Top 5 US-China Tech Stories

If 2023 is any barometer, 2024 should be insane

Pour one out for another crazy year in US-China geopolitical tech competition. 2023 had it all — spy balloons, panda diplomacy, the OpenAI fiasco. Where do we begin?

To discuss the top 5 US-China Tech stories of 2023, I have the great Kevin Xu, long-time ChinaTalk guest and creator of the Interconnected Substack.

We discuss:

TikTok’s weird resilience — despite sitting in the congressional crosshairs.

The sudden rise and dominance of Chinese EVs in the PRC and abroad.

US-China AI model competition redux, open-source infrastructure, and drawing 2024’s algorithmic battle lines.

Why the chip war will continue to define US-China tech competition in 2024 and beyond… especially if Secretary Gina Raimondo has anything to say about it.

#5 Temu & TikTok

Jordan Schneider: Let’s start with my number five — Temu’s rise and TikTok’s chugging along.

The last show we did was in the wake of the big congressional hearing where the TikTok CEO had this awkward performance, which has been exceeded only by the Harvard and Penn presidents being dragged in front of Congress.

Both of us were calling that moment a real turning point and the death knell for any Chinese tech firm with ambitions in the US. But somehow we’ve entered this timeline where in December 2023 we still have TikTok growing at double-digit percentages each year.

Temu, of course, is Pinduoduo’s US product that they brought to the US. Temu has this group buy feature where you get ten bras for $4, or other totally insane things like that. It’s grown so big that Amazon is starting to get scared.

Maybe we were actually wrong in calling it so early — that this momentum you initially saw in both the executive and legislative branches would amount to real regulatory restrictions on what Chinese tech firms can do in the US.

Kevin Xu:

We probably gave our congressional legislators too much credit for translating C-SPAN outrage into real action.

There are other interesting, under-the-radar currents when it comes to who is pulling the strings to keep TikTok around. There’s obviously a lot of outrage continuously around why TikTok is bad for the United States for a bunch of reasons.

But at the end of the day, if you look at their cap table, one of their largest and earliest investors is one of the founders of Susquehanna International Group, Jeffrey Yass. He’s a massive donor and a lifelong libertarian, for lack of a better label. He’s really pulling the strings on a bunch of different congressional members. This was reported in the Wall Street Journal a few months ago.

There’s enough vested commercial interest in TikTok or ByteDance to continue to do what they do. It’s just not going to be that easy. Our political attention span is basically the same as a goldfish. We just kind of moved on.

In the same bucket, we had the RESTRICT Act. That also got a lot of attention and, frankly, a lot of political support from the White House. It was a bipartisan proposal. You had Senator Mark Warner on your show to talk about it. That also fizzled out, at least for now.

Something to watch out for next year is if these high-attention, high-profile proposals or desires get rekindled. In an election year, that could become a real action or just another issue to campaign around.

#5.2 VC Breakups

My number five story is the splintering of VC firms, the actual physical breaking up of cross-border VC firms like Sequoia and GGV Capital. There are probably a few others that I thought would have done the same because of their setup, but they haven’t. Like Lightspeed Venture Partners, Redpoint Ventures, and Kleiner Perkins — these are all firms that have a presence in both countries.

They’re now setting up these global VC firms because of their affiliation and their actual portfolio in China — things that are now considered basically on the naughty list, if you will, of the US government. That is a real tangible impact.

We talk a lot about de-risking, decoupling, and all the different variations of the relationship. This is one example where it physically feels like there is a wall in something that is as fluid as capital.

In a free-market society, money just flows to wherever the opportunity is. Right now, that is not the case when it comes to cross-border venture investing.

It sets up these frenemy relationships now. The former VC firm Sequoia China is now renamed HongShan, which is still the word for Sequoia in Chinese. It’s everywhere in the US, looking for deals and talking to founders, mostly of Chinese descent, as a way to still do their business. That’s especially the case since the Chinese VC market in general is in a bit of a downward spiral or really not doing so well.

But most people might have already forgotten these new VC restrictions at this point.

Jordan Schneider: Let’s pour one out for US dollar-based VC investing in China.

Kevin, do you want to give a retrospective on the highs and lows we’ve seen over the past 20 years with US-China capital flows?

Kevin Xu: The Internet sector and everything that came out of that has made a lot of money for a lot of Chinese LPs, US endowments, and large pension funds — including Canadian pension funds and probably even a few Middle Eastern wealth funds.

That has been an obvious trend to bet on for the last 15 years or so. But it’s very unclear where that’s going in the next 20 years. There is a huge shift — as far as what is favorable now — in the Chinese tech market when it comes to what will get more investment dollars.

We are focusing on the hardware tech side of things when it comes to manufacturing semiconductors, electric vehicles, and everything else that comes with AI.

It’s just a very different tone at this point. The way American VCs have always done business is something the Chinese VCs have done a very good job both adapting and evolving in their own market for their own success. That is clearly coming to an end.

We are looking for sponsors to partner with ChinaTalk. Do reach out at jordan@chinatalk.media. I’d love to explore how we could work together!

#4 Chinese Electric Vehicles

Jordan Schneider: My number four story is the Chinese EV explosion. China is just beating the entire world by leaps and bounds, sans Tesla, on scaling, production, and deployment of electric vehicles.

You see everyone besides Tesla just not getting it or figuring it out. You have this innovator’s dilemma with the long tail of Japanese, South Korean, and American, German producers who maybe have just too much coding debt or their equivalent of that. They have too much internal combustion tech debt they can’t work themselves through.

The political response to EVs is just beginning with the Inflation Reduction Act in the US and other policies coming out of the EU. It’ll start to crest in the next year or two when imports, particularly in Europe, start to be a real thing.

The decision point that Europe is going to have to make will be whether or not they’re comfortable having tens, hundreds of thousands, or even millions of Chinese electric vehicles sold in their countries.

Kevin Xu: That’s one of my top fives as well. The growth and global dominance of Chinese EVs is partly because their domestic market has been heavily supported from the top. But there is a bit of a demand softening inside the Chinese market.

If you have the chance to go to China this year, you see just a lot more green places on the street almost wherever you go. It’s relatively easy now. Get a visa, just go. It’s really not that hard.

There are a bunch of different domestic brands, not just Tesla, which is the only kind of foreign EV that still has a decent market share in China. But that demand is probably not going to be accelerating as much as it used to.

A lot of these Chinese EV makers need to go abroad. Europe is a very willing market for the most part, but we’ll see if they come up with different regulations to push Chinese makers out in the same way that the US has already done so, whether it’s through IRA credits or tariffs and whatnot.

There’s quite a bit of action on EVs in the US when it comes to bilateral US-China competition. We’re shooting ourselves in the foot. Ford has some decent momentum when it comes to battery collaboration with Korean battery makers. Licensing CATL’s technology for its marquee Michigan battery plant has gathered some controversy, but that really would have happened regardless if not for the UAW labor strike that significantly increased the cost of making cars in general in the US.

The Big Three automakers in Detroit are converting or trying to transition into EVs, but it’s becoming less and less tenable. You can make up all kinds of excuses like, “Oh, Americans just don’t like EVs,” “Americans like our gas guzzlers,” or “We like our road trips,” and so forth.

But I think everything that Tesla has been doing is really pushing back on that narrative with real sales and real adoption. It’s just that none of the traditional national champions in America are really getting their shit together.

They have a pretty bad hand that they’ve dealt as far as labor agreements are concerned. We’ll see if UAW keeps up its organizing victory streak, perhaps even extending into Tesla or Toyota battery plants and other EV plants. Those are all on the table as part of the negotiation win from the union side.

That’s making something already hard for US automakers now even harder. The end result will be none of us will be able to get our hands on the EV F-150. But we also can’t get an NIO because they’re just not allowed to come in here.

Jordan Schneider: A parallel story to the Chinese EV explosion is the dramatic successes you’ve started to see out in the Chinese commercial space industry. They’re basically just SpaceX on the other side, which has figured out how to launch Starship, which is sort of incredible.

But sans SpaceX, the US would be in a really weird place when it comes to the future of space launches, but China seems to have a less advanced, but more broad-based and healthier ecosystem. There are a number of companies that have figured out how do their own reusable launch. There are international ambitions around that too.

It would be great if the one tycoon keeping American industrial ambitions alive didn’t happen to be a horrific human being. But it’s two firms against two entire Chinese ecosystems right now. I don’t know what that says about Elon or about the stultification of American capitalism, but it is very striking that you have such vibrant and maybe over-exuberant competition in China domestically. Whereas in the US, it is much more stultified, it seems.

Kevin Xu: On the EV front specifically, there’s probably a volume surplus at this point on the Chinese side, while there’s clearly a volume deficit on the American side. We haven’t even talked about the infrastructure side of building charging stations. It’s all these very basic elements of electrification that frankly should be happening with or without knowing which cars or EVs are going to be on the street in the US. That is unfortunately just not happening.

#3 The Rise of Pinduoduo

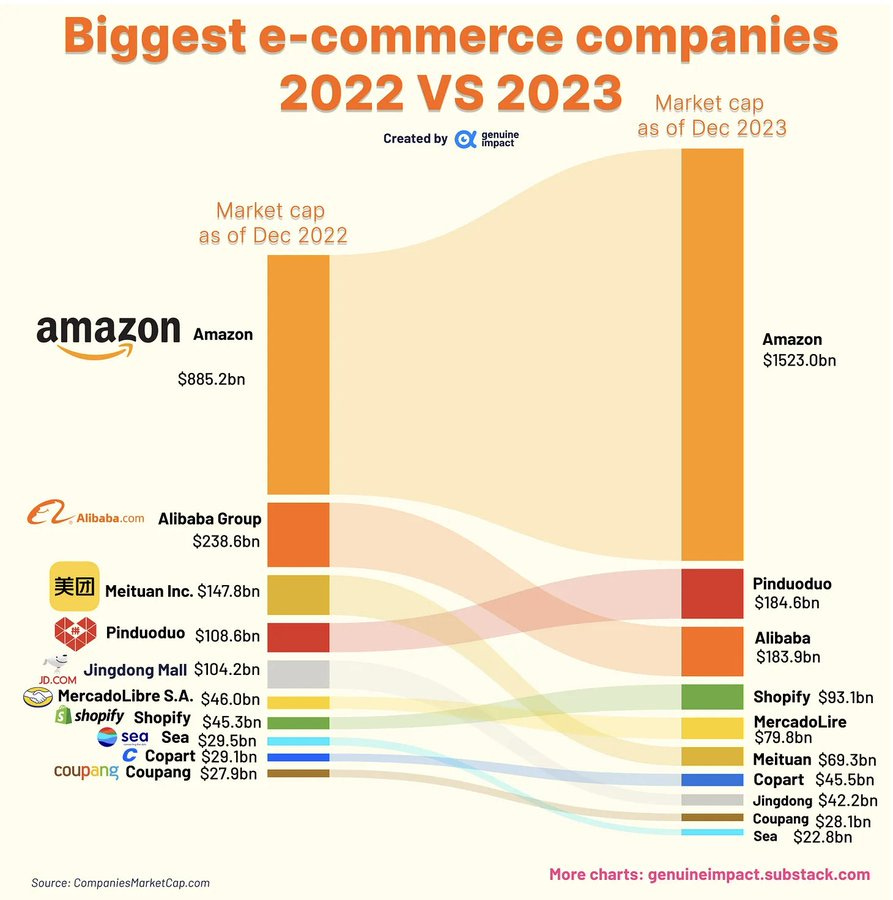

Kevin Xu: My number three is Pinduoduo taking over Alibaba’s market cap. This may feel more like a China ecosystem story. For those of you who haven’t been tracking the public market as closely, Pinduoduo is the e-commerce new kid on the block. Now it’s a juggernaut and has officially overtaken Alibaba in terms of market capitalization. That just happened within the last couple of weeks or so.

It’s been a huge deal, certainly within Alibaba, which has been going through a really rough year of massive corporate reorganization.

The company is breaking up into six different pieces, looking to IPO or absorb additional funding for any of those six pieces, and then canceling one of the most prominent pieces, Alibaba Cloud.

Pinduoduo, meanwhile, is just heads-down doing its thing, cranking out more referral codes and selling more cheap stuff on their very attractive sticky app — not to mention the growth of the team. This is worth noting because everyone vaguely interested in China has been guessing a lot about how the Chinese economy is doing.

The rise of Pinduoduo very much has just honed the buyer persona of getting deals, social buying. It really reflects the consumerist mood in China, which is that luxury buying is cool.

Right now, though, we’re in a bit of a tough environment after three years of COVID lockdown. Where we’re going to buy affordable things. We still enjoy shopping. We enjoy the entertainment of shopping. But it’s Pinduoduo that’s really engineered the design for that consumer persona that’s becoming more pervasive. As long as you design for that, you can still do really, really well as a company and as a platform.

It’s a bit of a nuanced take on where the consumer is in China and where the spending is going to manifest.

Paid subscribers get access to the second part of our conversation. We discuss:

What Huawei’s seven-nanometer chip breakthrough portends for the Chinese semiconductor ecosystem in 2024.

Why Kevin (and Sun Tzu?) think looser US restrictions on Chinese tech might actually be a good idea… limiting China’s capabilities without pushing them into extreme self-reliance.

How Chinese companies like Shein and Zeekr might disrupt the US IPO market in 2024.

How Trump — or any GOP presidential admin — could reshape US-China tech competition.