What Happens Without Taiwan's Chips?

"If you wanted to attack the supply chain, you wouldn't have to invade Taiwan. China has the capacity to hurt everyone if they want to. Let’s hope that they don't."

TSMC makes over half of the world’s semiconductors. It gets two-thirds of contracts for semiconductor manufacturing, is one of the two companies that can make 5nm transistors and will be, for some time, the only company to make 3nm chips.

It’s not just TSMC of course–many other smaller segments of the semiconductor supply chain are monopolized by Taiwanese production, particularly in tricky materials subsectors. There’s a whole lot of orange in the following BCG chart.

Should the Taiwanese chip industry be destroyed due to war or embargo, the consequences for the rest of the world would be immediate and dramatic. The capital investment required to replace that segment is in the trillions. Even once that money starts to be spent, global production would fall to early 2000s levels for perhaps 15 years as the lag in production of fabs and tools, not to mention engineering know-how, would take decades to reaquire. Given the importance of microelectronics to the global economy and the centrality of Taiwan to microelectronics, the disruption caused by such an eventuality would be hard to quantify.

To put Taiwan going dark into context, consider the most recent chip shortage. A Goldman Sachs report estimated that 169 industries were impacted by the chip shortage and there would be a reduction in GDP growth by 0.5 to 1%. This was because of a 20% shortage of semiconductors which led to slowing industrial production. But the impacts of this are non-linear, so merely extrapolating from this would be inappropriate. As Secretary Raimondo said in her blog post, American companies were holding 5 days worth of semiconductor inventory. But if this number went to 0, the impact would force entire industries to shut down.

To discuss, recently I had on the podcast Eric Breckenfield, the director of technology policy at the Semiconductor Industry Association (SIA) and Hassan Khan, who holds a PhD in engineering and public policy. We discussed:

How losing Taiwan’s semiconductor industry means an immediate and steep global recession;

Why China can’t easily take ownership of TSMC’s capacities in an invasion;

And how Taiwan represents the best of globalization.

(The intro blurb was co-written with Pradyumna Prasad)

ChinaTalk is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

A World Without TSMC?

Eric Breckenfeld: There's no chips. There’s no smartphones. You’re not getting the chips that go into your servers, so you only have the chips you already have. Google is not building new servers. Amazon Web Services is not building new servers. Cloud computing basically stops growing.

To me that sounds like global recession, but I'm not an economist.

Image: A TSMC factory in Hsinchu, Taiwan. (Arusanov/Wikimedia Commons)

Hassan Khan: I think for the last two years throughout the pandemic, we learned about supply shortages. I don't know if you guys ever hoarded toilet paper, [and] there was obviously the PPE shortage. One of the most humbling things to think about here is: we lived through all those acute shortages, and they were really frustrating, but it wasn't like a semiconductor shortage of every major component that we need for all advanced processes. Those [shortages during the pandemic] were usually very specific, like shortages for display ICs or the lower-cost ones.

We weren't really seeing massive shortages for the kinds of advanced chips that are key to all these technologies that we take for granted now, and there's no spare production capacity to bring it up.

Eric Breckenfeld: Let’s picture a world where, suddenly, Taiwan isn't allowed to have electricity anymore. You’re going to start building fabs in the US, Japan, and South Korea, but there's a lead time on that. That'll be a few years, at least — that's optimistic.

But then when those fabs turn on, you have no guarantee that you're going to hit yields.

TSMC's magic is that they have engineering special sauce: they can somehow hit insane yield at processes that are challenging for everybody else.

(Samsung too. I won't short-change Samsung.)

Even if you step up new capacity — we didn't talk about how Taiwan went dark — in the worst-case scenario, you also don't have access to their engineering talent. Who's going to run these fabs? You have to relearn a lot of the knowledge in the fabs’ proprietary — and that's the Coca-Cola recipe, right? They keep that safely guarded. So you're a decade behind, at least.

Hassan Khan: TSMC has a partnership with Sony in Japan. They’re building the fabs in Arizona. The chairman of TSMC, or some of their leadership, made this point that was like, “we can build fabs outside of Taiwan, but the epicenter of our internal knowledge as a company is in Taiwan.

“I can send my best engineers to any of my fabs to problem-solve, but f I build it in Arizona and have to put them on a plane, it's going to take them two days to get there and then they're jet-lagged. We're still human beings. Or you're doing it over video-calls, and it’s just not as effective as having literal boots on the ground from your best engineers [being] in the room together.”

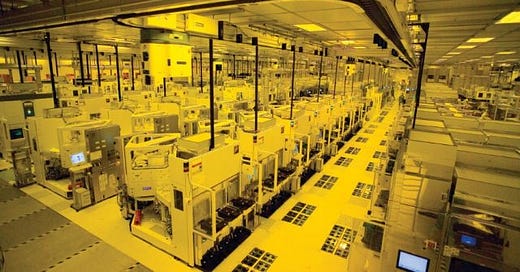

Image: Inside a TSMC foundry facility. (ExtremeTech)

Jordan Schneider: And It's not just your best engineers: it's everyone, [including] all your suppliers. They’re not building a new factory in Arizona.

Eric Breckenfeld: ASML has teams that sit next to TSMC foundries. It’s not just Taiwan's best engineers; it's also the best ASML engineers. It’s AMAT. It's the everyone in the process.

We can build new stuff in Arizona, but Taiwanese people are coming over here to run those fabs and ASML is sending engineers out to help. If you remove the Taiwanese engineers from the picture, even if you could build a fab in three years, you're not turning it on at capacity in three years.

People make a comparison between Taiwan and Ukraine, and of course I could see why that would happen. But not only is China not Russia, Ukraine is not Taiwan.

Ukraine, first of all, would have value even if nobody lived there, because it has huge agricultural and natural-gas resources. If you could magically zap everyone from Ukraine to go live somewhere else tomorrow, that land would have value.

Taiwan's value is its workforce. It has manufacturing capacity, too, but that's easier to rebuild than an entire engineering workforce is to retrain. That’s a generational effort. To invade Taiwan is to destroy the value that it provides in the supply chain.

If its engineering workforce is unable to perform because it's in an occupation, then Taiwan's value in the supply chain goes down to almost nothing.

Winning Hearts and Minds

Jordan Schneider: Whoever's left is not going to be super excited to work for their new state-owned overlords.

Eric Breckenfeld: Yes. It's not a question of “do you want to own Taiwan's capabilities?” to China. That is not in the cards for them. “Do you want to destroy Taiwan's capabilities?” That's a question they could answer. But [in terms of] owning it, you would have to win the hearts and minds of the engineers who work there. If they're not performing, you don't have TSMC.

Image: Protests against Chinese investment in Taiwan during the 2014 Sunflower Movement. (Guava Anthropology)

Jordan Schneider: And somehow get the world to be cool with it. On the one hand, yes, subjecting the US to 1990 [technological standards] all of a sudden is a pretty powerful piece of leverage, but you’d figure there would be some intestinal fortitude to eat pain in that situation.

Eric Breckenfeld: I just don't think that if China moved in on Taiwan, ASML would just say, “yeah, we'll still send our engineers out to help you.”

Hassan Khan: I think there would be perhaps some folks who are captive. I could imagine a lot of Taiwanese folk would find it very difficult to leave. But to that same point, there are probably lots of folks who work for those suppliers who aren't necessarily Taiwanese born-and-raised, and they would be willing to leave. They would bring that expertise to other fabs around the world.

But to Eric's point, it's not going to happen without a delay. That would sap global talent out of Taiwan's ecosystem and do irreparable damage to that ecosystem. It would be a benefit to the other ecosystems, but it wouldn't be an instantaneous flip of the switch. There would still be a lag in getting the facilities up and running, filling the gaps and knowledge because they wouldn't have all the knowledge that is located in TSMC’s ecosystem. It would be a net win for the rest of the world, but I think a loss to the world globally.

Eric Breckenfeld: It wouldn't have to be a direct military action: it could be cyber-attacks; it could be disruptions in the grid. Of course, these fabs often have internal grids and they have resilience built in, but China also has sophisticated cyber-attack capabilities.

If you wanted to attack the supply chain, you wouldn't have to invade Taiwan. China has access to other ways to slow manufacturing and create delays that they could pull as a lever if they wanted.

And it would be bad for China, by the way: they use TSMC too. Everyone uses TSMC: Intel uses TSMC for some of their products. China has the capacity to hurt everyone if they want to. Let’s hope that they don't.

Hassan Khan: It's really unfortunate that we've gotten to the point where these conversations are more imaginable than they were in the past. I think even as this conversation's happening, some of the tension around China after Nancy Pelosi's visit has ratcheted up to a level that didn't seem possible a few years ago, even as the rhetoric was increasing. These scenarios are more imaginable than they were before, which is not where we want to be.

Image: Nancy Pelosi and Tsai Ing-wen meeting in Taipei. (Yahoo)

TSMC’s Lesson for Globalization

Jordan Schneider: It's worth reflecting on the beauty of the system that we have.

That there is a Taiwan in the first place, which has been able to be so outrageously successful over the past 30-40 years; it’s the best case for globalization, right? The fact that this island has been able to specialize in such a way that they are now creating the future.

Eric Breckenfeld: I've seen some rhetoric at times — even in conversations I've had with folks on the Hill — conflating the loss of manufacturing sectors abroad, especially to East Asia, to the loss of the semiconductor industry (for example, the loss of auto manufacturing and lower-value consumer electronics to countries leveraging their low labor costs).

One thing I try to do always is remind people that while that is what happened in some manufacturing, companies carelessly pursuing low labor costs is not what happened in the semiconductor industry.

Taiwan educated their workforce and restructured a lot of their society and education structures around specializing in engineering and semiconductor technology, and then outcompeted everyone else on the merits of the technology.

Not because they have bad environmental regulations, not because their labor is cheap, none of the stuff that we hate; they did it the way you should be doing it, which is through excellence and education. There is a certain beauty to that, but there should be a level of applause that goes to them as well. As fragile as it clearly is, the supply chain wouldn't work as well as it does without their efforts. They made risky bets that paid off, and I think that there's an element of applause that needs to go to that.

Image: Gates of the National Taiwan University of Science and Technology in Taipei. (Taiwan Ministry of Education)

Jordan Schneider: We could still be making shoes in America: they'd be 50% more expensive, and they'd basically still be the same shoe. The return that humanity has gotten from Taiwan being able to metamorphosize into what it is today is so much more impactful to the planet, the way we live our lives, and [how we] are able to live our lives than having a 50% cheaper shoe. It’s a ridiculous analogy.

Eric Breckenfeld: It’s supposed to be how globalization works when it works beneficially: it's supposed to allow a group of people to pull themselves into a high-value part of the supply chain by making the right investments and bets. That is supposed to be what happens.

Hassan Khan: But also, we should be clear:

Although Taiwan's gain here has not been America's, some of the biggest beneficiaries of the ascendance of TSMC are US-based firms.

Qualcomm, Nvidia, AMD, Google, Facebook, Apple; these are all firms that have leveraged their capabilities to bring their designs up to par, surpassing what anyone else can do.

Everyone makes the point [that] only TSMC can manufacture the leading-edge node, [but] up to 90% of the customers that it is manufacturing for are US-based design firms. So although I understand why for the American psyche, “we're now dependent on TSMC for leading-edge chips” feels shaky, our firms have been the ones who have been best positioned to leverage its expertise and to turn its manufacturing prowess, combined with our design prowess, into the world's best products.

AMD is the clearest example, right? AMD was always lagging its capabilities to Intel because Intel had the integrated design-and-manufacturing lead. AMD tried to play that same game but could never catch up.

When it ditched global foundries for the leading edge and moved to TSMC, it overtook Intel at the performance edge. It's the clearest example of where this worked to the benefit of a US-based firm. Now, Intel is the loser in this case, but American firms and consumers worldwide benefitted.

Jordan Schneider: I remember reading my PC Gamer in the late nineties and everyone was like, “haha, AMD trash! You guys suck!” And here we are today. It’s crazy.

Eric Breckenfeld: I think it's hard to get your head around, especially if you are a member of the public, when you see that the US’ share of the pie has shrunk, [because] that’s easy to see.

Seeing that the pie has grown much larger than it would have otherwise? That is more invisible.

Jordan Schneider: It’s not invisible if you think about what your life was like 20 years ago.

Eric Breckenfeld: But I think it's hard to see that counter-world where you're like, “what would the world look like if the pie was smaller?” Well, it's not hard because you can just look back to how it was, but you'd like to say, “no, I want the same-sized pie, but our share larger.” Well, that actually was not on the menu as it turns out.

It's not just AMD and Nvidia, which are at the very end of the supply chain; it's also further up. It's having a customer our EDA tools. it's having a customer for AMAT. We talk about ASML; the US maybe does not dominate in the EUV, but does dominate in many other tools. We dominate in the design tools. The value of those companies is enormous.

I don't want to be a TSMC fanboy too much, but you have to tip the hat at a certain point and acknowledge what they've unlocked for the rest of the supply chain, both up and downstream.

ChinaTalk is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.