Deepseek Meets Li Qiang, Data Labeling Subsidies, Taiwan's Debt, Automation Optimism

Friday Bites!

China AI Policy Updates

Trying a new thing this week giving you quick China AI policy updates led by Bitwise. Let us know if you like it!

DeepSeek CEO attends meeting with Premier Li Qiang

DeepSeek — the quiet giant leading China’s AI race — has been making headlines. Its latest r1 model, an open source model with comparable performance to o1 at a fraction of the cost, has turned the internet upside down. We’ll be covering the geopolitical implications of the model’s technical advances in the next few days.

Having flown under the radar domestically, policymakers in Beijing at the highest level have now officially taken notice. DeepSeek CEO Liang Wenfeng 梁文锋 attended a symposium hosted by Premier Li Qiang 李强 on January 20. This event is part of the deliberation and revision process for the 2025 Government Work Report, which will drop at Two Sessions in March.

Liang thus far has maintained an extremely low profile, with very few pictures of him publicly available online. One domestic reporter noted after seeing the state media video of the meeting, “The legendary figure in China’s AI industry is even younger in real life than expected. He takes great care of his skin, and at first glance, you might think he’s a student representative.”

At a similar symposium in January last year, Baidu’s Robin Li 李彦宏 was among the attendees. Not bad for Liang, beating out CEOs of China’s biggest tech companies.

Liang’s invitation should be interpreted as political recognition of DeepSeek’s critical place in China’s AI ecosystem. Attention like this is double-sided. Rising to the ranks of a “national champion” can open doors for both private and state-backed investment, as well as deliver government contracts (though past interviews indicate this probably isn’t what Liang is after…). However, it also may invite additional scrutiny and burdens. As we’ve covered in recent months, Chinese AI regulatory barriers are relatively low and narrowly focused on content moderation. As the Chinese political system starts to engage more directly, however, labs like DeepSeek may have to deal with headaches like government Golden Shares. It is also still an open question just how today’s regulators feel about closed- vs. open-source AI. In the coming weeks, we will be exploring relevant case studies of what happens to emerging tech industries once Beijing pays attention, as well as getting into the Chinese government’s history and current policies toward open-source development.

Unfortunately, the official readout of the meeting provides little detail on what was actually discussed and only notes that attendees “shared their insights on addressing current development challenges and improving this year’s government work.”

Apart from Liang Wenfeng, eight other experts attended, with robotics as the only other industry getting special attention:

Zhang Hui 张辉: Dean of the Economics School at Peking University;

Ren Shaobo 任少波: trained political economist and Party Secretary of Zhejiang University;

Liu Jun 刘珺: Vice President and General Manager of the ICBC (Industrial and Commercial Bank of China);

Wei Hongxing 魏洪兴: Chairman of AUBO Robotics 遨博智能 (a firm we covered in this piece last month);

Chen Xuedong 陈学东: Chinese Academy of Engineering academician and expert in robotics;

Chen Hongyan 陈红彦: Director of the National Center for Ancient Book Protection and specialist in cultural preservation;

Du Bin 杜斌: Deputy Director of Beijing Union Medical College Hospital;

Zou Jingyuan 邹敬园: Gymnast and Olympic medalist.

To catch up on China and robotics, check out our two-part series introducing the industry.

Policy support for the data labeling industry

The National Data Administration 国家数据局, a government entity established in 2023, has released “opinions” to foster the growth of the data labeling industry. The policy aims to harness China’s vast data resources and diverse application scenarios to drive this emerging sector forward.

Goals by 2027:

Achieve an average annual growth rate of over 20%.

Build a “relatively complete industrial ecosystem” for data annotation, including the development of influential, innovative enterprises and specialized annotation hubs.

The policy emphasizes advancing core technologies such as multimodal annotation, large model annotation, and quality evaluation. It also calls for the establishment of industry standards for data annotation, particularly in sectors like agriculture, manufacturing, healthcare, and smart cities.

Specific support measures include:

Tax incentives: Implement policies such as R&D expense deductions and tax benefits for high-tech enterprises to reduce costs for data annotation businesses.

Government procurement: Regions and departments are encouraged to allocate funds for purchasing data products and annotation services.

Cost reduction: Promote the use of data vouchers 数据券, algorithm vouchers 算法券, and computing power vouchers 算力券 to lower operational costs for data annotation enterprises.

Investment promotion: Encourage government funds to increase investments in the data annotation industry.

Talent development: Cultivate and attract high-level professionals in data annotation through talent programs, revised national occupational standards. Encourage partnerships between enterprises, universities, and research institutions to promote training, continuing education, and certification of skills.

Additionally, the policy underscores the importance of AI safety in data annotation, with a focus on strengthening privacy protection, AI alignment, and security assessments.

Our take: High-quality data annotation is crucial for cutting-edge AI development. For example, Scale AI, a US-based firm specializing in this field — whose CEO, Alex Wang, we interviewed last year — recently raised $1bn at a $14bn valuation. Similar Chinese firms currently appear to be behind: Scale AI’s 2024 revenue was around 10x that of leading comparable Chinese firms like DataTang 数据堂 and Data Ocean 海天瑞声. It is unlikely that this new policy will do much to completely change dynamic, but the attention shows that the government recognizes the strategic importance of these firms and intends to continue helping them on their way.

State Council opinions on government guidance funds

In early January, the Chinese State Council released high-level “opinions” on improving government guidance funds, following discussions in December.

State-backed funds are now essential to China’s tech ecosystem. With foreign venture capital retreating and limited domestic private investment, local governments account for roughly 80% of all investments, making them the dominant limited partners (LPs). Understanding the challenges these funds face — and how the State plans to address them — is critical.

The “opinions” propose several measures to address the shortcomings of government-backed investment funds:

Encouraging collaboration to avoid duplication

National and local funds are urged to coordinate and focus on specialization, preventing redundant investments.

Stronger specialization of funds

Industrial investment funds: Support industrial chain modernization and critical sectors.

Venture investment funds: Drive early-stage, high-risk, and innovative projects.

Broadening exit strategies. The “Opinions” stress the need to expand exit pathways, including:

Private equity secondary markets (S-Funds): These funds specialize in purchasing stakes in private equity investments.

Mergers and acquisitions (M&A): Funds can exit by selling their stakes to strategic investors or companies looking to expand through acquisitions.

Listing on multi-tiered capital markets: Funds can sell their stakes through platforms like the National Equities Exchange and Quotations (NEEQ) (also called “New Third Board” 新三板) and regional equity markets.

Encouraging risk-taking and long-term investments

Focus on early-stage, high-risk projects, adopt “invest early, invest small, invest long-term” strategies, and extend fund durations to support projects requiring sustained development.

The above is essentially a list of the current shortcomings of government guidance funds:

Duplication of efforts: Funds compete to support every high-tech industry in every city instead of fostering specialized clusters with agglomeration effects.

Lack of specialization: Funds try to cover too many industries without building deep expertise.

Limited exit strategies: Start-ups over-rely on IPOs. In Silicon Valley, only 5% of exits come from IPOs, while 95% are acquisitions. In China, the “better to be the head of a chicken than the tail of a phoenix” 宁当鸡头,不做凤尾 mindset discourages acquisitions, limiting exit options and ecosystem dynamism.

Short-term mindset: Funds prioritize low-risk investments in established companies to ensure returns, rather than taking risks on transformative, high-impact technologies.

The “Opinions” correctly identify these issues, but the bigger question is: What can the State Council actually do to address them effectively?

New AI Standardization Committee under MIIT

The Ministry of Industry and Information Technology (MIIT) has established a new AI Standardization Technical Committee, numbered MIIT/TC1.

This committee’s responsibility spans five major areas.

Foundational and general standards:

Developing standards for AI terminology, evaluation and testing, reference architectures, and operations and maintenance.

Support infrastructure:

Creating standards for datasets, foundational hardware, and software platforms.

Algorithms and models:

Formulating standards for foundational large models and industry-specific large models.

Operations management:

Establishing guidelines for the application of large models, application maturity, and application development management.

Safety governance:

Developing standards to identify and prevent AI risks, ensure safety governance, address technological ethics, and safeguard data and information security.

The committee is comprised of 41 members, with the secretariat hosted by the China Academy of Information and Communications Technology (CAICT) — an MIIT-affiliated think tank. Professor Zheng Zhiming 郑志明 from Beihang University has been appointed as the Chairperson.

The other members include experts from major research institutions, universities, and companies, such as the three major telecom operators (China Mobile, China Telecom, and China Unicom), Baidu, Tencent, iFLYTEK, Huawei, Alibaba, SenseTime, and Unitree Robotics 宇树科技.

The big question on our mind now: How will this committee position itself vis-à-vis existing AI standard-setting bodies, such as the TC260 and SAC/TC28?

China leads the world in positive AI sentiment

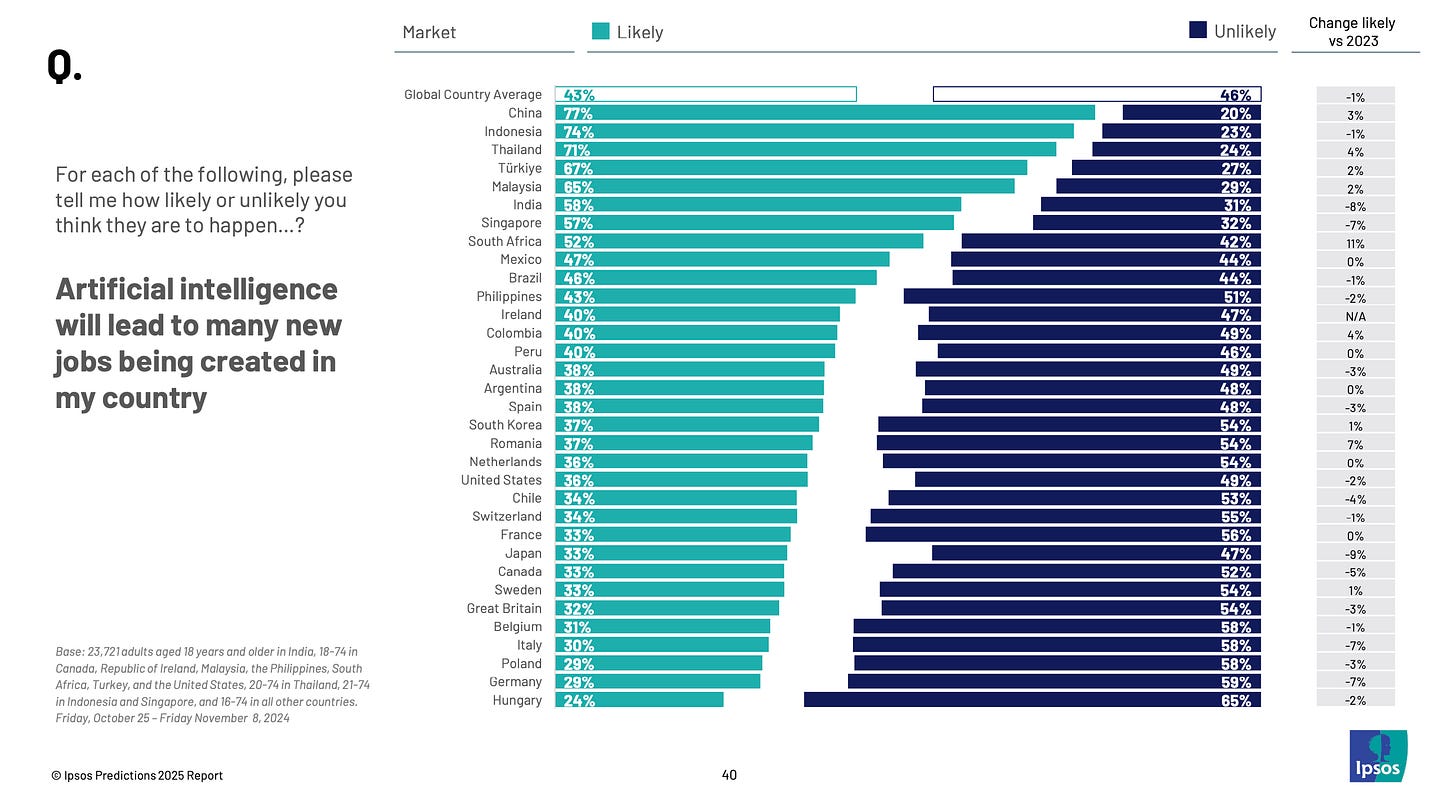

According to a new Ipsos poll, China is the most optimistic about AI’s ability to create jobs out of the 33 countries surveyed, up there with Indonesia, Thailand, Turkey, Malaysia and India. The 77% of Chinese agreeing with the statement “AI will lead to many new jobs created in my country” contrasts pretty dramatically with America’s 36%. What this means for regulatory barriers for diffusion

Taiwan needs to scrap its Public Debt Act

Joseph Webster is a senior fellow at the Atlantic Council and edits the independent China-Russia Report. This article represents his personal opinions.

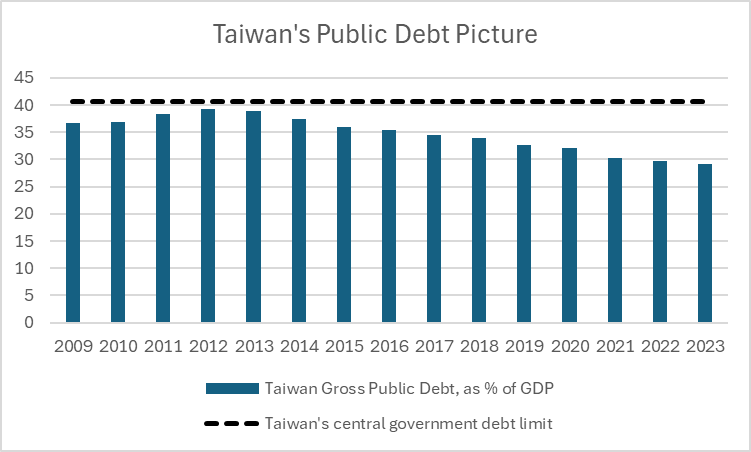

Taiwan’s debt levels are far too low. Taiwan’s low central government debt-to-GDP ratio, capped at 40.6% by the Public Debt Act, is abnormally low compared to other developed economies and limits its ability to address pressing security challenges. Given the security challenges facing the island, Taiwan must revoke the Public Debt Act and invest wisely in military kit and other whole-of-society resilience measures.

In 2023, Taiwan’s debt-to-GDP ratio stood at 29.1 percent, the sixth lowest of the 41 economies in the International Monetary Fund’s “advanced” classification. Moreover, Taiwan’s public debt has fallen significantly since peaking in 2012. While central government frugality is usually highly commendable, this policy is wildly inappropriate for Taiwan, given its unique conditions.

Taiwan’s perilous security environment demands greater investments. The CCP has repeatedly declared its intent to subjugate Taiwan, by force if necessary, and is building the military capabilities to do so. With the world’s largest navy and a vast dual-use civilian fleet, the PRC is escalating coercive measures, including large-scale military exercises, blockades, and potential kinetic actions, demonstrating both intent and growing capability.

Given these fraught security conditions, it is astonishing — infuriating to some — that Taiwan continues to underinvest in defense. Taiwan’s defense outlays stand at 2.5 percent of GDP, above the 2 percent baseline for NATO members, but also far below its needs. SIPRI estimates PRC military expenditures totaled $309 billion in 2023, more than 17 times the ROC’s outlays. While Taiwan should not be expected to approach total PRC military spending or conventional capabilities, it can procure “a large number of small things” and make itself indigestible via a porcupine strategy based on asymmetric capabilities.

And Taiwan’s holistic security needs extend beyond just military affairs. Taiwan, which faces a real risk of a quarantine or blockade, is more than 95 percent reliant on seaborne energy imports. Taiwan is already the world’s largest per-capita coal consumer in the electricity sector, but its power needs are only increasing due to the demands of data centers (including those for AI), electric transportation, and more. Mitigating Taiwan’s serious and growing energy security challenges will require substantial investment in indigenous nuclear energy, offshore and onshore wind, and next-generation solid-state batteries, which could play a major role in a cross-Strait contingency. US LNG could enhance Taiwan’s energy security, limit urban air pollution, and reduce bilateral trade deficits — all of which are increasingly important again in Washington, DC.

Taiwan’s Public Debt Act hampers essential security investments, particularly in military readiness. With rising risks from Beijing and an increasingly complex relationship with Washington, Taipei should repeal the act to prioritize critical security spending.

In your item on the January 20 symposium hosted by Premier Li Qiang 李强, you mentioned Chen Hongyan 陈红彦: Director of the National Center for Ancient Book Protection and specialist in cultural preservation. It would be interesting to read a bit more on this National Center, an update on its activities, and how it fits in to the larger picture. Caught my attention because I had just this piece from the IFLA (International Federation of Library Associations and Institutions).

https://www.ifla.org/news/building-a-digital-network-of-chinese-ancient-books-chinese-ancient-books-resources-database-construction-and-services

What do you think are the incentives for releasing Deepseek model weights for free? Hedge fund companies are not known for their ... generosity.