To understand AI’s impact in China, it’s essential to go beyond the sort of coverage we’ve focused on in the past year around cloud computing, AI chips and algorithmic progress and start looking at applications in the real world. To that end, we’re kicking off our China AI Applied series today.

Where better to start than the only industry that really matters, farming?

Sunny Cheung, an associate fellow at the Jamestown Foundation, and Dawn A bring us a deep dive into the techno-agro revolution. We explore the hard tech behind the seed development industry and explore parallels to semiconductor policy questions. We also get into:

How seriously does the CCP take its food self-sufficiency problems?

Are seeds really “the chips of agriculture”?

What is “information construction” 信息化建设, and what does it have to do with food security?

What are the strategic priorities of Chinese biotech companies? And what should the US government do about their US-based subsidiaries?

“Modern China,” for most people, probably conjures images of an emerging global superpower, advanced technology, and high productivity. Our coverage yesterday on just how central tech policy is to the Third Plenum only underscores that fact. But if there’s one thing Xi cares about just as much as semiconductors, it’s food.

Xi Jinping in his speeches has repeatedly described food security as “a matter of national importance” 国之大者.

The annual document No. 1 Central Document, issued by the CCP Central Committee and the State Council, has consistently prioritized agricultural and rural issues — from the 1982 announcement of the Household Responsibility System 家庭联产承包责任制 to this year’s unsurprising priority of “ensuring national food security” 确保国家粮食安全.

At the Central Conference on Rural Work 中央农村工作会议 in 2020, Xi emphasized that food cannot be treated as a general commodity with short-term economic implications — it must be treated as a strategic commodity with long-term political implications (不能把粮食当成一般商品,光算经济账、不算政治账,光算眼前账、不算长远账).

Two years later, at the same conference in 2022, Xi said (alluding to the Warring States Period, and then today’s Ukraine crisis),

Without agriculture, there is no stability; without grain, there is chaos. This scenario has played out repeatedly throughout history, both in China and abroad. Historically, the State of Qi enticed the State of Lu to abandon grain cultivation for mulberry trees, then cut off their food supply to subjugate them. King Goujian of Yue cooked seeds before offering them as tribute to the State of Wu, seizing the opportunity to conquer Wu when their crops failed. Since the Ukraine crisis began this year, over thirty countries have restricted food exports, leading to social unrest and even regime changes in some nations. Only by firmly grasping the initiative in food security can we secure the initiative in national rejuvenation and strengthening.

无农不稳,无粮则乱。这一幕在古今中外反复上演。历史上,齐国诱导鲁国弃粮种桑,关键时候断粮降服鲁国;越王勾践把种子煮熟贡给吴国,趁其粮食绝收一举灭吴。今年乌克兰危机爆发以来,全球30多个国家限制粮食出口,部分国家因此社会动荡甚至政权更迭。只有把牢粮食安全主动权,才能把稳强国复兴主动权。

Given all this, it should come as no surprise that China is accelerating its progress in improving food security, from central to provincial and local levels, at breakneck speed:

Since the war broke out in Ukraine — the granary of Europe — several studies have been published in China discussing the diplomatic and strategic role of food security in the war.

Then in 2023, the National People’s Congress Standing Committee finalized “the Law of the People’s Republic of China on Assuring Food Security,” which embedded a national grain-security strategy into China’s overall national security concept. The law’s provisions stipulate a production strategy based on cultivated land management and application of technology (藏粮于地、藏粮于技), while also establishing a grain-security responsibility system that confines local governments at or above the county level.

And the Chinese central government is strengthening enforcement. Last year, China’s natural-resources inspectors investigated land in thirty-one provinces and administrative regions, and leaders of nine local governments have been summoned to Beijing and criticized seriously for ineffectively investigating and curbing cultivated-land violations. This February, the Ministry of Natural Resources 自然资源部 found sixteen fraud or misconduct cases of offenses in the latest annual nationwide land-change survey.

Land, Self-Sufficiency, and Soybeans

In 2006, the 11th Five-Year Plan set forth a legally binding goal of maintaining 1.8 billion mu 亩 (about 296 million acres) of arable land. That figure was based on a calculation which included grain production and the population at that time, in theory guaranteeing that the nation’s food self-sufficiency rate will stay above 95% until 2030.

According to the Ministry of Natural Resources, China recorded over 1.9 billion mu of arable land at the end of 2022, an increase for the second year in a row. But Chinese agricultural experts also revealed that about one-third of China’s arable land is suffering from degradation, acidification, or salinization. Perhaps more concerningly, China’s latest food self-sufficiency ratio plummeted to 76%. Although the self-sufficiency rate of the Chinese staple food triad — rice, wheat, and corn — is near 100% self-sufficient, China was the world’s largest food importer in terms of value in 2023.

In fact, China has a structural food shortage. Soybeans illustrate the problem well. China is the world’s largest importer and consumer of soybeans in the world. Due to its culinary culture and population base, China has huge demand for soybeans, 80% of which go to the manufacture of vegetable oils and animal fodder.

Over the past few years, soybean imports have accounted for 60% of total grain imports — but the self-sufficiency rate for soybeans is only 17%. So if China wants to grow soybeans without importing from others, it would need an extra 700 million mu of arable land, in addition to the 180 million mu of land already being used to grow soybeans.

Unsurprisingly, China is seeking substitutions to American soybean imports. According to China’s General Administration of Customs 海关总署, China’s share of Brazilian soybean imports has dramatically increased: in the first two months of 2024, China’s soybean imports from Brazil doubled, compared to the same period last year. But we’re still not getting the full picture: a few months ago, a Bloomberg report revealed significant gaps between China’s soybean import data and exporting nations’ figures — China claims it imported 96 million tons of soybeans in 2023, while exporting nations (including the US and Brazil) say they exported 101 million tons of soybeans to China. A Chinese customs-agency spokesperson attributed the divergence “to various reasons, such as re-exports to third places.”

‘Information Construction’ 信息化建设 for Strategic Grain Reserves

China hopes to get rid of its food-security chokeholds through revolutionary advancements in technology. Article 7 of China’s new national food-security law stipulates that the state should strengthen “scientific and technological innovation capabilities and information construction” 科技创新能力和信息化建设. In March, the National Food and Strategic Reserves Administration 国家粮食和物资储备局 announced that China reached 100% information coverage for grains related to government policies. In other words, China has successfully built a digital regulation system for grain purchases, sales, and reserves.

This milestone also reflects China’s capacity to conduct real-time, dynamic food-security supervision via AI. Sinograin 中储粮 — a state-owned enterprise responsible for purchasing grain, including American soybeans — uses intelligent inspection to detect moisture, impurities, weight, and imperfections in grain. Cameras and sensors, alongside information systems deployed in Sinograin’s depots, can monitor incoming grain in any weather conditions. From 2014 to 2017, Sinograin deployed 4.32 million temperature sensors and more than 80,000 surveillance cameras, and claims it has the world’s largest Internet of Things (IoT) application on grain storage. Earlier this year, the National Food and Strategic Reserves Administration said that its national food and material management platform now integrates 400 million data entries, describing its system as a “digital brain” 数字大脑 for grain purchase, sale, and reserve supervision.

The new national food-security law promises to secure China’s domestic food supply by enhancing international grain-security cooperation — and digitalization has huge potential to improve grain purchase decision-making. Sinograin said it was involved in a macro-control mission last year which efficiently implemented a purchase policy that strongly benefited farmers. The mission included the launch of the minimum purchase price of rice in Heilongjiang as well as an increase in domestic soybean storage.

Information construction for grain storage is more than a series of isolated management systems across scattered depots. It’s an integrated network for all kinds of grain-related decisions:

A secretary of the Party committee at Sinograin’s branch in Dalian 大连 said that Sinograin regulates the supply and demand of all national grains, maintains the stability of the grain market, and responds to major natural disasters and other emergencies.

Last year, the Chinese central government revised the “National Food Emergency Preparedness Plan” 国家粮食应急预案, introducing a framework for improving the food-emergency response system with plans introduced for all provincial-, municipal-, and county-level administrations. Notably, the revision also stipulated adherence to “extreme thinking” 极限思维, which implies preparations for contingencies like grains embargo and global food crisis.

The Joint Logistics Support Center 联勤保障中心 of the People’s Liberation Army has been busy working on information construction projects for military-civilian integration (军民融合军粮供应工程信息化建设), in particular, provincial-level military food supply. These projects are evidence that the PLA is pursuing what it calls “joint security and joint supply” 联保联供, based on the concept of “peacetime to wartime conversion” 平战转换.

The Revitalization of the Seed Industry

In addition to information construction, scientific innovation 科技创新 is another major part of technological applications stipulated in the new national food-security law.

Seeds have been described as the “chips” of agriculture — and considering the unprecedented attention given by officials and scholars, including in the Ministry of Agriculture and Rural Affairs 农业农村部, that doesn’t feel like an exaggeration.

In 2021, the twentieth meeting of the Central Committee for Comprehensively Deepening Reform 中央全面深化改革委员会 adopted the “Seed Industry Revitalization Action Plan” 种业振兴行动方案, which focuses on “(1) the protection and utilization of germplasm resources, (2) innovation and tackling key problems, (3) support for enterprises, (4) base improvement, and (5) market purification” 种质资源保护利用、创新攻关、企业扶优、基地提升、市场净化.

The grain-production chapter of the new national food-security law also focused on germplasm and breeding development of the seeds industry.

Xi published a Qiushi 求是 article titled, “Correctly Recognizing and Grasping the Major Theoretical and Practical Issues of China’s Development” 正确认识和把握我国发展重大理论和实践问题. Xi stressed the implementation of revitalizing the seed industry and ensuring soybean self-sufficiency: “The rice bowls of the Chinese people should be firmly in their own hands at all times, and our rice bowls should be filled mainly with Chinese grains” 中国人的饭碗任何时候都要牢牢端在自己手中,我们的饭碗应该主要装中国粮.

Researchers in China have picked up on those cues, and focused in particular on crop genomics. Their fixation on crop genomics was inspired by “Breeding 4.0,” a concept pioneered by US plant geneticist Edward Buckler. Breeding 4.0 imagines a future generation of breeding in which molecular breeding will evolve into optimized combinations of genes with integrated technologies such as transgenics, whole-genome selection, genome editing, synthetic biotechnology, and artificial intelligence.

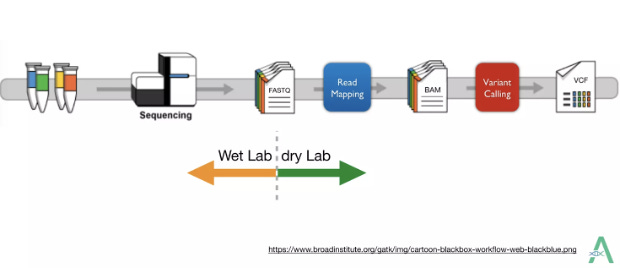

That future requires next-generation sequencing (NGS) such as high-throughput sequencing technologies, which can cost-effectively sequence millions of DNA fragments. NGS, for instance, would enable rapid and comprehensive genotyping to find disease-causing variations in a particular breed of crop.

Chinese researchers have enjoyed considerable success in making scientific breakthroughs:

In 2017, the Chinese Academy of Agricultural Sciences (CAAS) 中国农业科学院 utilized single-nucleotide polymorphism (SNP) and sequencing technologies to study the germplasm of hundreds of varieties of corn, soybeans, and wheat. A year later, the academy published a groundbreaking assembly and sequence analysis on Chinese soybean genomes, paving the way for an evolutionary graph-based genome study of soybeans.

Chinese scientists in recent years have decoded the complete reference genomes of several different soybean varieties. Nanjing Agricultural University 南京农业大学, for example, used US soybean variety Williams 82 to build the world’s first open mutant library for soybeans, with genome-wide coverage and clear mutation information. Guangxi University 广西大学 and Northeast Agricultural University 东北农业大学 also released the complete genome of Chinese soybean variety Zhonghuang (中黄) 13, and last year they mapped the epigenetic modifications of the variety for the first time.

And just last year, the Institute of Crop Science 作物科学研究所 of CAAS took the lead in researching domestic wheat, maize, and soybeans. The institute has validated thirty-eight new crop varieties, and ten of those have been selected to be promoted in more than 24 million mu of farmlands. Soybean varieties Zhonghuang 301 and Zhongji (中吉) 602 have set new highs in yield and harvestability in alkali soil, respectively.

The Chinese government firmly believes that the nation’s world-leading germplasm-resources database and competitiveness in sequencing and artificial intelligence will give it the edge in the next generation of breeding. China’s National Intellectual Property Administration 国家知识产权局 confirmed that China has more biological-breeding patent applications than anyone else in the world; the number of applications of molecular-markers breeding also exceeded the United States. And for the first time, China last year approved thirty-seven transgenic corn varieties and fourteen transgenic soybean varieties, effectively beginning a new chapter of biological breeding.

Sequencing Collaborations in the US

In recent years, Chinese biotech companies have strengthened agriculture cooperation with their US counterparts.

Back in 2012, Chinese genomic science giant BGI 华大基因 and California-based Affymetrix announced a strategic cooperation to co-develop and commercialize genomic microarrays for agriculture. (Microarrays allow researchers to analyze and compare genomes of different organisms.) The reason BGI sought out the California company is clear: Affymetrix, later acquired by ThermoFisher, possesses the leading microarray platform GeneChip, which allows high-throughput gene-expression analysis and genotyping based on photolithographic techniques, similar to semiconductor manufacturing processes (as the name “GeneChip” suggests). BGI said the cooperation agreement will improve genomic-selection capabilities for scientists seeking to improve breeding outcomes.

Litho World & Commerce: Lost in Translation?

Today’s breakdown is authored by “Lithos Graphien,” an anonymous contributor with decades of experience in the chip industry. Special thanks to Arrian Ebrahimi of Chip Capitols for his edits. Jordan is in LA next week and holding a meetup! Register here

In 2013, the Committee on Foreign Investment in the United States (CFIUS) approved BGI’s purchase of Complete Genomics, another California company which invented a high-density technique to improve NGS. The acquisition gave BGI the capability to produce a DNA sequencer and then combine it with its own trans-omics technology platform. BGI co-founder Wang Jun 王俊, who revealed his company’s intention to Chinese media, said Complete Genomics’ core sequencing technology and other core intellectual properties will take BGI’s scientific research scale up to another level.

The transfer of those core technologies enabled BGI to found MGI Tech 华大智造, a leading producer of high-throughput genome-sequencing machines, in 2016. BGI has received over $1 million in research grants from the US Department of Agriculture’s (USDA) Agricultural Research Service since 2018. BGI’s tech acquisitions also allowed it to reduce its dependence on US sequencing giant Illumina: in 2022, Illumina agreed to pay BGI $325 million to settle a patent-litigation suit, which also resolved a pending antitrust lawsuit.

And MGI Tech’s footprint in the US continues: last year, Complete Genomics became a BGI subsidiary, and announced plans for a $3.2 million NGS-products manufacturing facility at its headquarters in San Jose, California. In a statement, MGI Tech labeled the construction of the San Jose facility as its “second overseas manufacturing base” 在海外布局的第2个制造基地 (Latvia was its first).

This January, Complete Genomics announced an agreement with New York–based Gencove, providing a bundled solution for low-pass whole genome sequencing (LP-WGS). Complete Genomics expected the agreement to empower researchers in molecular breeding and plant and animal research through enabling low-cost, high-throughput sequencing results that could lead to the discovery of novel variants.

Not even a month later, Complete Genomics announced a partnership with Massachusetts-based seqWell, a company which provides NGS library preparation at low cost. Gencove and seqWell promoted their streamlined and cost-effective solutions as innovators in agricultural genotyping, and both have collaborated with the USDA. The aforementioned agreements are set to enhance the sequencing capabilities of MGI-Tech’s DNBSEQ-T7RS sequencers, a model involved in a strategic cooperation between MGI Tech and Higentic 华智生物 in promoting China’s seed industry. (Higentic is a national seed-industry platform and molecular-breeding center advocated and supported by the Ministry of Agriculture and Rural Affairs, the Ministry of Science and Technology 科学技术部, and the National Development and Reform Commission 国家发展和改革委员会.)

MGI Tech’s sequencing platform has used low-pass whole genome sequencing to decipher the genetic architecture of agricultural economic traits in pigs. According to MGI Tech, its sequencing platform has solved the significant “stranglehold” problem in breeding. Moreover, MGI Tech claims its technology provided a new genetic-analysis method — with completely independent intellectual-property rights — to support the “Seed Industry Revitalization Action Plan,” as stated in China’s 14th Five-Year Plan.

Another study by Chinese agricultural experts (on the research progress of whole genome resequencing in soybean breeding) likewise asserts that the technology will effectively solve key issues, including lack of marker genes — and that, eventually, these advancements will allow them to modify the genetic materials of soybeans, give new traits to crops, and significantly improve their yield and quality.

The DNA-sequencing industry — just like the semiconductor industry — can be subdivided into different manufacturing processes. Complete Genomics is a state-of-the-art hardware firm, while Gencove is a leading data platform. Similarly, BGI and MGI Tech tap into distinct, niche areas of the sequencing and breeding industry.

But unlike the chips industry, BGI and MGI Tech’s collaborations with these US biotech companies in agriculture — and their implications on breeding techniques in China — have seldom been scrutinized, either on a political or a compliance basis. Especially given the strategic competition between the US and China and the national-security implications of the agricultural sector, these partnerships should be further investigated.

During the Cultural Revolution, Xi Jinping, then a teenager, was sent to rural Shaanxi 陕西 during the “Down to the Countryside Movement” 下乡运动, and a secretary assigned him to a seed-production site to study breeding. A memoir revealed that he kept his breeding knowledge in a booklet, sharing it with others when the opportunity arose. These experiences planted a seed inside an ambitious opportunist, who decades later finally has a chance to embed his agricultural theories into China’s grand strategy. With a newly enacted food-security law, an agricultural surveillance system, and breakthroughs in breeding technologies, the country is now becoming an agricultural superpower.

From information construction in cultivated lands to scientific innovation in crop breeding, China is entering into an agricultural revolution that promises changes from the peasantry to the military. Beijing is trying to drop the US as its largest soybean supplier, build a surveillance infrastructure that covers all its grains, and mark every trait of crops and livestock that can tolerate an increasingly intolerable climate. And in today’s ever-shifting geopolitical climate, China is ramping up preparedness for contingencies, including grain embargoes and global food crises.

Indeed, as an idiom from ancient China goes, “Before the troops move, the grain and rations go first” 三军未动,粮草先行.

One podcast for the road

What do you get when you take a Chinese national, a rental car, rural Iowa, and a $52 billion seed business hanging in the balance? Said one review, "not since Alfred Hitchcock's in North by Northwest has a cornfield produced so much excitement."

Mara Hvistendahl's book, "The Scientist and the Spy," delivers a compelling narrative diving deep into the nature of Chinese industrial espionage and America's response.