To G or not to G? How to Sell Software to the Chinese Government

The Promise and Peril of "2G" Businesses in China

“For Chinese B2B companies, if you don't understand the government, then perhaps your income will be reduced by 30%” – Li Wei of Laiye Technology

The Chinese government continues to promote the modernization of their governance systems and capabilities by investing in the use of digital technology to transform their governance concepts, processes, methods and tools.

According to an article published on the Jiazi Guangnian WeChat channel, the latest buzzword surrounding the government market is the pro-B2G sentiment of ‘to G’, meaning to enter the government market. The article likens the Chinese B2G opportunity to a hidden feast in the government affairs hall, where the most sumptuous cake comes in the form delectable digitalisation.

What follows is a summary, translated and often paraphrased for brevity. All research is that of the original author, Liu Jingfeng. Thanks to Alice Osborne for her work on this. Interspersed in the text are some comments by Eric Lofgren, of the AcquisitionTalk blog and newsletter, for some comparative perspective on how the US government buys software.

盛宴背后:to G or not to G? | 甲子光年

Feb 20, 2021. Jazzyear Wechat Channel. Jazzyear includes reporting, think tank-type work, financing, and brand consulting aimed at promoting the industrialization of China's technology.

All aboard the digital transformation train

Since the beginning of 2021 alone, 10 provinces and cities have proposed the building of digital government (数字政府), including Shanghai, Suzhou, Guandong, Henan and Sichuan. This presents an unmissable opportunity in the eyes of technology companies, especially after the challenges of 2020.

Turning data into assets that are visible, usable, and operable, is an important part in building digital government. Jiazi Guangnian interviewed Li Wei, the Co-CEO and President of Laiye Technology Co., Wu Kai, GM of the Shulan Technology’s Digital Government Affairs Division, and the Director of a government enterprise. Only a couple of weeks into this year, Wu Kai had already received nearly 20 consultation requests for digital government plans to build urban data centers. Li Wei, the co-CEO and president of Laiye Technology is also feeling the shift – “almost every day we receive government consultant clients’ requirement for Robotic Process Automation+AI”.

The A-share market hears opportunity knocking

At the beginning of 2021, the price of shares in China’s digital sector skyrocketed. Companies which used to be seen as representatives of the traditional security market, such as Hikvision and Dahua, began to diversify their operations into the field of urban digital governance due to institutional research highlighting broad prospects in this domain. Both companies’ shares hit their daily upper limit on January 5th. Their research also highlighted other related fields that will soon be digitally upgraded including public judicial, disciplinary inspection, water conservancy, environmental protection, fire protection and emergency services.

Behind these busy digital-sector enterprises are local governments setting out on their respective digital governance journeys. At the end of last and beginning of this year, Wuhan, Shanghai, Shenzhen, Suzhou and other cities intensively issued related opinions on digital transformation and the construction of digital government. The provincial-level digital government construction plan has been launched intensively from the second half of 2020 and businesses are clearly taking note.

From the provincial level up

Provincial-level plans to build digital governments have been launched intensively since the second half of 2020. Guandong, Hubei, Ningxia, Shanxi, Shandong, Anhui, Henan, Heilongjiang and other provinces have already successively introduced policies and measures to promote the building of digital government. The Guangdong Provincial Government Big Data Center, for example, has already shared 3348 categories of 25.5 billion data points for 63 provincial-level departments. Henan proposes that by the end of 2022, it will have established a digital government and set a national benchmark province.

At a national level, the framework has gradually taken shape too. During the 15th China E-Government Forum at the end of 2020, Zhuang Rongwen (Deputy Minister of the Central Propaganda Department, Director of the Central & National Cyberspace Administration of China) said: “In the next step, we will increase the vigor of digital government construction and strengthen it by building a top-level design; accelerating the establishment of data resources, basic systems and standards specifications; and forming an organically coordinated digital government construction framework”.

Why now?

First off, the Chinese government has high informatization demands – the scale of Chinese government procurement exceeded 3.1 trillion yuan in 2016 – making it a market that all companies doing B2B business cannot ignore. The CICC (Corporate Credit International Consulting) Report shows the current annual growth rate of China’s overall e-government investment scale at more than 15%, far exceeding the growth rate of overall IT expenditure. Just for comparison, the USG overall growth rate over the last ten years is only around 20%. In the future, the Chinese e-government investment market will continue to maintain an annual growth rate of 10%-15% until 2022, or until it exceeds the value of 500 billion yuan.

Eric Lofgren: This is pretty amazing. For USG it looks like small growth, 75B to 90B over last 10 years.

Look at the JEDI contract in DoD. One cloud to rule them all back in 2017, and it took forever, protest after protest, and now it’s probably going to be canceled. NGEN is another one.

I love this stat. ”Of government software projects that cost more than $6 million, only 13% succeed.” i.e., bring value.

The COVID-19 pandemic has directly accelerated the pace of government digitalization, so much so that state representatives have begun actively accepting the application of emerging technologies in government services, such as cloud computing, artificial intelligence, big data, etc.

This wave of impetus also comes from changes in people, namely the appointment technically savvy officials with relatively high academic qualifications, making them more receptive to new knowledge and new technologies. On a business trip to Guiyang at the beginning of the year, Wu Kai of Shulan Technology noted that when communicating with local government officials, they took the initiative to talk about things that Internet practitioners would be concerned about, such as data operations and closed-loop scenarios.

The mentality of the government has changed, creating an opportunity for enterprises to land them as a major customer.

Long term market or short-term opportunity?

A question that plagues many “to G” practitioners is whether the government market is here to stay.

Pessimists believe that this is not a purely market-oriented field and the government's demand for a certain product is fleeting, so “to G” companies will eventually collapse. By contrast, optimists believe that the government market has huge potential as China's national government controls a large quantity of scarce resources such as market access, industry data, land resources, and policy support funds. They also anticipate that the rate of digital transformation and informatization upgrade for the Chinese government will be faster than private enterprises.

Hu Yu, CEO of iFlytek, explains that China succeeds in the world because of its dual economic system. The combination of planned and market economy "concentrate power to do things in a big way".

Not everyone can seize the opportunity

B2G opportunity is hidden amongst each round of reform, whether that be with regard to administrative systems or government institutions.

Take real estate registration as an example. Before 2014, the registration responsibilities of real estate were dispersed across the multiple departments of land, housing, forestry, and ocean. In November 2014, the State Council integrated the responsibilities of real estate registration under one department and unified registration in order to straighten out departmental responsibilities and reduce the number of certification procedures. Following the 2014 administrative reforms, Cangqiong Digital entered the arena in 2015 and developed a unified real estate registration information management platform, successively won bids for projects with multiple local governments, and became the leading enterprise in the field.

Eric Lofgren: I’d love to know more about this process of early competition and finding a winner. Sounds like a real market! In the United States, they would have fixed the requirements of an entire system upfront, and then put it out in a single big contract to be bid on, and then go execute. That’s why the Obamacare website was such a dud, as well as every other federal IT program. See Clinger Cohen Act, by the way, for some of that US federal IT regulation craziness.

Opportunities come and go quickly. As of the end of August 2019, a total of 3,007 registration halls in more than 330 cities (out of 337) and 2,852 (out of 2856) counties and districts across the country have been reformed. Within 5 years, the bonus period for unified real estate registration was almost over. Fortunately, there will always be new opportunities in this market. Just as the dividends of real estate registration gradually dried up, opportunities in the field of natural resources quietly appeared in 2018.

In March 2018, the new State Council's institutional reform plan established a Ministry of Natural Resources. The new department needed a management and business system suitable for its new activities, having integrated responsibilities of the; land and resources, housing, urban-rural development, water resources, agriculture and forestry ministries. Since then, various information systems – such as the basic land and space information platform, the early warning and evaluation platform for land and space planning, and the natural resource asset evaluation platform – have appeared in quick succession.

Xue Yang surmises that “like a wavy line, opportunities in the government market disappear and reappear”. The most important thing is to have sufficient sensitivity towards policies as “if you don't grasp policies, you won't know where the opportunities are”.

If you look at the books of emerging technology companies, you will find that many of their products are used in government affairs. For example Yitu, one of the four little dragons in the field of artificial intelligence, disclosed that its smart public service business revenues accounted for 79.86% and 89.54% in 2018 and 2019 respectively.

So, how to impress the government?

Understanding the reform

Many government-related companies hire experts and professors in the fields of public management and e-government as consultants. Their responsibilities are to help companies study the direction and framework of government reform, sort out government business processes, and find optimal solutions.

Innovate

The Chinese government views innovation as a key political achievement. An entrepreneur in the government industry with political experience told Jiazi Guangnian, "enterprises doing government business in China must sell products that allow the government to achieve political success."

Cutting edge for competitive edge

If this technology or product has been implemented elsewhere, the government is a lot less interested. “In terms of improving work efficiency, the government has a high demand for new technologies. Governments at all levels hope to use the latest technological solutions to improve work efficiency and enhance government service capabilities” said Li Wei of Laiye Technology.

Profit Margin an Issue

Not everyone is optimistic about the government market. Yi Feifan, a VC practitioner and Zhihu author, once wrote that among the top 60 corporate service companies in China, B2G accounts for nearly 70%, with half of the companies experiencing (mean) gross profit margins below 50%. In contrast, average gross profit margins of American counterparts exceed 70%. However, we don’t know the mix of the American companies and how prevalent B2G is.

Eric Lofgren: American companies doing big business with the US government MUST segment their business units to create a separate federal arm. Cost accounting practices dictate 10-15% profit on cost. All R&D, G&A, sales and marketing, etc., is allocated to the cost of goods sold. So their gross profits are low in US govcon. Only a couple of companies like Palantir have high gross margins in the federal sector, but they are really weird and different from the big guys.

Why is it argued that this pessimistic situation will inevitably emerge? First, to clarify, the companies in China’s domestic government market can be divided into three categories: integrators (集成商), manufacturers (厂商), and integrator-manufacturers (集成商兼厂商). The so-called integrator is an enterprise or organization that provides customers with system integration products and services, such as Inspur, Digital China, and Donghua Software. The manufacturer is the producer and provider of a certain equipment, technology, and service. In terms of scalability potential, neither can dream of competing with the technology giants like Ali, Huawei or Tencent.

Integrators have greater government resources, can directly participate in project bidding, and sign orders with the government. However, increased transparency in the pricing system causes their order profits to deteriorate, whilst costs such as labor and implementation continue to increase. Contrary to integrators, many domestic manufacturers have limited government resources. The products they make are specific, so the company's revenue scale is usually small, but the revenue quality is good, and the profit is higher.

Eric Lofgren: In the US government, we have this thing called Truth in Negotiations Act in which companies provide certified cost or pricing data to the government on all orders over $2M.]]

Sometimes the two cooperate, or in other cases, government affairs companies are both manufacturers and integrators. This one-stop-shop approach has the advantage of being able to achieve a certain scale and profit, but the cost is still relatively high, and often hits a ceiling after reaching a certain scale, also meaning they are unable to compete with industry big players.

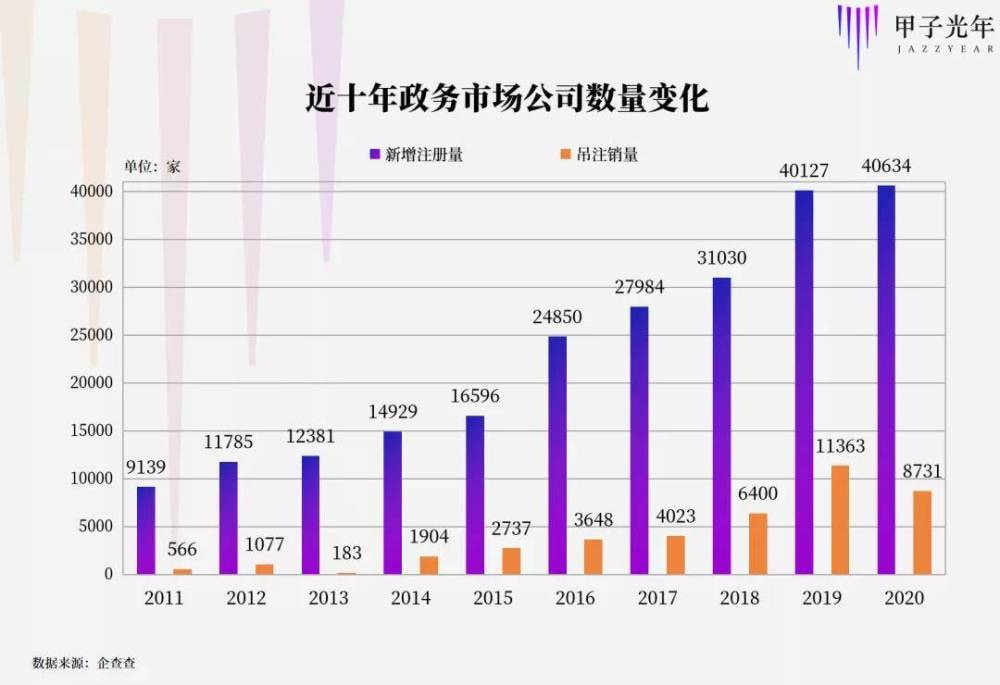

Quantity of companies in the government affairs market over the last decade

Purple represents new registered companies, orange represents delistings

From 2011 to 2020, the number of new companies in the domestic government market increased by 40,000. However, the number of write-offs also increased rapidly from 566 to 8731, an increase of more than tenfold.

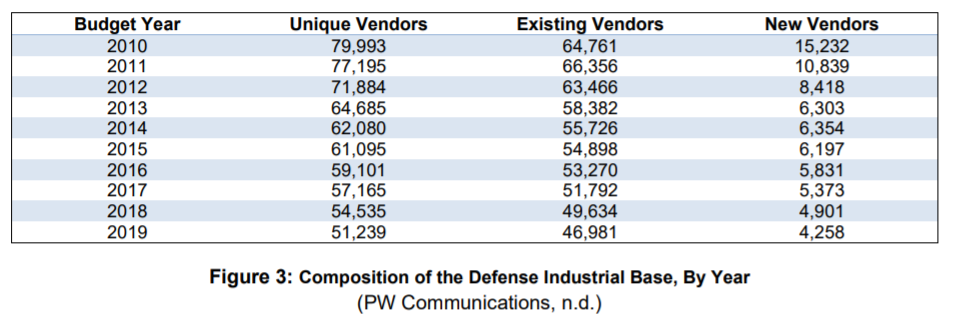

Eric Lofgren: Unique DOD vendors fell from 80K to 51K between 2010 and 2019. New vendors per year fell from 15K in 2010 to 4K in 2019. Pretty sad contrast.

The government market is not as good as it seems due to the issue of receivables, budget cuts during the pandemic, reliance on face-to-face high-frequency communication and rigid operating methods. Several salespeople who engaged with the building of digital government also expressed that despite its massive size, the Chinese government market is very fragmented. It is difficult to establish smooth communication with the government without “access”(门路) i.e., the right social connections.

Unlike selling to enterprises, the government is very concerned about project mistakes and pays special attention to risk. Therefore, they often hand over large orders to state-owned enterprises or powerhouses such as Ali, Huawei, and Tencent. Small companies then become outsourcers for these corporate giants. There is a clear division of labor: big players do the bottom layer, integrators do design, and SME outsourcers do upper-layer applications. “This structure means that giants gain the most profits and take the least risks, whilst for small and medium-sized outsourcers it is just the opposite”, said the sales manager of an RPA company.

A popular industry case concerns Tencent in 2019, whereby their investment company Digital Guangdong won the 1 billion-level order from the Guangdong Provincial Government, followed by the 874-million-yuan Chengdu Tianfu greening project, and the 520-million-yuan Changsha City Super Brain Project.

Although the opportunity in the government market is good, some feast like kings and other merely catch the crumbs.