offer significantly more flexible career paths. The chip industry has lost its comparative advantage for knowledge workers as the software industry has skyrocketed in size, scale, and wealth.

In numerous interviews with policymakers and industry leaders, we consistently heard about the “high labor costs” of U.S. semiconductor talent and the need to lower these costs to make America more competitive with the labor cost structures in Taiwan, South Korea, and China.

However, that thinking is precisely the opposite of how U.S. policymakers should be approaching the industry’s critical workforce challenge. The US should not try to lower salaries and make the industry even less compelling to potential workers who have abundant choices in their careers.

Policymakers and industry leaders need to make the industry far more attractive for top technical talent, including matching comparable software salaries, dramatically improving the financial calculus of education and training in semiconductors, and upgrading the flexibility of careers in the industry.

The Education of a Semiconductor Engineer

Up until the 1970s, the semiconductor and software industries essentially offered identical pipelines for workers (and indeed, at some schools like MIT and University of California, Berkeley, the two fields remain organized within the same department). Students attended universities equipped with early computers, took lectures from faculty pioneering these nascent fields, and graduated into this new industry where it was assumed that they would apprentice for multiple years before being productive employees.

Yet, a slow divergence between these fields that began in the 1980s and 1990s has accelerated in the past two decades, creating vastly different pipelines for workers.

First and most importantly, software engineering has become ever more democratized, opening up the field to new workers at all ages. Computers, which were once only available in multi-million dollar computing centers on university campuses, are now widely available to every American. The open-source movement in software has allowed any budding engineer with access to a computer to tinker with existing software and build their own—all for free.

Barriers to software engineering careers have also been eliminated through better and cheaper tooling as well as innovative education programs. Today, many of the most important software development tools are widely available for free. More advanced software frameworks and programming languages as well as cloud computing have lowered the cost and skill required for building useful software.

At the same time, education entrepreneurs have launched dozens of in-person and online software “boot camps,” which can turn a novice coder into a competent, employable one in a matter of months. Some of these programs, like Lambda School, don’t even require upfront tuition fees, but rather will take a percentage of their students’ future earnings through an instrument known as an “income share agreement,” lowering the immediate financial burden for education in this sector.

During the same time period though, chip engineering has moved in the opposite direction. As chip nodes have shrunk ever closer to the limits of physics, the skill and cost of equipment required to do pathbreaking work in the field has gone up exponentially. Whereas in the 1960s and 1970s, a student could tinker with state-of-the-art computers in college research laboratories, today, extreme ultraviolet lithography equipment from suppliers like ASML can run more than $120 million per machine, putting this technology out of range of even the most well-endowed university.

While RISC-V and OpenRAN are increasingly popular open-source ecosystems in hardware, the reality is that the vast majority of chip design tools like electronic design automation packages (EDA) are closed-source and extraordinarily expensive (although EDA companies often provide cheaper educational licenses to students while in school). Licenses for mid-range software to be productive in the field can easily total tens of thousands of dollars per year per user, with pricing that is completely opaque. In fact, concerns about pricing are so high that DARPA initiated a $1.5 billion program in 2017, called the Electronics Resurgence Initiative, designed to incubate cheaper and more competitive chip design software. In short, there remains no easy way for aspiring chip designers to get in the field without deep and upfront resources at their disposal.

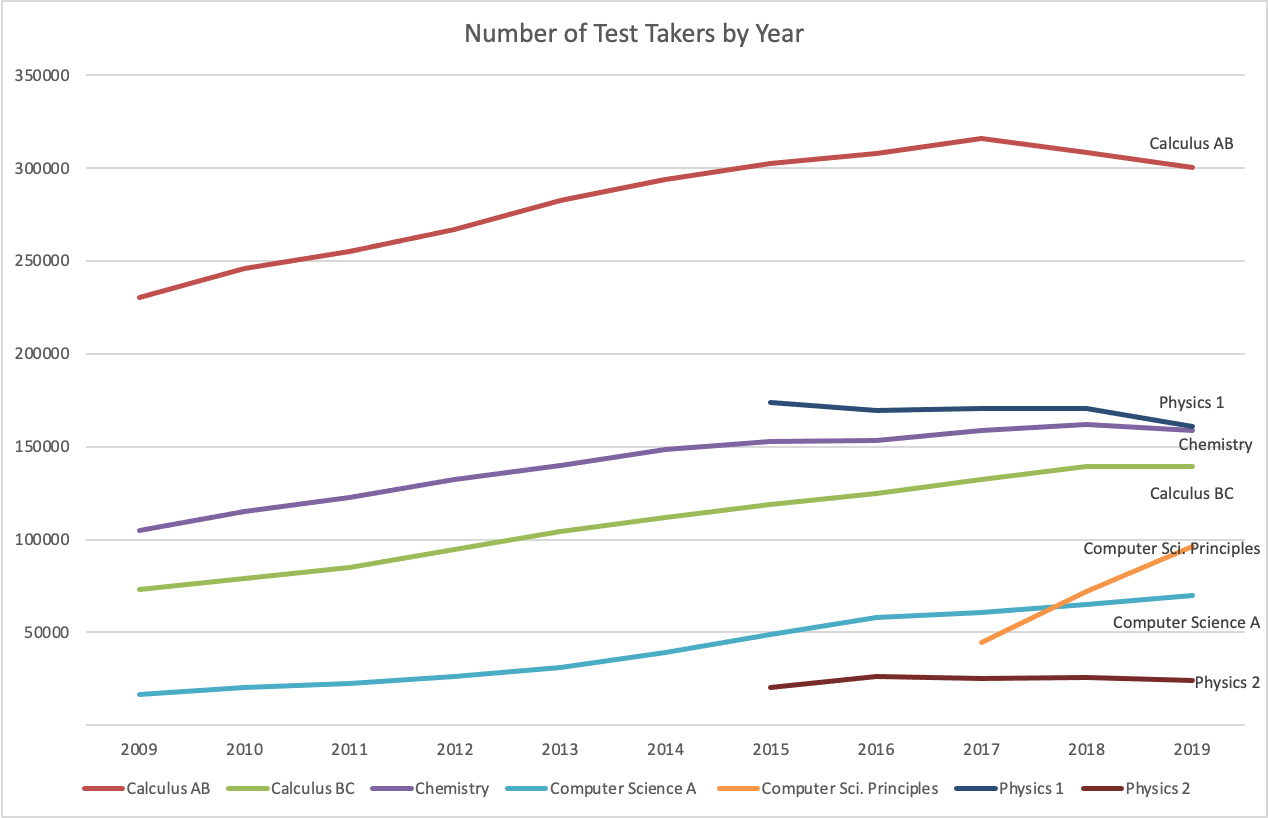

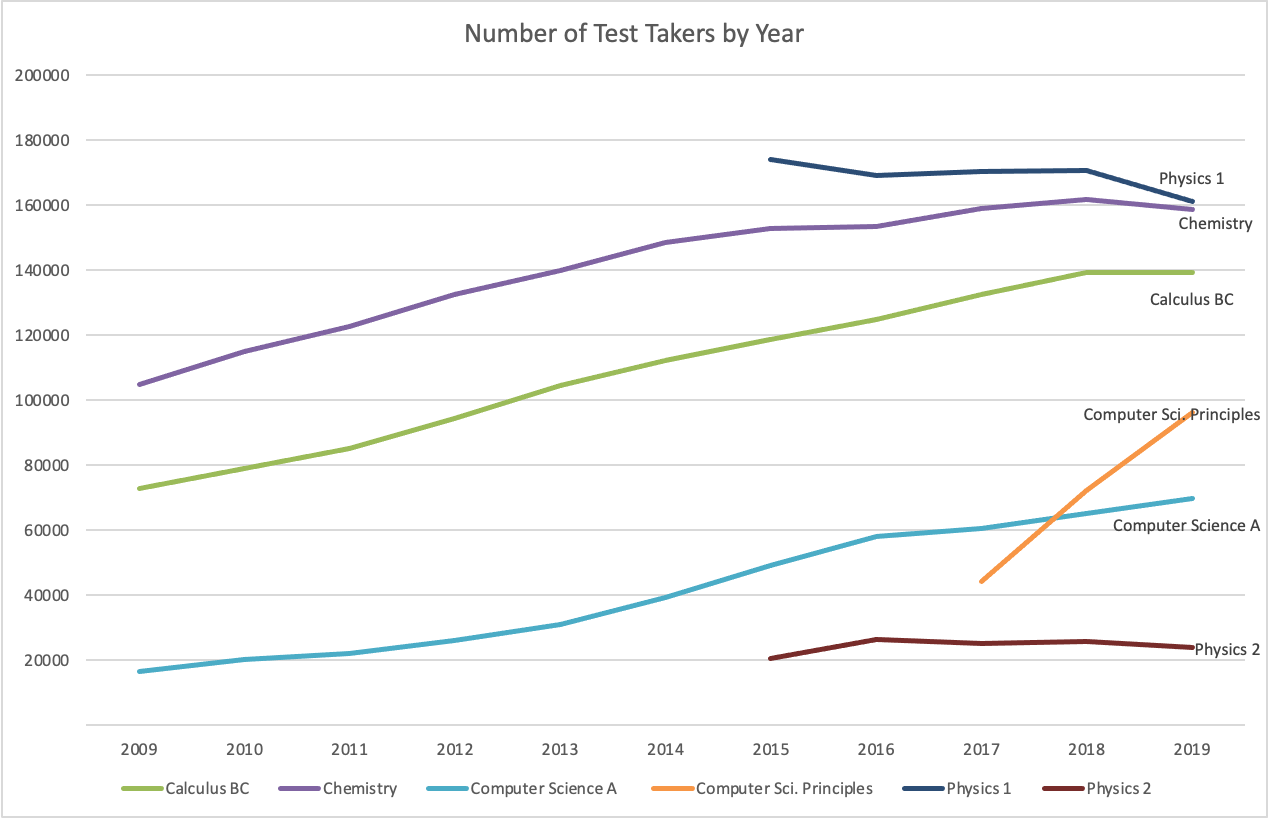

Unsurprisingly, as the barriers to learning computer science (CS) have fallen, enrollments have soared. College Board, which administers the Advanced Placement high school curriculum, has seen students sitting for its Computer Science A exam soar from about 20,000 in 2010 to more than 70,000 in 2020—the largest growth among the College Board’s more than three dozen subjects during this decade. The organization also introduced a Computer Science Principles course in 2017, which debuted with 44,000 high school exam takers and grew to almost 117,000 in 2020 (see Figure 3 and 4). That growth in popularity for CS is not mirrored in other sciences relevant to hardware engineering. The College Board’s data shows calculus exam takers are nearly flat over the decade, barely up in chemistry, and declining in physics.

Source: Data from “AP Exam Volume Changes (2010-2020),” College Board, https://research.collegeboard.org/programs/ap/data/participation/ap-2020.

Source: Data from “AP Exam Volume Changes (2010-2020),” College Board, https://research.collegeboard.org/programs/ap/data/participation/ap-2020.

On the other side of the education pipeline, the National Science Foundation’s Survey of Earned Doctorates shows that CS has grown from about 600 doctorates in 1989 to 2,228 in 2019 (growth of 370%), while electrical engineering has gone from about 1,000 doctorates to about 1,800 in the same period (growth of 80%). While electrical engineering doctorates are not the only field of study applicable to the chip industry (chemistry, materials science, and physics graduates are also courted by companies depending on their exact subfields), the pipeline for chip workers has not kept pace with the rapid growth in computer science.

Software engineering has lowered barriers and costs while making developer tools more accessible to aspiring workers. Chip engineering has gone in the opposite direction, making it more expensive and harder than ever to join the field.

It’s little wonder then that the software talent pipeline is flush, while chip firms struggle to attract workers in the United States.

Chip careers today are more work with less payoff

The democratization of software engineering is coupled with powerful inducements to learn to code: widely available high salaries, career flexibility, and market-competitive stability compared to chip engineering careers.

Aggregate labor data can hide many of these software career advantages. For instance, the Bureau of Labor Statistics (BLS) reports that salaries are roughly equal between software developers and computer engineers across all percentiles, with computer hardware engineers earning about 6-12% more than software engineers on average. Data from visa applicants supplied by the Department of Labor shows a greater variance, with semiconductor jobs having a 30-50% wage premium over software engineering jobs across salary percentiles.

Yet, according to the same BLS data, there were roughly 68,000 computer hardware engineers in the United States, compared to more than 1.4 million software engineers (and even more if adjacent labor categories are included). In the visa dataset analyzed for this report, there were 14,375 semiconductor visa applications in fiscal year 2020, compared to 228,411 software visa applications. Perhaps more directly, if we look at applications with wage rates above $100,000, there were 10,557 applications in semiconductors compared to 77,071 applications in software.

The key point here is labor market depth: The software industry has many more jobs—including high-paying jobs—than the semiconductor labor market. That market depth gives individual engineers more flexibility and stability in software since there are more available positions.

Perhaps even more importantly, software engineers can find jobs at a vast range of potential companies. There are hundreds of publicly traded American software companies hiring software engineers, not to mention governments, research labs, nonprofits, and more. Since software can be developed remotely, many of these jobs are available to any American with an internet connection and a computer. On the hardware side, however, there are just a few dozen companies that demand the unique skillsets of chip designers and manufacturers, with most companies requiring workers to be present in offices or fabs.

Considering the lengthy training timeline for chip engineers, the small labor market and relatively limited wage premium in semiconductors makes the individual financial calculus of these careers very tough. Worse for the industry, the depth of the software labor market always beckons to hardware engineers, who can make the leap to software with reasonable effort. Online forums for industry professionals like Reddit, HackerNews, Quora, Blind, and others are filled with requests for advice on making this transition.

When it comes to industrial power, software is America’s greatest industry. Six of the top ten largest companies in the world by market cap are American software companies (with Apple being an unusual hybrid company between software and hardware). The other companies in the top ten are the two Chinese software giants Alibaba and Tencent, Saudi Aramco, and Warren Buffet’s holding company Berkshire Hathaway. The extreme success of software companies in the United States allows them to pay significantly higher wages, offer a better working environment, and compete for the best talent unencumbered by most notions of cost structure.

Taiwan and South Korea lack the same success in software, with neither having a world-class software company that is internationally competitive. For domestic workers in these two economies, the semiconductor industry is one of the most lucrative opportunities available. In November 2020, TSMC announced that it would raise wages by 20%, but would also offset bonuses to compensate. According to the chip fab, the average worker makes roughly $56,000. That wage is significantly below comparable American salaries, but is nearly 2.5 times the rate of the average Taiwanese full-time worker. In short, local conditions make chip jobs—and the long education and training courses required to attain them—very attractive for workers eager for financial success and a stable future.

Source: “What is the Average Software Developer Strategy Around the World,” DAXX, February 17, 2021, https://www.daxx.com/blog/development-trends/it-salaries-software-developer-trends

China, which also has a comparatively low per capita gross domestic product (GDP), has understood this comparative dynamic and has embarked on attracting workers to this critical technology industry with globally competitive pay packages—as opposed to locally competitive ones. The country and its leading chip companies have made salary offers in the millions of dollars for star chip designers, and they will pay other workers who relocate to China or work abroad for Chinese companies hundreds of thousands of dollars a year in salary, most notably through the Thousand Talents Program.

Opening the pipeline and flushing it with cash

Too much of American policymaking focuses on “lowering costs” instead of making an industry relatively more attractive to workers. The United States has an open and competitive labor economy, and workers are encouraged and incentivized to choose the career paths that give them the highest wages and the most job satisfaction. The technically talented workers that chip companies need are adaptable and have many other directions they can take their careers to maximize their expected incomes and quality of life.

The United States needs to give its domestic chip industry a comparative advantage in the labor market, particularly from the siren song of U.S. software giants.

First and foremost, the United States must aggressively and rapidly open up and democratize computer hardware engineering through open-source and experimental manufacturing programs. A key goal should be to make the mainstream tools of the field free and openly accessible to students, hobbyists, and new entrants into the labor force. Much as open-source has democratized software engineering and ultimately created some of the most valuable companies in the world, forcing open the hardware engineering economy will create significant positive externalities, while still ensuring that companies can develop and protect proprietary and valuable intellectual property.

Second, the United States must incentivize more technical talent to build careers in semiconductors by making the career more financially enticing. Options might include additional scholarship dollars and stipends for students in relevant fields while still in college, better funding for experimental projects, more robust stipends for graduate students, and tax credits or other forms of corporate incentives to significantly raise salaries in the industry to give them a more competitive wage premium compared to software careers.

Third, the United States needs to ensure that star chip design talent stays in the United States. Additional flagship grant programs for researchers, incentive funding for venture capitalists to invest in chip startups, and high-priority visa and grant processing can ensure this talent remains in the United States and continues to be attracted from abroad.

Compared to the past, a career in chip design isn’t as attractive for American workers today. Policymakers face a choice of either letting the industry wither given the globally competitive labor market, or bolstering the workforce so that an ecosystem of chip firms can flourish. Other countries can be counted on to continue cultivating their own comparative advantages. If the United States can’t find a way to attract more skilled workers into semiconductors, then America will find itself increasingly dependent on imports for this critical technology.

Wow, Jordan. You guys hit it out of the park with this one! Not a month ago I wrote this to a friend, talking about contract hardware manufacturing:

"Offshore manufacturing has sucked so much oxygen out of the industry in other countries that you have to be very lucky to find anybody even remotely local to you with the capacity and the know-how to build something you want. It's been commoditized to such a degree that nobody wants to go into these careers anymore because the pay is lousy.

Semiconductor engineering is really, really hard and takes *years* to learn to do well. Why would I go into electronics engineering when I can make twice the money in software, for less effort and in less time? I want to have a life, too."

Please don't think I'm blaming China, Taiwan or South Korea here. The industry in the U.S. and Europe needs to take a long look in the mirror!